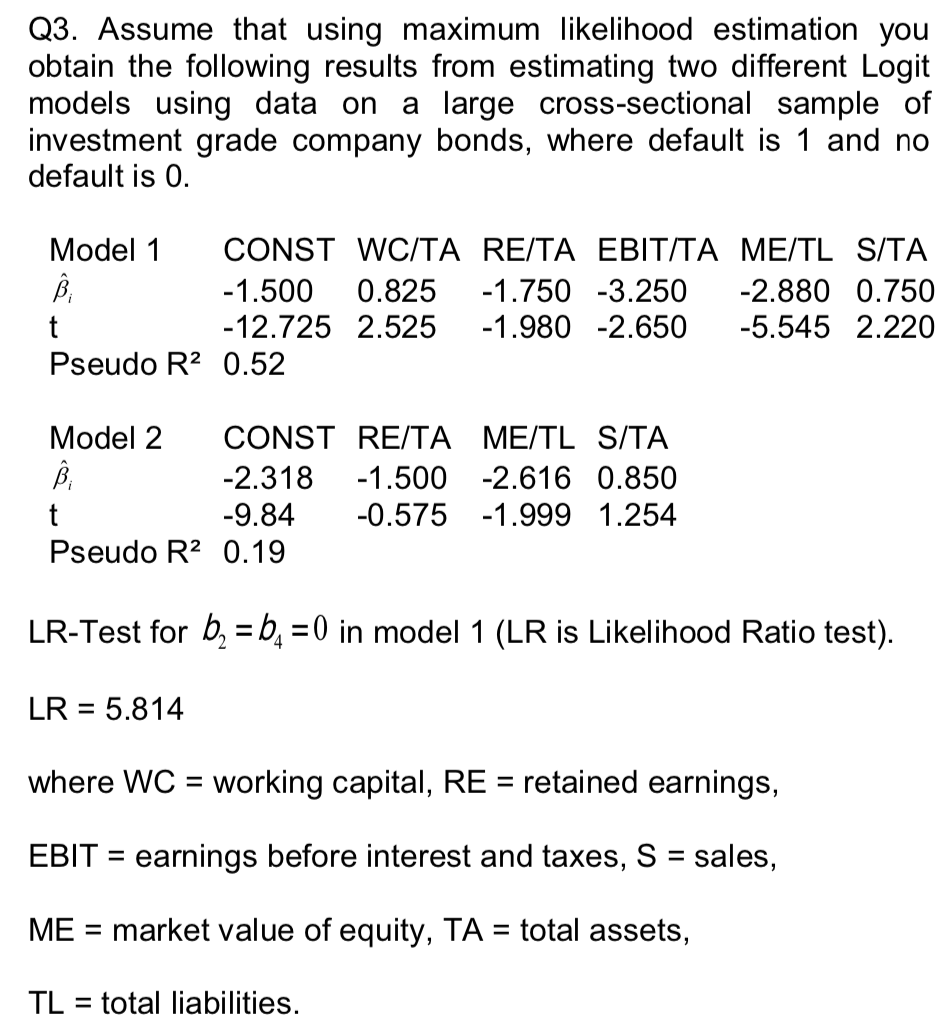

Question: Q3. Assume that using maximum likelihood estimation you obtain the following results from estimating two different Logit models using data on a large cross-sectional sample

Q3. Assume that using maximum likelihood estimation you obtain the following results from estimating two different Logit models using data on a large cross-sectional sample of investment grade company bonds, where default is 1 and no default is 0 Model 1CONST WC/TA RE/TA EBITITA ME/TL S/TA 1.500 0.825 1.750-3.250 -2.880 0.750 12.725 2.525 1.980 -2.650 5.545 2.220 Pseudo R2 0.52 Model 2 CONST RE/TA ME/TL S/TA 2.318 1.500 2.616 0.850 -9.84 0.575 1.999 1.254 Pseudo R2 0.19 LR-Test for b b in model 1 (LR is Likelihood Ratio test). LR = 5.814 where WC working capital, REretained earnings, EBIT earnings before interest and taxes, S - sales, MEmarket value of equity, TA total assets, TL total liabilities. (c) For model 1, and for each explanatory variable, state whether the signs of the estimated parameters for each model are what you would expect? 30% (d) Explain which model is statistically preferred 20% Q3. Assume that using maximum likelihood estimation you obtain the following results from estimating two different Logit models using data on a large cross-sectional sample of investment grade company bonds, where default is 1 and no default is 0 Model 1CONST WC/TA RE/TA EBITITA ME/TL S/TA 1.500 0.825 1.750-3.250 -2.880 0.750 12.725 2.525 1.980 -2.650 5.545 2.220 Pseudo R2 0.52 Model 2 CONST RE/TA ME/TL S/TA 2.318 1.500 2.616 0.850 -9.84 0.575 1.999 1.254 Pseudo R2 0.19 LR-Test for b b in model 1 (LR is Likelihood Ratio test). LR = 5.814 where WC working capital, REretained earnings, EBIT earnings before interest and taxes, S - sales, MEmarket value of equity, TA total assets, TL total liabilities. (c) For model 1, and for each explanatory variable, state whether the signs of the estimated parameters for each model are what you would expect? 30% (d) Explain which model is statistically preferred 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts