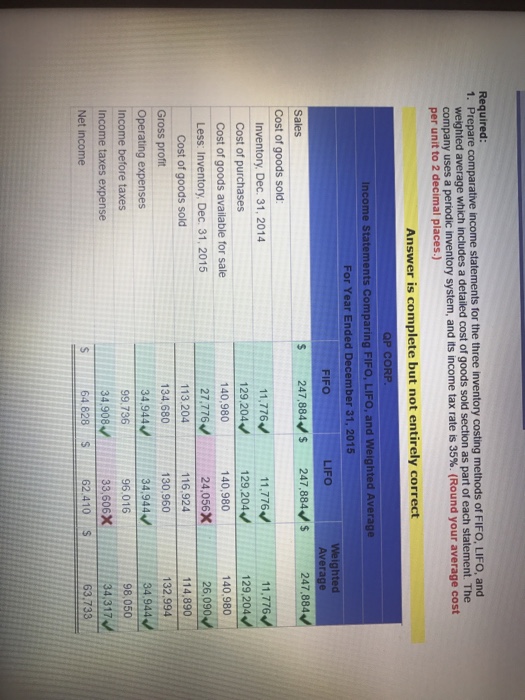

Question: Need answers for the incorrect ( in red) Question 1 (of 10.00 points Problem 5-8AA Periodic: Income comparisons and cost flows LO A1, P3 QP

Need answers for the incorrect ( in red)

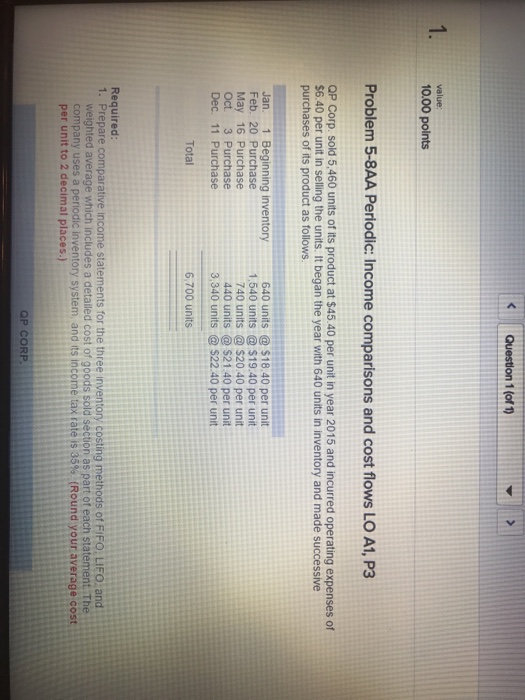

Need answers for the incorrect ( in red) Question 1 (of 10.00 points Problem 5-8AA Periodic: Income comparisons and cost flows LO A1, P3 QP Corp. sold 5,460 units of its product at $45.40 per unit in year 2015 and incurred operating expenses of S6.40 per unit in selling the units. It began the year with 640 units in inventory and made successive purchases of its product as follows. Jan 1 Beginning inventory 640 units $18.40 per unit Feb. 20 Purchase 1,540 units $19.40 per unit May 16 Purchase 740 units $20.40 per unit Oct. 3 Purchase 440 units $21.40 per unit Dec. 11 Purchase 3,340 units S22.40 per unit Total 6,700 units Required: 1. Prepare comparative income statements for the three inventory costing methods of FIFo LIFo and weighted average which includes a detailed cost of goods sold section as part of each statement The company uses a periodic inventory system, and its income tax rate is 35% (Round your average cost per unit to decimal places.) QP CORP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts