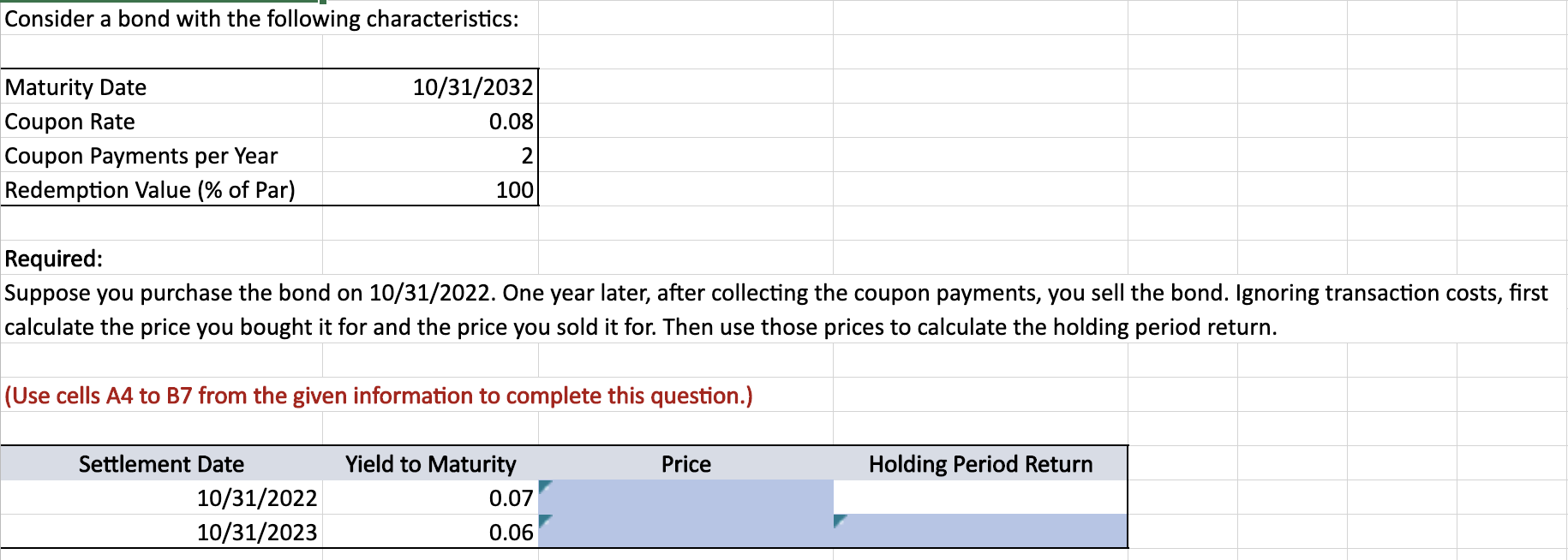

Question: Need excel formulas for blue cells Consider a bond with the following characteristics: 10/31/2032 0.08 Maturity Date Coupon Rate Coupon Payments per Year Redemption Value

Need excel formulas for blue cells

Consider a bond with the following characteristics: 10/31/2032 0.08 Maturity Date Coupon Rate Coupon Payments per Year Redemption Value (% of Par) 2 100 Required: Suppose you purchase the bond on 10/31/2022. One year later, after collecting the coupon payments, you sell the bond. Ignoring transaction costs, first calculate the price you bought it for and the price you sold it for. Then use those prices to calculate the holding period return. (Use cells A4 to B7 from the given information to complete this question.) Price Holding Period Return Settlement Date 10/31/2022 10/31/2023 Yield to Maturity 0.07 0.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts