Question: need answer quickly Abe, Bob, Cory and Dan have the following partnership business: Assets Liabilities and equities Cash $55,000 Liabilities $40,000 Current assets 30,000 Abe,

need answer quickly

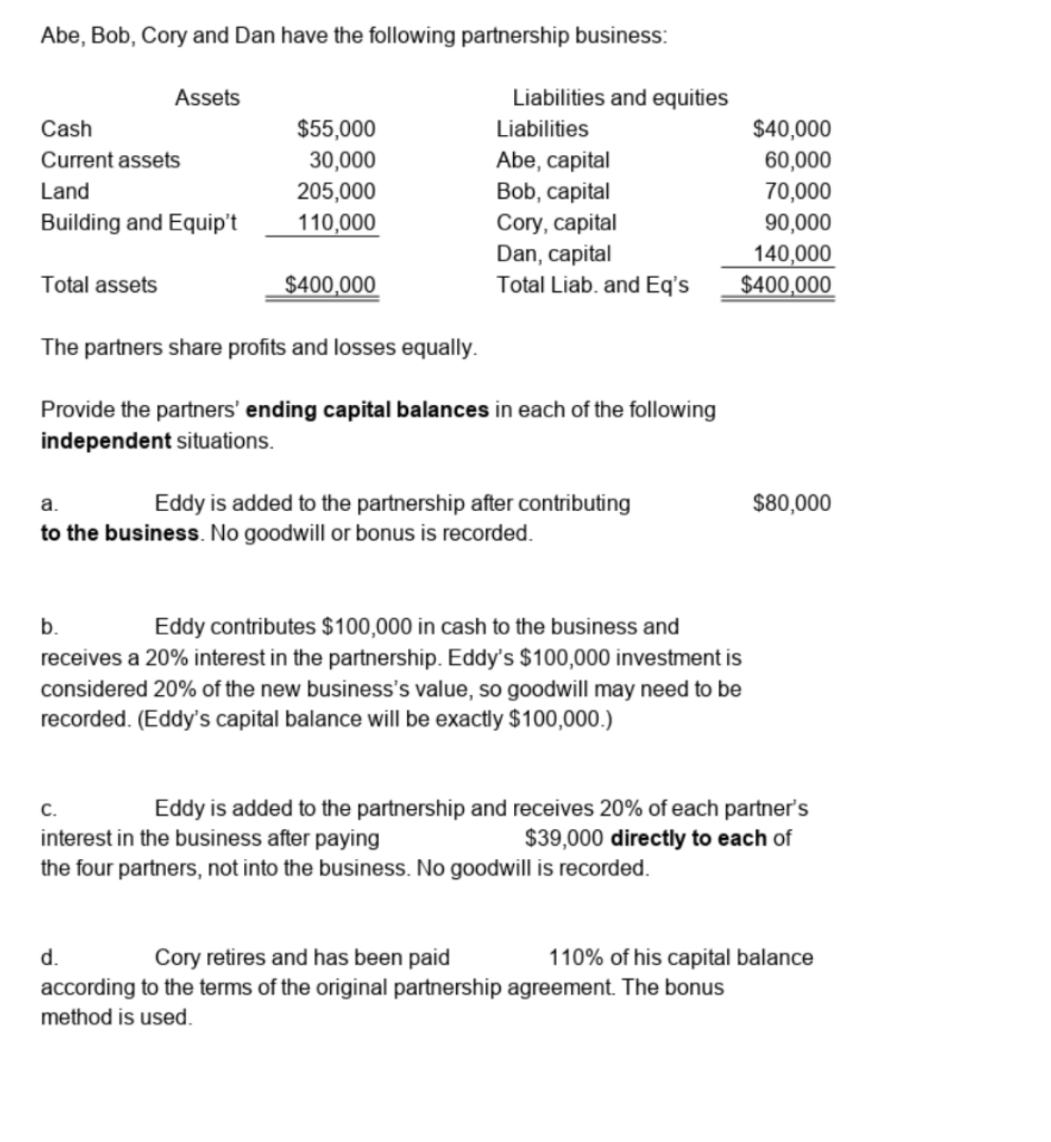

Abe, Bob, Cory and Dan have the following partnership business: Assets Liabilities and equities Cash $55,000 Liabilities $40,000 Current assets 30,000 Abe, capital 60,000 Land 205,000 Bob, capital 70,000 Building and Equip't 110,000 Cory, capital 90,000 Dan, capital 140,000 Total assets $400,000 Total Liab. and Eq's $400,000 The partners share profits and losses equally. Provide the partners' ending capital balances in each of the following independent situations. a. Eddy is added to the partnership after contributing $80,000 to the business. No goodwill or bonus is recorded. b. Eddy contributes $100,000 in cash to the business and receives a 20% interest in the partnership. Eddy's $100,000 investment is considered 20% of the new business's value, so goodwill may need to be recorded. (Eddy's capital balance will be exactly $100,000.) C. Eddy is added to the partnership and receives 20% of each partner's interest in the business after paying $39,000 directly to each of the four partners, not into the business. No goodwill is recorded. d. Cory retires and has been paid 110% of his capital balance according to the terms of the original partnership agreement. The bonus method is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts