Question: Need answer for the second question.(Exercise-7 mentioned is actually the first question. If you need the answer for the first question then you can check

Need answer for the second question.(Exercise-7 mentioned is actually the first question. If you need the answer for the first question then you can check it on chegg it's already solved.)

Need answer for the second question.(Exercise-7 mentioned is actually the first question. If you need the answer for the first question then you can check it on chegg it's already solved.)

I need the accurate answer for the second question. Excel explanation Please!!

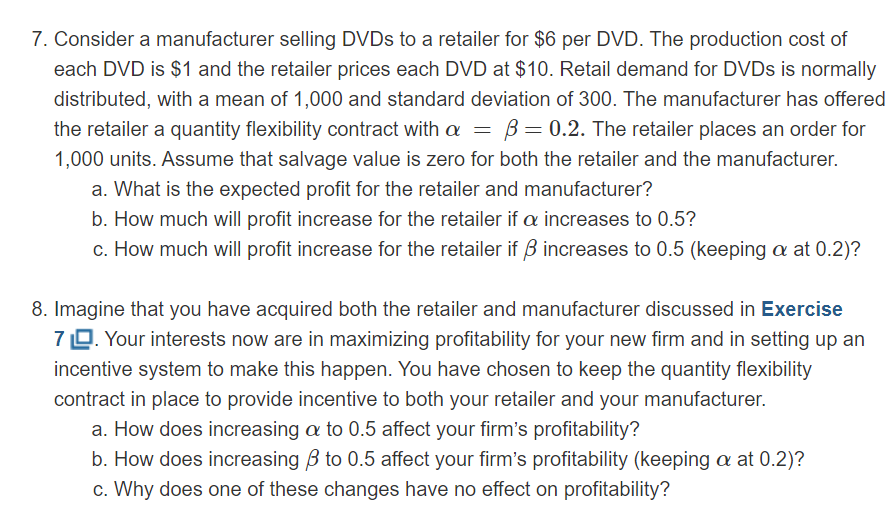

7. Consider a manufacturer selling DVDs to a retailer for $6 per DVD. The production cost of each DVD is $1 and the retailer prices each DVD at $10. Retail demand for DVDs is normally distributed, with a mean of 1,000 and standard deviation of 300 . The manufacturer has offered the retailer a quantity flexibility contract with ==0.2. The retailer places an order for 1,000 units. Assume that salvage value is zero for both the retailer and the manufacturer. a. What is the expected profit for the retailer and manufacturer? b. How much will profit increase for the retailer if increases to 0.5 ? c. How much will profit increase for the retailer if increases to 0.5 (keeping at 0.2 )? 8. Imagine that you have acquired both the retailer and manufacturer discussed in Exercise 7 . Your interests now are in maximizing profitability for your new firm and in setting up an incentive system to make this happen. You have chosen to keep the quantity flexibility contract in place to provide incentive to both your retailer and your manufacturer. a. How does increasing to 0.5 affect your firm's profitability? b. How does increasing to 0.5 affect your firm's profitability (keeping at 0.2)? c. Why does one of these changes have no effect on profitability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts