Question: Need Formulas to answer each question. Show your work - show your computations in details Q1. You put half of your money in a stock

Need Formulas to answer each question.

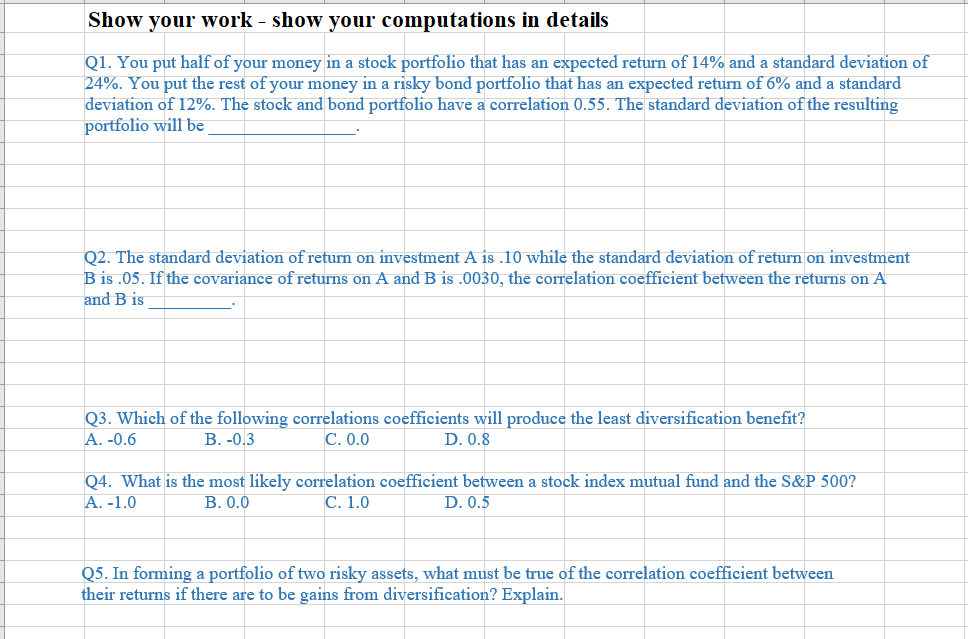

Show your work - show your computations in details Q1. You put half of your money in a stock portfolio that has an expected return of 14% and a standard deviation of 24%. You put the rest of your money in a risky bond portfolio that has an expected return of 6% and a standard deviation of 12%. The stock and bond portfolio have a correlation 0.55 . The standard deviation of the resulting portfolio will be Q2. The standard deviation of return on investment A is .10 while the standard deviation of return on investment B is .05. If the covariance of returns on A and B is .0030, the correlation coefficient between the returns on A and B is Q3. Which of the following correlations coefficients will produce the least diversification benefit? A. -0.6 B. -0.3 C. 0.0 D. 0.8 Q4. What is the most likely correlation coefficient between a stock index mutual fund and the S\&P 500? A. -1.0 B. 0.0 C. 1.0 D. 0.5 Q5. In forming a portfolio of two risky assets, what must be true of the correlation coefficient between their returns if there are to be gains from diversification? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts