Question: NEED ANSWER TO PART C PLS (FULL WORKING OUT PLS) Barry wants to purchase a 1-year European call option on ABC shares with a strike

NEED ANSWER TO PART C PLS (FULL WORKING OUT PLS)

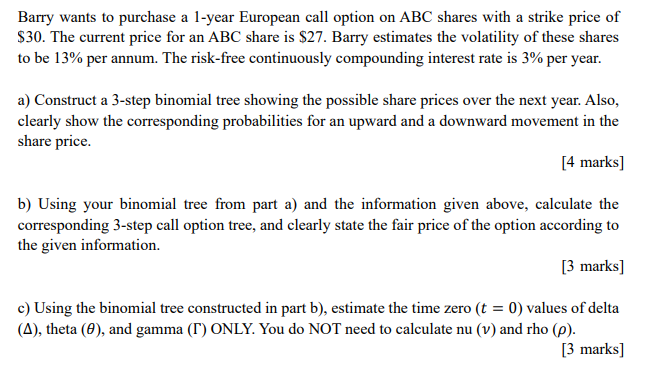

Barry wants to purchase a 1-year European call option on ABC shares with a strike price of $30. The current price for an ABC share is $27. Barry estimates the volatility of these shares to be 13% per annum. The risk-free continuously compounding interest rate is 3% per year. a) Construct a 3-step binomial tree showing the possible share prices over the next year. Also, clearly show the corresponding probabilities for an upward and a downward movement in the share price. [4 marks] b) Using your binomial tree from part a) and the information given above, calculate the corresponding 3-step call option tree, and clearly state the fair price of the option according to the given information. [3 marks] c) Using the binomial tree constructed in part b), estimate the time zero (t = 0) values of delta (A), theta (O), and gamma (T) ONLY. You do NOT need to calculate nu (v) and rho (p). [3 marks] Barry wants to purchase a 1-year European call option on ABC shares with a strike price of $30. The current price for an ABC share is $27. Barry estimates the volatility of these shares to be 13% per annum. The risk-free continuously compounding interest rate is 3% per year. a) Construct a 3-step binomial tree showing the possible share prices over the next year. Also, clearly show the corresponding probabilities for an upward and a downward movement in the share price. [4 marks] b) Using your binomial tree from part a) and the information given above, calculate the corresponding 3-step call option tree, and clearly state the fair price of the option according to the given information. [3 marks] c) Using the binomial tree constructed in part b), estimate the time zero (t = 0) values of delta (A), theta (O), and gamma (T) ONLY. You do NOT need to calculate nu (v) and rho (p). [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts