Question: NEED HELP A-E USING LIFO INVENTORY METHOD Data The company uses a perpetual inventory system. It had the following beginning inventory and current-year purchases of

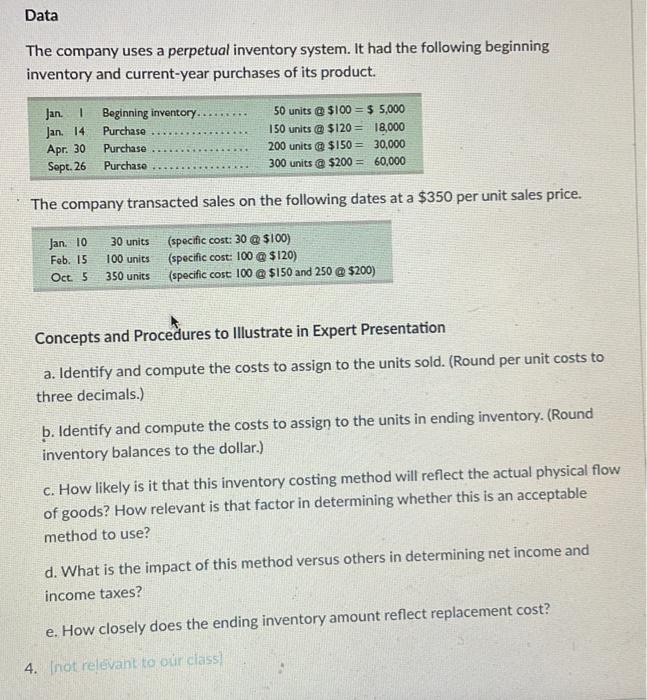

Data The company uses a perpetual inventory system. It had the following beginning inventory and current-year purchases of its product. The company transacted sales on the following dates at a $350 per unit sales price. Concepts and Procedures to Illustrate in Expert Presentation a. Identify and compute the costs to assign to the units sold. (Round per unit costs to three decimals.) b. Identify and compute the costs to assign to the units in ending inventory. (Round inventory balances to the dollar.) c. How likely is it that this inventory costing method will reflect the actual physical flow of goods? How relevant is that factor in determining whether this is an acceptable method to use? d. What is the impact of this method versus others in determining net income and income taxes? e. How closely does the ending inventory amount reflect replacement cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts