Question: need equations too not just answer please. It has all the information you need so if you dont know what to do move on and

need equations too not just answer please. It has all the information you need so if you dont know what to do move on and let someone else answer it

need equations too not just answer please. It has all the information you need so if you dont know what to do move on and let someone else answer it

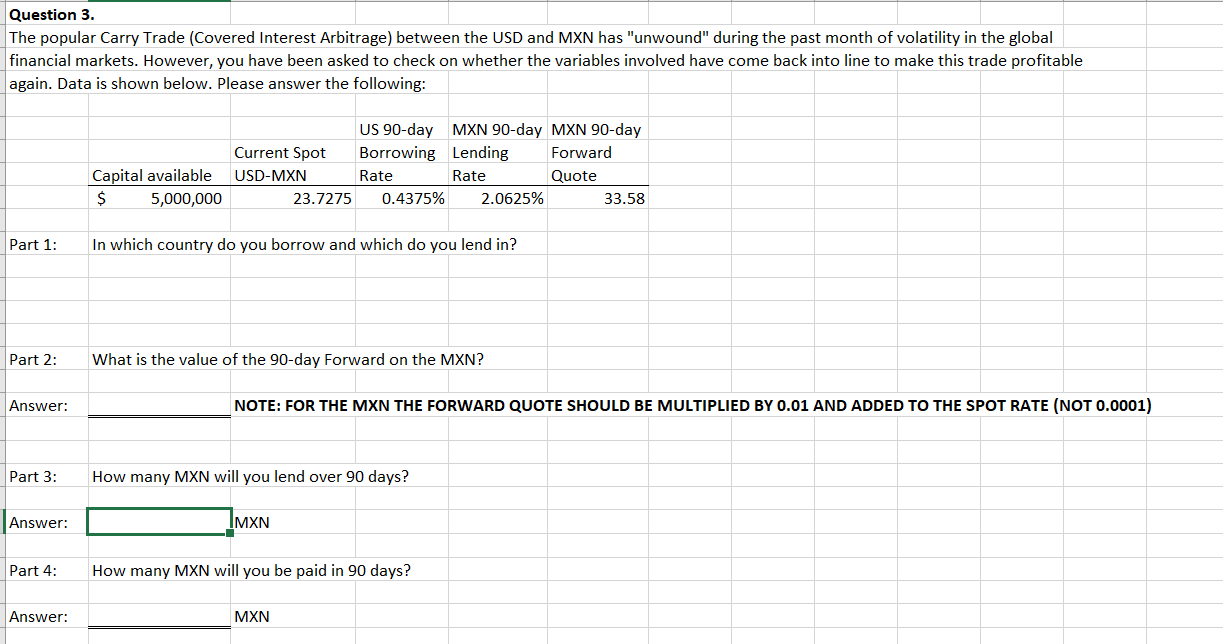

Question 3. The popular Carry Trade (Covered Interest Arbitrage) between the USD and MXN has "unwound" during the past month of volatility in the global financial markets. However, you have been asked to check on whether the variables involved have come back into line to make this trade profitable again. Data is shown below. Please answer the following: US 90-day MXN 90-day MXN 90-day Current Spot Borrowing Lending Forward USD-MXN Rate Rate Quote 23.7275 0.4375% 2.0625% 33.58 Capital available $ 5,000,000 Part 1: In which country do you borrow and which do you lend in? Part 2: What is the value of the 90-day Forward on the MXN? Answer: NOTE: FOR THE MXN THE FORWARD QUOTE SHOULD BE MULTIPLIED BY 0.01 AND ADDED TO THE SPOT RATE (NOT 0.0001) Part 3: How many MXN will you lend over 90 days? Answer: IMXN Part 4: How many MXN will you be paid in 90 days? Answer: MXN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts