Question: Need Help and all excel work shown with formulas !! This is a problem from excel. Problem 3-9 You run a construction firm. You have

Need Help and all excel work shown with formulas !! This is a problem from excel.

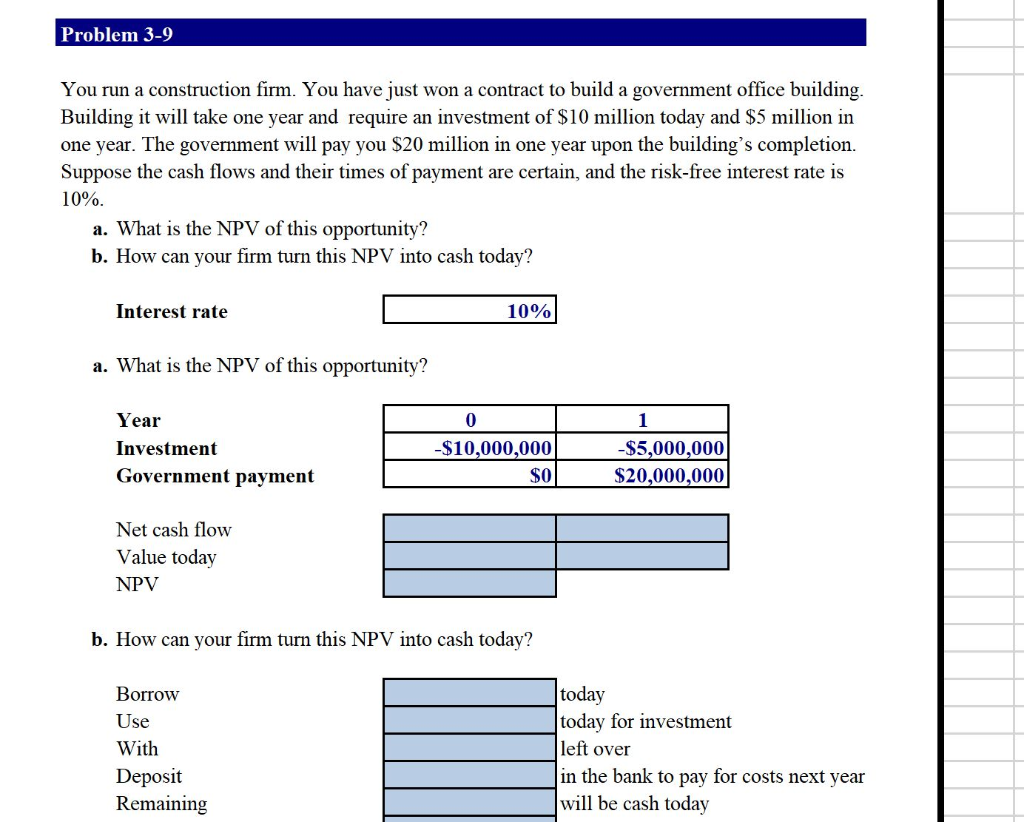

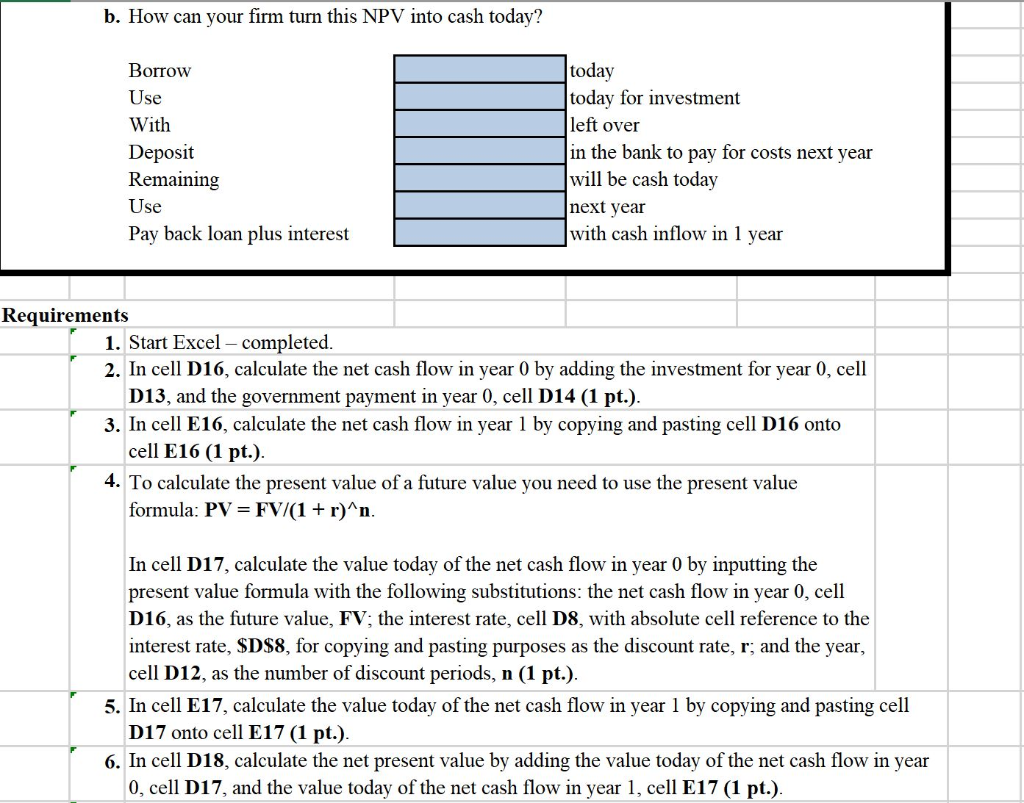

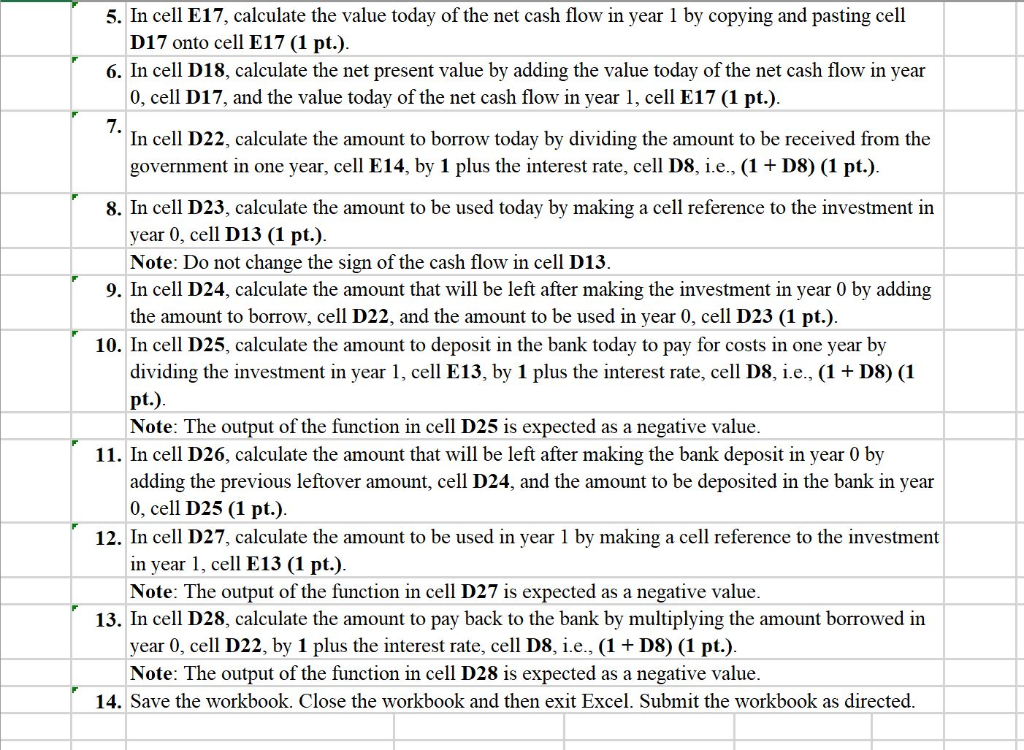

Problem 3-9 You run a construction firm. You have just won a contract to build a government office building Building it will take one year and require an investment of $10 million today and $5 million in one year. The government will pay you $20 million in one year upon the building's completion Suppose the cash flows and their times of payment are certain, and the risk-free interest rate is 10% a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? 10% Interest rate a. What is the NPV of this opportunity? Year $5,000,000 Investment $10,000,000 $20,000,000 Government pavment S0 Net cash flow Value today NPV b. How can your firm turn this NPV into cash today? today Borrow today for investment Use With left over Deposit in the bank to pav for costs next vear will be cash today Remaining b. How can your firm turn this NPV into cash today? today Borrow Use today for investment With left over Deposit Remainin;g in the bank to pav for costs next vear will be cash today Use next year Pay back loan plus interest with cash inflow in 1 vear Requirements 1. Start Excel - completed 2. In cell D16, calculate the net cash flow in year 0 by adding the investment for year 0, cell D13, and the government payment in year 0, cell D14 (1 pt.) 3. In cell E16, calculate the net cash flow in year 1 by copying and pasting cell D16 onto cell E16 (1 pt.) 4. To calculate the present value of a future value you need to use the present value formula: PV = FV/(1 r)^n In cell D17, calculate the value today of the net cash flow in year 0 by inputting the present value formula with the following substitutions: the net cash flow in year 0, cell D16, as the future value, FV; the interest rate, cell D8, with absolute cell reference to the interest rate, SDS8, for copying and pasting purposes as the discount rate, r, and the year, cell D12, as the number of discount periods, n (1 pt.) 5. In cell E17, calculate the value today of the net cash flow in year 1 by copying and pasting cell D17 onto cell E17 (1 pt.) 6. In cell D18, calculate the net present value by adding the value today of the net cash flow in year 0, cell D17, and the value today of the net cash flow in year 1, cell E17 (1 pt.) 5. In cell E17, calculate the value today of the net cash flow in year 1 by copying and pasting cell D17 onto cell E17 (1 pt.) 6. In cell D18, calculate the net present value by adding the value today of the net cash flow in year 0, cell D17, and the value today of the net cash flow in year 1, cell E17 (1 pt.) 7. In cell D22, calculate the amount to borrow today by dividing the amount to be received from the government in one year, cell E14, by 1 plus the interest rate, cell D8, i.e., (1 + D8) (1 pt.) 8. In cell D23, calculate the amount to be used today by making a cell reference to the investment in year 0, cell D13 (1 pt.) Note: Do not change the sign of the cash flow in cell D13 9. In cell D24, calculate the amount that will be left after making the investment in year 0 by adding the amount to borrow, cell D22, and the amount to be used in year 0, cell D23 (1 pt.) 10. In cell D25, calculate the amount to deposit in the bank today to pay for costs in one year by dividing the investment in year 1, cell E13, by 1 plus the interest rate, cell D8, i.e., (1 + D8) (1 t. Note: The output of the function in cell D25 is expected as a negative value 11. In cell D26, calculate the amount that will be left after making the bank deposit in year 0 by adding the previous leftover amount, cell D24, and the amount to be deposited in the bank in year 0, cell D25 (1 pt.) 12. In cell D27, calculate the amount to be used in year 1 by making a cell reference to the investment in year 1, cell E13 (1 pt.) Note: The output of the function in cell D27 is expected as a negative value 13. In cell D28, calculate the amount to pay back to the bank by multiplying the amount borrowed in year 0, cell D22, by 1 plus the interest rate, cell D8, i.e., (1 + D8) (1 pt.) Note: The output of the function in cell D28 is expected as a negative value 14. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed Problem 3-9 You run a construction firm. You have just won a contract to build a government office building Building it will take one year and require an investment of $10 million today and $5 million in one year. The government will pay you $20 million in one year upon the building's completion Suppose the cash flows and their times of payment are certain, and the risk-free interest rate is 10% a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? 10% Interest rate a. What is the NPV of this opportunity? Year $5,000,000 Investment $10,000,000 $20,000,000 Government pavment S0 Net cash flow Value today NPV b. How can your firm turn this NPV into cash today? today Borrow today for investment Use With left over Deposit in the bank to pav for costs next vear will be cash today Remaining b. How can your firm turn this NPV into cash today? today Borrow Use today for investment With left over Deposit Remainin;g in the bank to pav for costs next vear will be cash today Use next year Pay back loan plus interest with cash inflow in 1 vear Requirements 1. Start Excel - completed 2. In cell D16, calculate the net cash flow in year 0 by adding the investment for year 0, cell D13, and the government payment in year 0, cell D14 (1 pt.) 3. In cell E16, calculate the net cash flow in year 1 by copying and pasting cell D16 onto cell E16 (1 pt.) 4. To calculate the present value of a future value you need to use the present value formula: PV = FV/(1 r)^n In cell D17, calculate the value today of the net cash flow in year 0 by inputting the present value formula with the following substitutions: the net cash flow in year 0, cell D16, as the future value, FV; the interest rate, cell D8, with absolute cell reference to the interest rate, SDS8, for copying and pasting purposes as the discount rate, r, and the year, cell D12, as the number of discount periods, n (1 pt.) 5. In cell E17, calculate the value today of the net cash flow in year 1 by copying and pasting cell D17 onto cell E17 (1 pt.) 6. In cell D18, calculate the net present value by adding the value today of the net cash flow in year 0, cell D17, and the value today of the net cash flow in year 1, cell E17 (1 pt.) 5. In cell E17, calculate the value today of the net cash flow in year 1 by copying and pasting cell D17 onto cell E17 (1 pt.) 6. In cell D18, calculate the net present value by adding the value today of the net cash flow in year 0, cell D17, and the value today of the net cash flow in year 1, cell E17 (1 pt.) 7. In cell D22, calculate the amount to borrow today by dividing the amount to be received from the government in one year, cell E14, by 1 plus the interest rate, cell D8, i.e., (1 + D8) (1 pt.) 8. In cell D23, calculate the amount to be used today by making a cell reference to the investment in year 0, cell D13 (1 pt.) Note: Do not change the sign of the cash flow in cell D13 9. In cell D24, calculate the amount that will be left after making the investment in year 0 by adding the amount to borrow, cell D22, and the amount to be used in year 0, cell D23 (1 pt.) 10. In cell D25, calculate the amount to deposit in the bank today to pay for costs in one year by dividing the investment in year 1, cell E13, by 1 plus the interest rate, cell D8, i.e., (1 + D8) (1 t. Note: The output of the function in cell D25 is expected as a negative value 11. In cell D26, calculate the amount that will be left after making the bank deposit in year 0 by adding the previous leftover amount, cell D24, and the amount to be deposited in the bank in year 0, cell D25 (1 pt.) 12. In cell D27, calculate the amount to be used in year 1 by making a cell reference to the investment in year 1, cell E13 (1 pt.) Note: The output of the function in cell D27 is expected as a negative value 13. In cell D28, calculate the amount to pay back to the bank by multiplying the amount borrowed in year 0, cell D22, by 1 plus the interest rate, cell D8, i.e., (1 + D8) (1 pt.) Note: The output of the function in cell D28 is expected as a negative value 14. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts