Question: need answer now please in 10 mins I will give thumbs up please. The Pennington Corporation issued a new series of bonds with a par

need answer now please in 10 mins I will give thumbs up please.

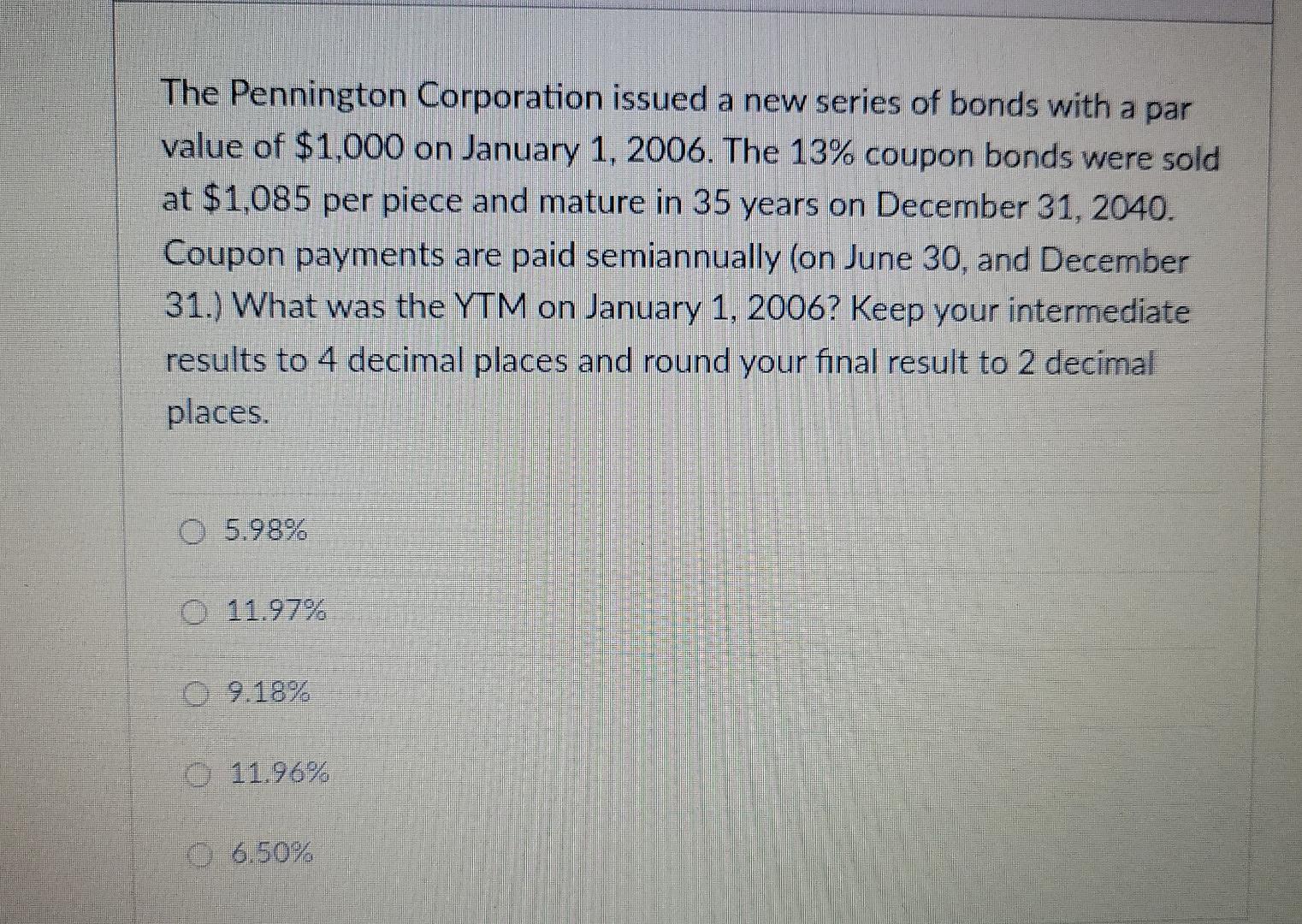

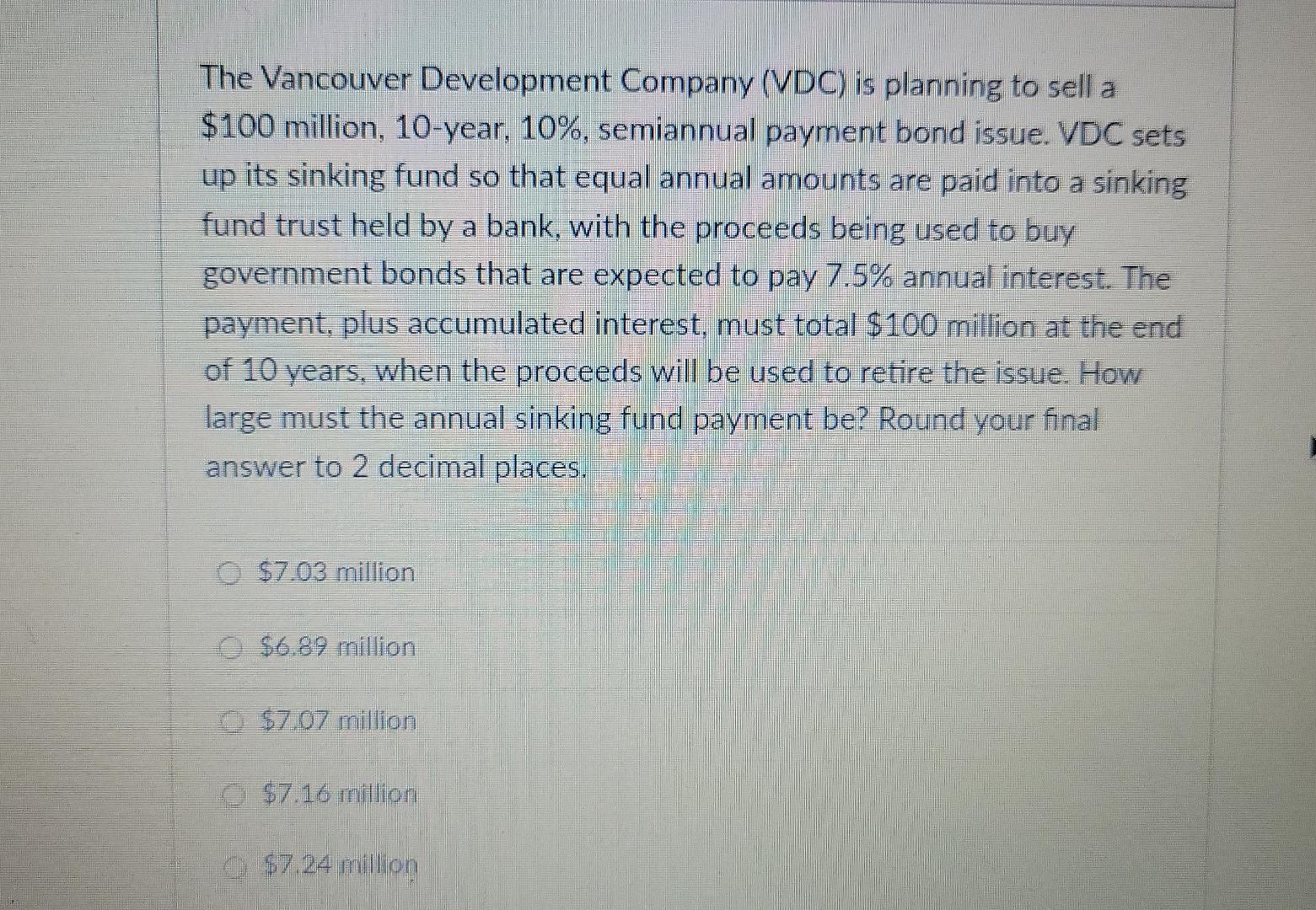

The Pennington Corporation issued a new series of bonds with a par value of $1,000 on January 1, 2006. The 13% coupon bonds were sold at $1,085 per piece and mature in 35 years on December 31, 2040. Coupon payments are paid semiannually (on June 30, and December 31.) What was the YTM on January 1, 2006? Keep your intermediate results to 4 decimal places and round your final result to 2 decimal places. O 5.98% o 11.97% 9.18% o 11.96% 0 6.50% The Vancouver Development Company (VDC) is planning to sell a $100 million, 10-year, 10%, semiannual payment bond issue. VDC sets up its sinking fund so that equal annual amounts are paid into a sinking fund trust held by a bank, with the proceeds being used to buy government bonds that are expected to pay 7.5% annual interest. The payment, plus accumulated interest, must total $100 million at the end of 10 years, when the proceeds will be used to retire the issue. How large must the annual sinking fund payment be? Round your final answer to 2 decimal places. o $7.03 million $6.89 million $7.07 million o$7.16 million 0 $7.24 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts