Question: need explanation on all Produc Pract Parte Pro 100,000 40.000 15.50.000 0.00 19,70,000 2. Product A discontinued Capacity utilised for Bor Cor both. TI used

need explanation on all

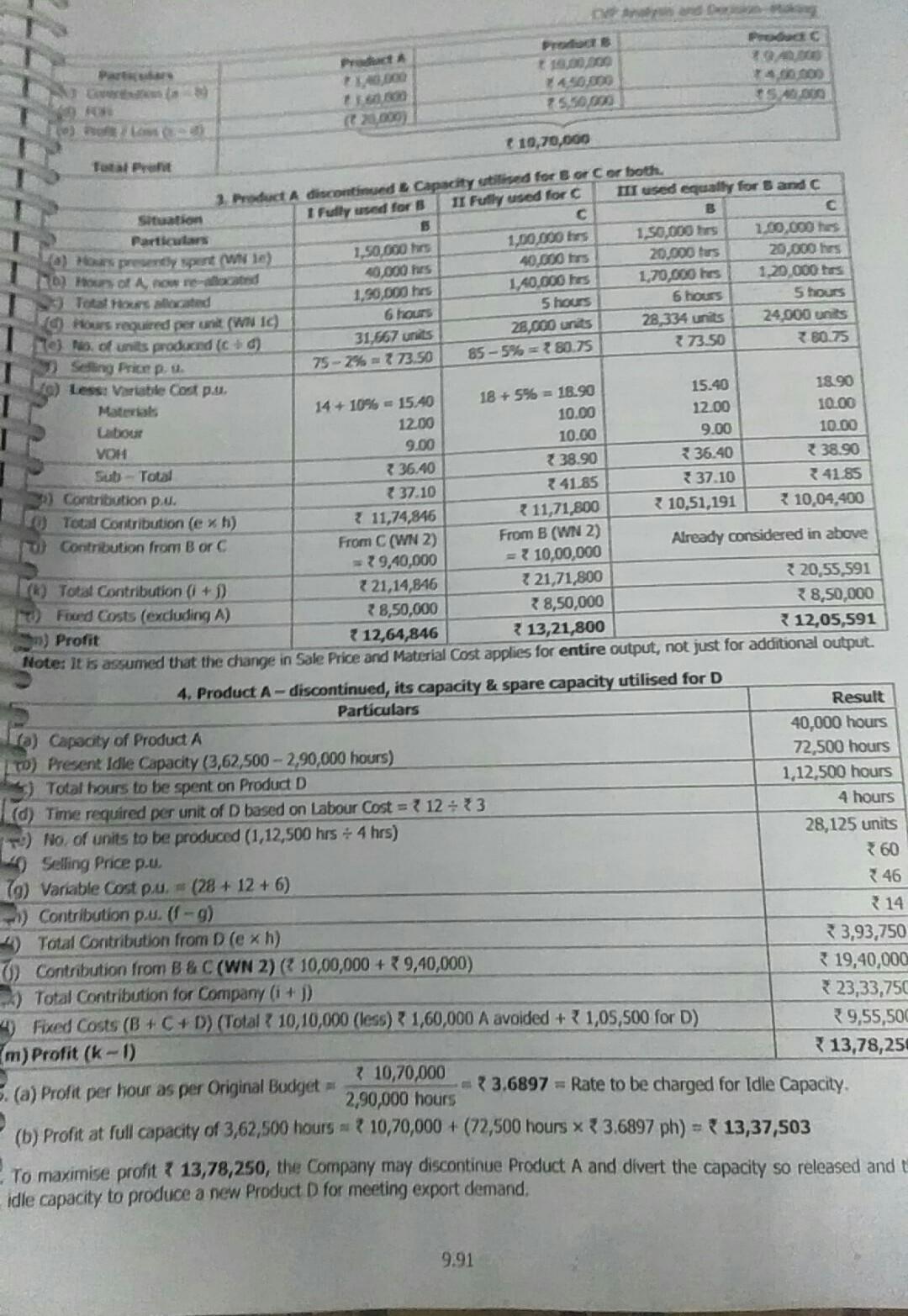

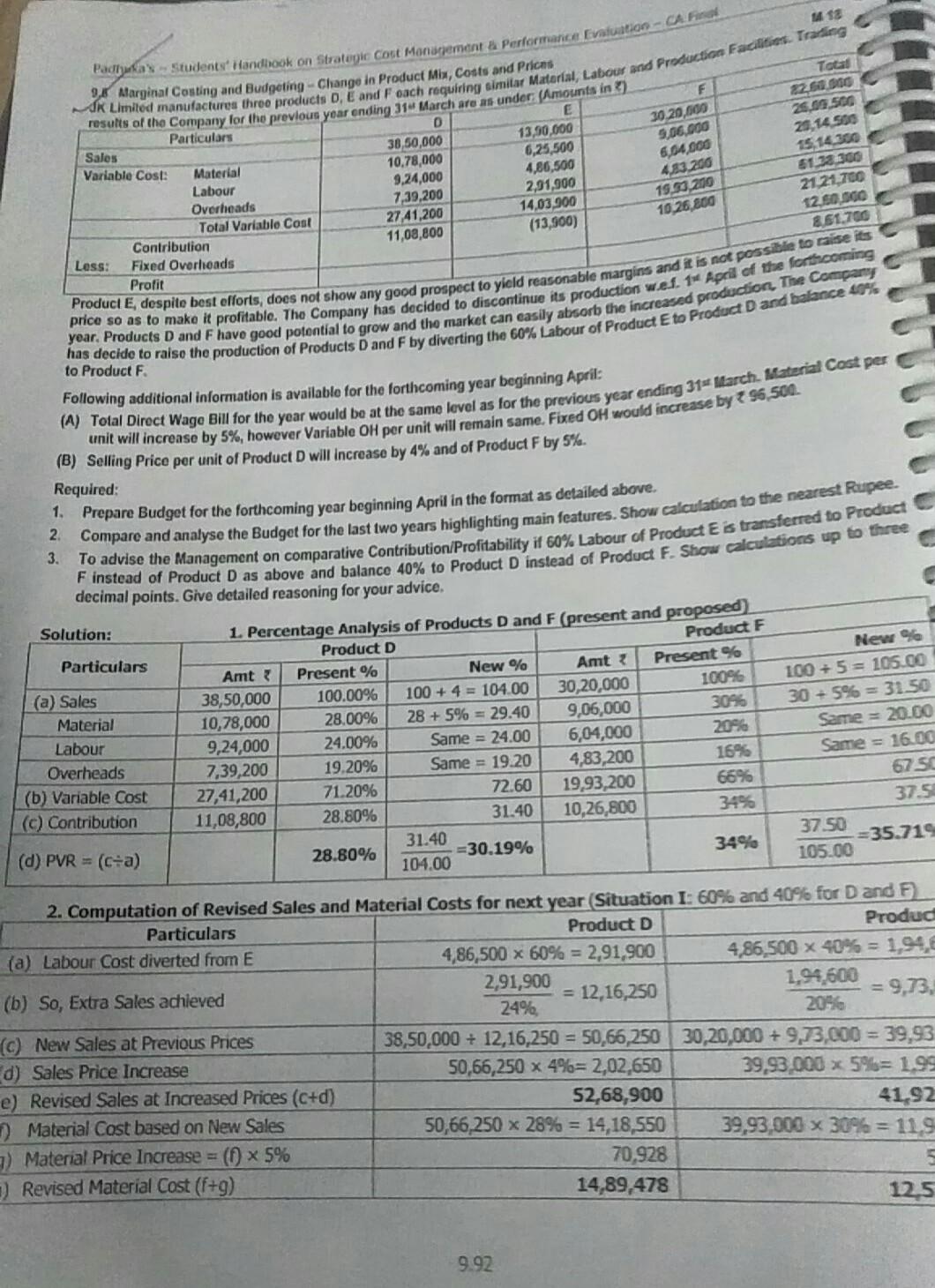

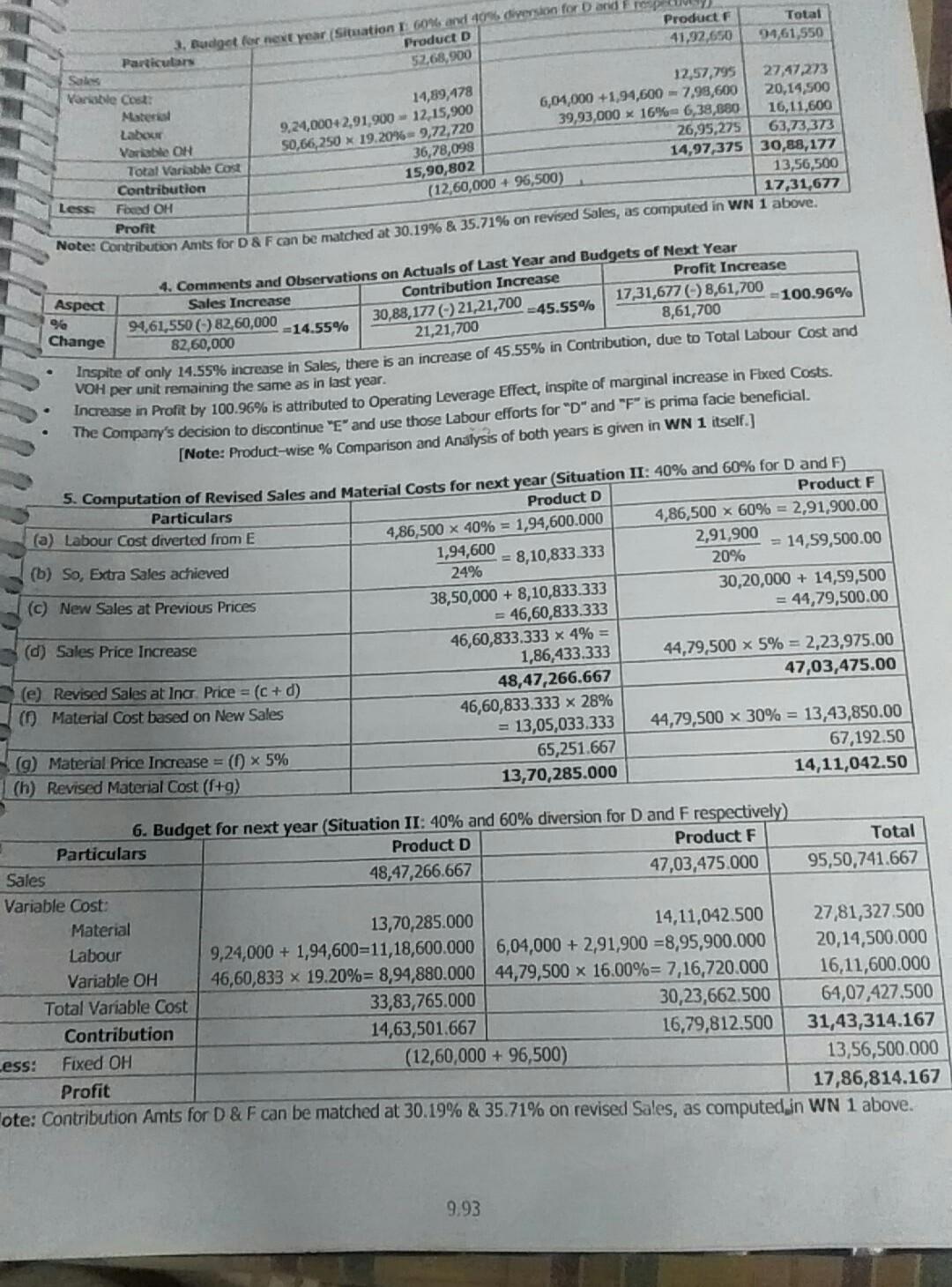

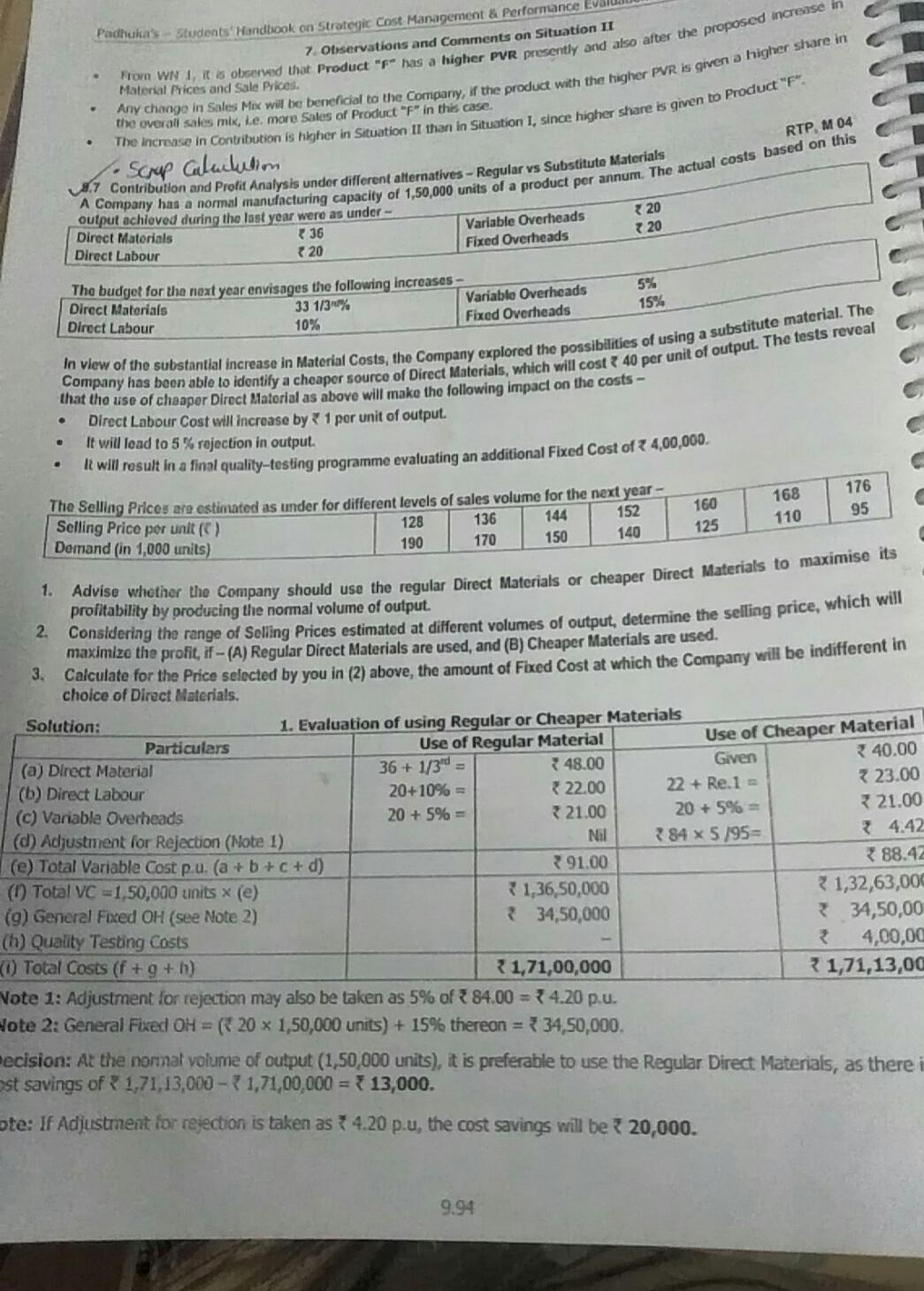

Produc Pract Parte Pro 100,000 40.000 15.50.000 0.00 19,70,000 2. Product A discontinued Capacity utilised for Bor Cor both. TI used equally for Band C II Fully used for Situation I Fully used for s B 5 Particulars 1,00.000 hrs 1,50,000 hrs 1.00,000 hes B) sprey spent W10) 1,50,000 hrs 40.000 hrs 20.000 turs 20,000 hrs D) Hours of now re-cated 40,000 hrs 1.70,000 hes 1,20,000 hrs 1.40.000 hes Totat Holocad 1,90,000 hrs 6 hours 5 hours 5 hours 6 hours Hours required per unit (WN 10) 28,334 units 24,000 units 28,000 units Toto of units produand (0) 31,667 units 73.50 7 80.75 Selling Priceps 85 -5% = 80.75 75 - 2% 73.50 Lesst Variable Costp.u. 15.40 18.90 18 + 5% = 18.90 Materials 14+ 10% = 15.40 12.00 10.00 10.00 Labour 12.00 9.00 10.00 10.00 VOH 9.00 Sub - Total 38.90 338.90 3 36.40 336.40 2) Contribution pu. 137.10 41.85 37.10 34185 0 Total Contribution (e xh) 3 11,74,846 11,71,800 10,51,191 10,04,400 0) Contribution from B or C From C(WN 2) From B (WN 2) Already considered in above 29,40,000 = ? 10,00,000 (5) Total Contribution (1 + D) 21,14,846 21,71,800 20,55,591 Fred Costs (excluding A) 88,50,000 * 8,50,000 38,50,000 m) Profit 12,64,846 13,21,800 12,05,591 Note: It is assumed that the change in Sale Price and Material Cost applies for entire output, not just for additional output. 4. Product A-discontinued, its capacity & spare capacity utilised for D Particulars Result a) Capacity of Product 40,000 hours LO) Present Idle Capacity (3,62,500 - 2,90,000 hours) 72,500 hours 3) Total hours to be spent on Product D 1,12,500 hours d) Time required per unit of D based on Labour Cost = { 12 = * 3 4 hours * No. of units to be produced (1,12,500 hrs + 4 hrs) 28,125 units Selling Price p.u. 760 (9) Variable Cost pu. (28 + 12 + 6) 346 - Contribution pu. (-9) 14 4) Total Contribution from D (e xh) 33,93,750 0) Contribution from B & C(WN 2) ( 10,00,000 + 9,40,000) 19,40,000 -) Total Contribution for Company (i+1) 23,33,750 4) Fixed Costs (B + C + D) (Total : 10,10,000 (less) 1,60,000 A avoided + 1,05,500 for D) 9,55,500 m) Profit (k-1) 13,78,25 5. (a) Profit per hour as per Original Budget ? 10,70,000 3.6897 = Rate to be charged for Idle Capacity. 2,90,000 hours (b) Profit at full capacity of 3,62,800 hours ? 10,70,000 + (12,500 hours 3.6897 ph) = * 13,37,503 To maximise profit ? 13,78,250, the Company may discontinue Product A and divert the capacity so released and idle capacity to produce a new Product D for meeting export demand, 9.91 148 Total Marginal Costing and Budgeting - Change in Product Mix, Costs and Prions results of the Company for the previous year ending 314 March are as under (Amounts in ) D E 38,50,000 13,90,000 10,78,000 6,25,500 9,24,000 4,86,500 7,39,200 2,91,900 27,41,200 14,03,900 11,08,800 (13,900) F 30 20,000 9,06,000 6,04,000 4,83.200 19.30,200 10,26,800 25.09.500 20.14 500 15,14.300 61.38 300 21.21,700 12.50.000 8,61.700 Padukas - Students' Handhook on Strategic Cost Management & Performance Evaluation - CA Final dk Limited manufactures threo products D, E and F each requiring similar Material, Labour and Production Facilities. Trading Particulars Sales Variable Cost: Material Labour Overheads Total Variable Cost Contribution Less: Fixed Overheads Profit Product E, despite best efforts, does not show any good prospect to yield reasonable margins and it is not possible to raise its year. Products D and F have good potential to grow and the market can easily absorb the increased production The Company price so as to make it profitable. The Company has decided to discontinue its production wef. 1 April of the forthcoming has decide to raise the production of Products D and F by diverting the 60% Labour of Product E to Product D and balance 40% to Product F Following additional information is available for the forthcoming year beginning April: (A) Total Direct Wage Bill for the year would be at the same level as for the previous year ending 31- arch. Material Cost per (B) Selling Price per unit of Product D will increase by 4% and of Product F by 5%. Required: 1. Prepare Budget for the forthcoming year beginning April in the format as detailed above. 2. Compare and analyse the Budget for the last two years highlighting main features. Show calculation to the nearest Rupee. 3. Finstead of Product D as above and balance 40% to Product D instead of Product F. Show calculations up to three To advise the Management on comparative Contribution/Profitability it 60% Labour of Product E is transferred to Product decimal points. Give detailed reasoning for your advice. Solution: 1. Percentage Analysis of Products D and F (present and proposed) Product F Product D Particulars New Amt 3 Present % New % Amt ? Presents (a) Sales 38,50,000 100.00% 100+ 4 = 104.00 30,20,000 100% 100 + 5 = 105.00 Material 10,78,000 28.00% 28 + 5% = 29.40 9,06,000 3096 30 + 5% = 31.50 Labour 9,24,000 24.00% Same = 24.00 6,04,000 20% Same = 20.00 Overheads 7,39,200 19.20% Same = 19.20 4,83,200 16% Same = 16.00 (b) Variable Cost 27,41,200 71.20% 72.60 19,93,200 66% 67 50 (c) Contribution 11,08,800 28.80% 31.40 10,26,800 34% 37.5 (d) PVR = (-a) 31.40 37.50 =30.19% 28.80% 34% =35.719 104.00 105.00 2. Computation of Revised Sales and Material Costs for next year (Situation 1: 60% and 40% for D and F) Particulars Product D Produd (a) Labour Cost diverted from E 4,86,500 x 60% = 2,91,900 4,86,500 x 40% = 1,94,6 2,91,900 1,94,600 (b) So, Extra Sales achieved = 12,16,250 = 9,73, 24% 2090 () New Sales at Previous Prices 38,50,000 + 12,16,250 = 50,66,250 30,20,000 + 9,73,000 = 39,93 d) Sales Price Increase 50,66,250 x 4%= 2,02,650 39.93.000 x 5%= 1.99 e) Revised Sales at Increased Prices (c+d) 52,68,900 41.92 1) Material Cost based on New Sales 50,66,250 x 28% = 14,18,550 39,93 000 x 30% = 11.9 7) Material Price Increase = (0 x 5% 70,928 Revised Material Cost (f+9) 14,89,478 12,5 9.92 3. Budget for next year (Situation 1 60% and 40% diversion for Dandry Product D 52,68,900 14,89,178 9,24,000+2,91,900 - 12,15,900 50,66,250 X 19.20% 9,72,720 36,78,098 15,90,802 (12,60,000+ 96,500) Less Aspect % Change Product Total Particulars 41,92,650 94,61 550 Sales Variable Cost: 12,57,795 27,47,273 Material 6,04,000 +1,94,600 = 7,99,600 20,14,500 Labour 39,93,000 x 16% 6,39,880 16,11,600 Variable OH 26,95,275 63,73,373 Total Variable Cost 14,97,375 30,88,177 Contribution 13,56,500 Feed OH 17,31,677 Profit Note: Contribution Amts for D&F can be matched at 30.19% & 35.71% on revised Sales, as computed in WN 1 above. 4. Comments and Observations on Actuals of Last Year and Budgets of Next Year Profit Increase Sales Increase Contribution Increase 17,31,677(-) 8,61,700 94,61,550 ( 82,60,000 30,88,177 () 21,21,700 -45.55% 100.96% 14.55% 8,61,700 21,21,700 82,60,000 Inspite of only 14.55% increase in Sales, there is an increase of 45.55% in Contribution, due to Total Labour cost and VOH per unit remaining the same as in last year. Increase in Profit by 100.96% is attributed to Operating Leverage Effect, inspite of marginal increase in Fixed Costs. The Company's decision to discontinue "E" and use those Labour efforts for "D" and "F" is prima facie beneficial. [Note: Product-wise % Comparison and Analysis of both years is given in WN 1 itself.] 5. Computation of Revised Sales and Material Costs for next year (Situation II: 40% and 60% for D and F) Particulars Product D Product F (a) Labour Cost diverted from E 4,86,500 x 40% = 1,94,600.000 4,86,500 x 60% = 2,91,900.00 2,91,900 1,94,600 (b) So, Extra Sales achieved = 8,10,833.333 = 14,59,500.00 24% 20% (c) New Sales at Previous Prices 38,50,000 + 8,10,833.333 30,20,000 + 14,59,500 = 46,60,833.333 = 44,79,500.00 (d) Sales Price Increase 46,60,833.333 x 4% = 1,86,433.333 44,79,500 x 5% = 2,23,975.00 (e) Revised Sales at Inar. Price = (c+d) 48,47,266.667 47,03,475.00 (0) Material Cost based on New Sales 46,60,833.333 x 28% = 13,05,033.333 44,79,500 x 30% = 13,43,850.00 9) Material Price Increase = (0 x 5% 65,251.667 67,192.50 (h) Revised Material Cost (f+9) 13,70,285.000 14,11,042.50 6. Budget for next year (Situation II: 40% and 60% diversion for D and F respectively) Particulars Product D Product F Total Sales 48,47,266.667 47,03,475.000 95,50,741.667 Variable Cost: Material 13,70,285.000 14,11,042.500 27,81,327.500 Labour 9,24,000 + 1,94,600=11,18,600.000 6,04,000 + 2,91,900 =8,95,900.000 20,14,500.000 Variable OH 46,60,833 x 19.20%= 8,94,880.000 44,79,500 x 16.00%= 7,16,720.000 16,11,600.000 Total Variable Cost 33,83,765.000 30,23,662.500 64,07,427.500 Contribution 14,63,501.667 16,79,812.500 31,43,314.167 ess: Fixed OH (12,60,000+ 96,500) 13,56,500,000 Profit 17,86,814.167 Note: Contribution Amts for D&F can be matched at 30.19% & 35.71% on revised Sales, as computed in WN 1 above. 9.93 Padhuka's Students Handbook on Strategic Cose Management & Performance 7. Observations and Comments on Situation II From WN It is observed that Product "F" has a higher PVR presently and also after the proposed increase in Material Prices and Sale Prices. Any change in Sales Mix will be beneficial to the Company, If the product with the higher PVR is given a higher share in The Increase in Contribution is higher in Situation II than in Situation I, since higher share is given to Product "F" the overall sales mi, le, more Sales of Product "F" in this case. RTP M04 Scrup calulution 17 Contribution and Protid Analysis under different alternatives - Regular vs Substitute Materials output achieved during the last year were as under - 736 Variable Overheads

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts