Question: need answer now in 10 mins please. will Give thumbs up The Pennington Corporation's 13% coupon bonds (with a par value of $1.000) which will

need answer now in 10 mins please. will Give thumbs up

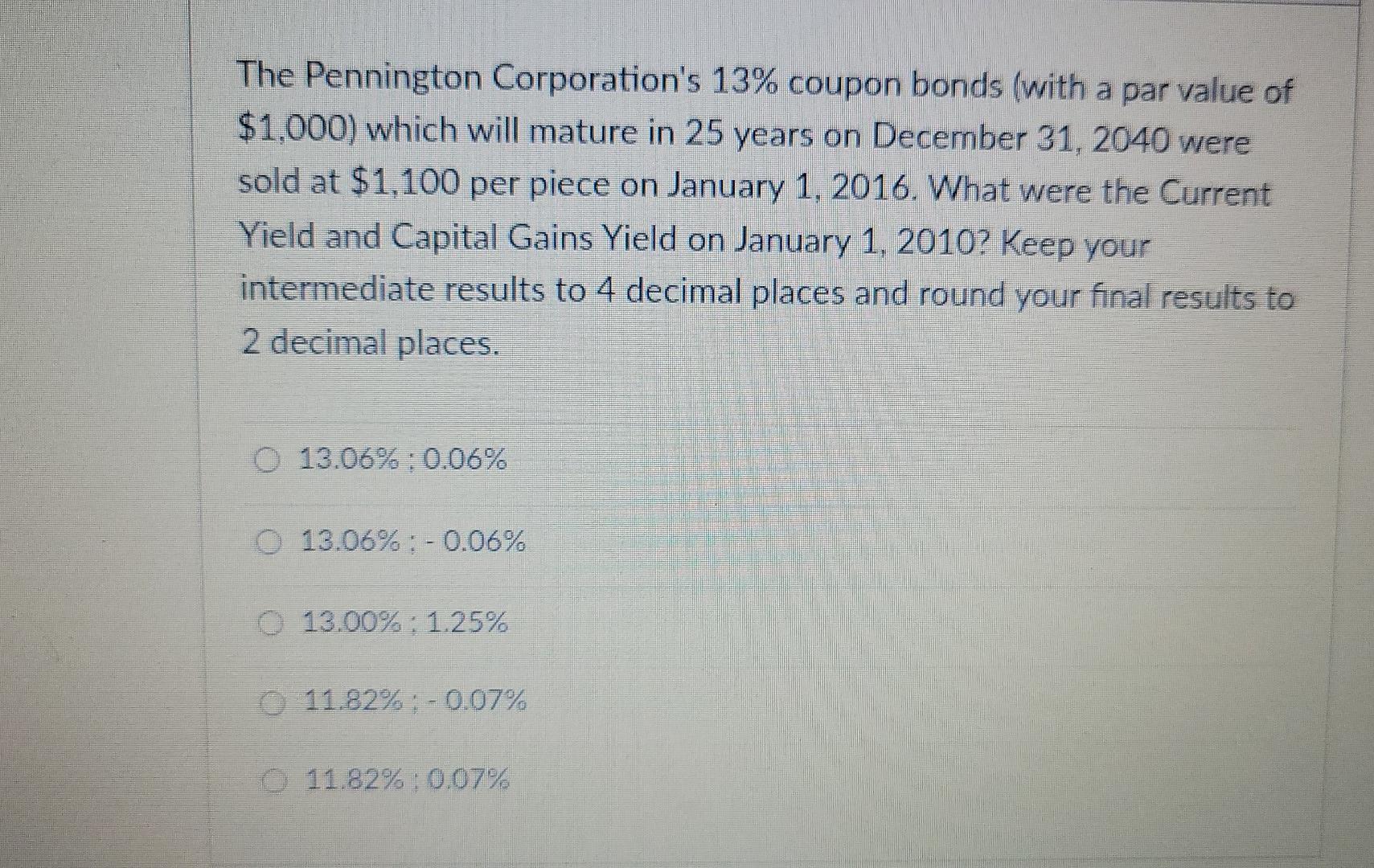

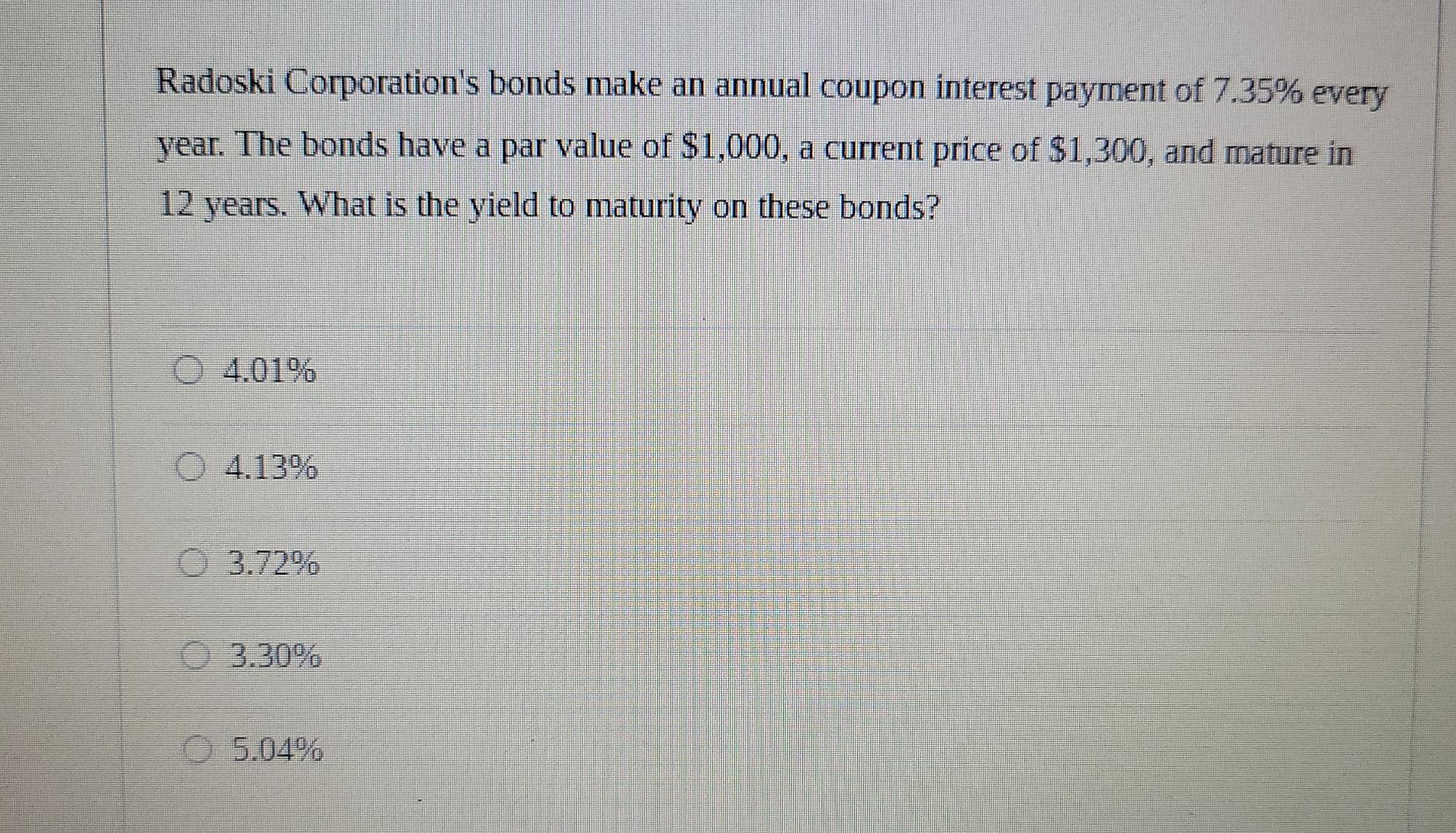

The Pennington Corporation's 13% coupon bonds (with a par value of $1.000) which will mature in 25 years on December 31, 2040 were sold at $1,100 per piece on January 1, 2016. What were the Current Yield and Capital Gains Yield on January 1, 20102 Keep your intermediate results to 4 decimal places and round your final results to 2 decimal places. 0 13.06% : 0.06% 13.06% : -0.06% 13.00%: 1.25% 11.82% -0.07% 11.82%:0.07% Radoski Corporation's bonds make an annual coupon interest payment of 7.35% every year. The bonds have a par value of $1,000, a current price of $1,300, and mature in 12 years. What is the yield to maturity on these bonds? 04.01% O4.13% 3.720 0 3.30% 5.04%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts