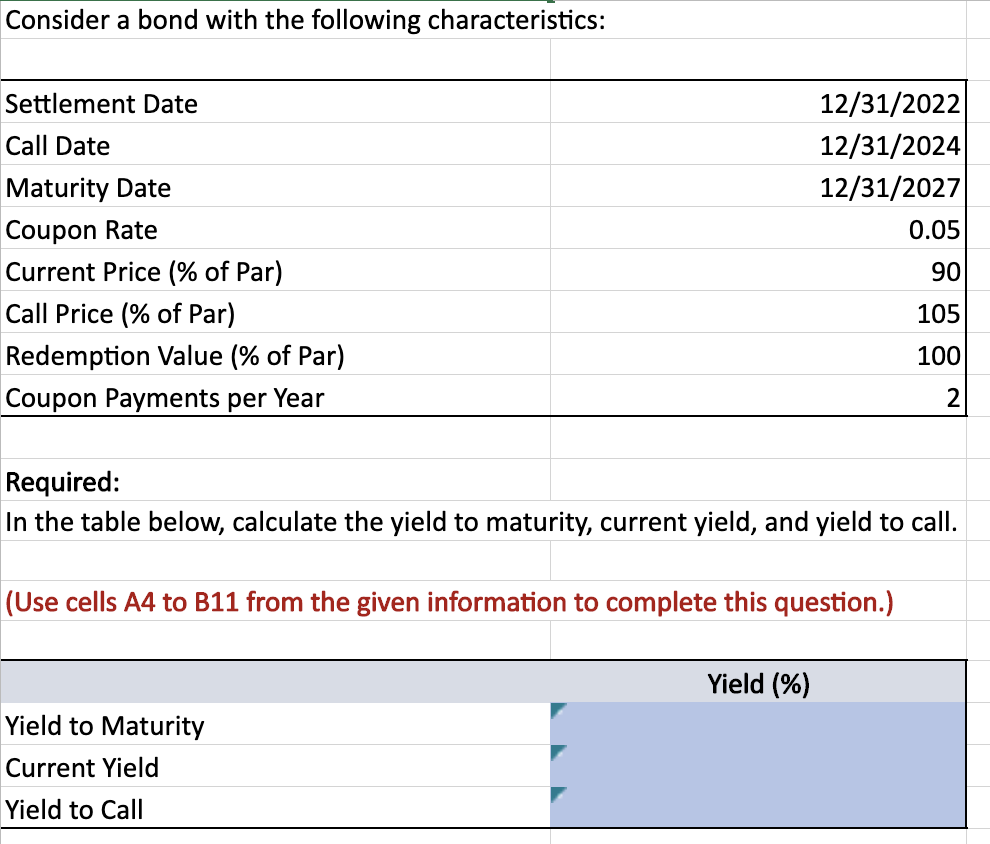

Question: Need Excel Formulas for blue cells Consider a bond with the following characteristics: Settlement Date Call Date 12/31/2022 12/31/2024 12/31/2027 0.05 90 Maturity Date Coupon

Need Excel Formulas for blue cells

Consider a bond with the following characteristics: Settlement Date Call Date 12/31/2022 12/31/2024 12/31/2027 0.05 90 Maturity Date Coupon Rate Current Price (% of Par) Call Price (% of Par) Redemption Value (% of Par) Coupon Payments per Year 105 100 2 Required: In the table below, calculate the yield to maturity, current yield, and yield to call. (Use cells A4 to B11 from the given information to complete this question.) Yield (%) Yield to Maturity Current Yield Yield to Call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts