Question: NEED ASAP IN 30 MIN PLEASE!! PLEASE SHOW WORK!! Question 9 8 points Save Answer Smithson Ltd. prepares its financial statements according to IFRS. On

NEED ASAP IN 30 MIN PLEASE!! PLEASE SHOW WORK!!

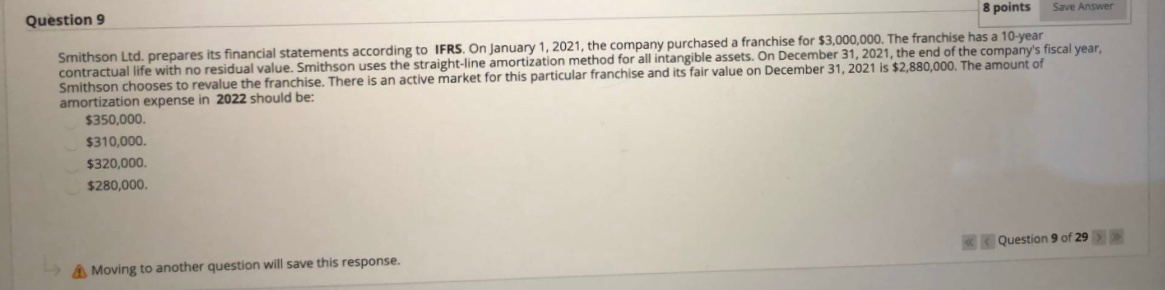

Question 9 8 points Save Answer Smithson Ltd. prepares its financial statements according to IFRS. On January 1, 2021, the company purchased a franchise for $3,000,000. The franchise has a 10-year contractual life with no residual value. Smithson uses the straight-line amortization method for all intangible assets. On December 31, 2021, the end of the company's fiscal year, Smithson chooses to revalue the franchise. There is an active market for this particular franchise and its fair value on December 31, 2021 is $2,880,000. The amount of amortization expense in 2022 should be: $350,000 $310,000 $320,000. $280,000. Question 9 of 29 >> Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts