Question: Need expert to help me solve the problem! A 10-year bond that pays coupon semi-annually at a coupon rate of 9% is priced at $

Need expert to help me solve the problem!

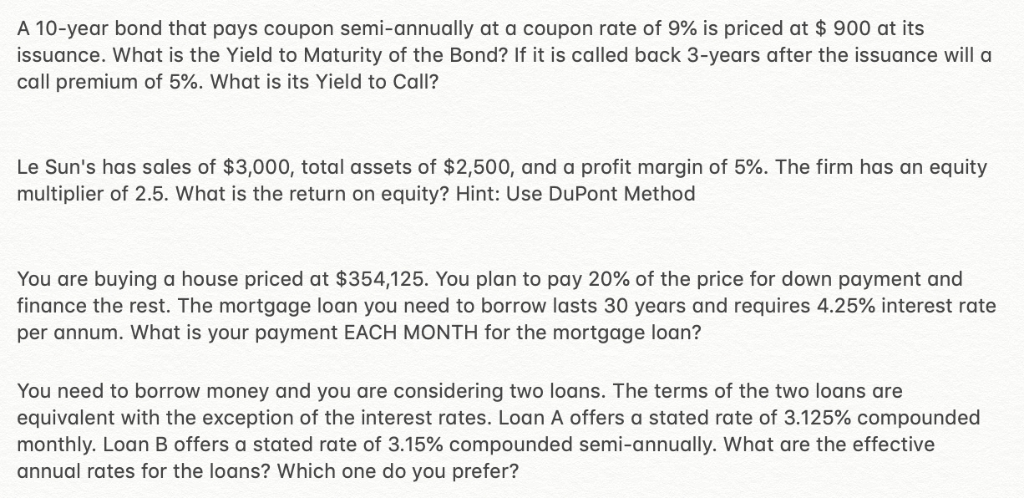

A 10-year bond that pays coupon semi-annually at a coupon rate of 9% is priced at $ 900 at its issuance. What is the Yield to Maturity of the Bond? If it is called back 3-years after the issuance will a call premium of 5%, what is its Yield to Call? Le Sun's has sales of $3,000, total assets of $2,500, and a profit margin of 5%. The firm has an equity multiplier of 2.5. What is the return on equity? Hint: Use DuPont Method You are buying a house priced at $354,125. You plan to pay 20% of the price for down payment and finance the rest. The mortgage loan you need to borrow lasts 30 years and requires 4.25% interest rate per annum. What is your payment EACH MONTH for the mortgage loan? You need to borrow money and you are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A offers a stated rate of 3.125% compounded monthly. Loan B offers a stated rate of 3.15% compounded semi-annually. What are the effective annual rates for the loans? Which one do you prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts