Question: Problem 5-8AA Periodic: Income comparisons and cost flows LO A1, P3 QP Corp. sold 5,440 units of its product at $45.60 per unit during the

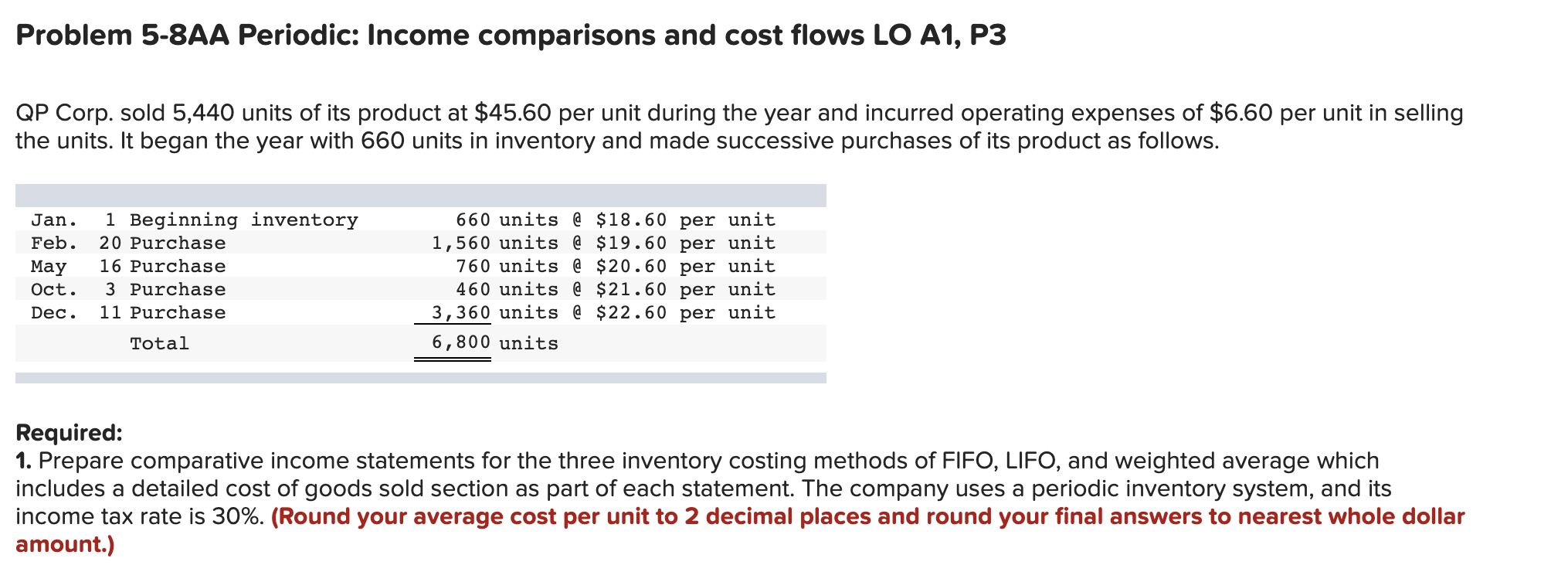

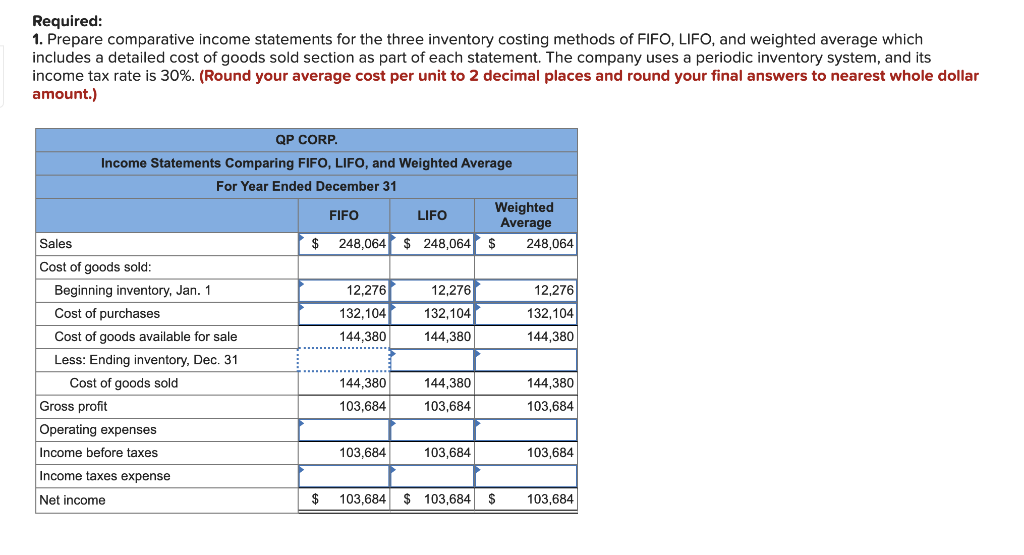

Problem 5-8AA Periodic: Income comparisons and cost flows LO A1, P3 QP Corp. sold 5,440 units of its product at $45.60 per unit during the year and incurred operating expenses of $6.60 per unit in selling the units. It began the year with 660 units in inventory and made successive purchases of its product as follows. Jan. Feb. May Oct. Dec. 1 Beginning inventory 20 Purchase 16 Purchase 3 Purchase 11 Purchase 660 units @ $18.60 per unit 1,560 units @ $19.60 per unit 760 units @ $20.60 per unit 460 units @ $21.60 per unit 3,360 units @ $22.60 per unit 6,800 units Total Required: 1. Prepare comparative income statements for the three inventory costing methods of FIFO, LIFO, and weighted average which includes a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 30%. (Round your average cost per unit to 2 decimal places and round your final answers to nearest whole dollar amount.) Required: 1. Prepare comparative income statements for the three inventory costing methods of FIFO, LIFO, and weighted average which includes a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 30%. (Round your average cost per unit to 2 decimal places and round your final answers to nearest whole dollar amount.) QP CORP. Income Statements Comparing FIFO, LIFO, and Weighted Average For Year Ended December 31 FIFO LIFO Weighted Average Sales $ 248,064 $ 248,064 $ 248,064 Cost of goods sold: Beginning inventory, Jan. 1 12,276 12,276 12,276 Cost of purchases 132,104 132,104 Cost of goods available for sale 144,380 144,380 144,380 Less: Ending inventory, Dec. 31 Cost of goods sold 144,380 144,380 144,380 Gross profit 103,684 103,684 103,684 Operating expenses Income before taxes 103,684 103,684 103,684 132,104 Income taxes expense Net income $ 103,684 $ 103,684 $ 103,684

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts