Question: Please help me with Excel sim, because my Excel sim did not work. If you can not run ExcelSim, create the input box as if

Please help me with Excel sim, because my Excel sim did not work. If you can not run ExcelSim, create the input box as if you were running it for real. Thank you so much!!!

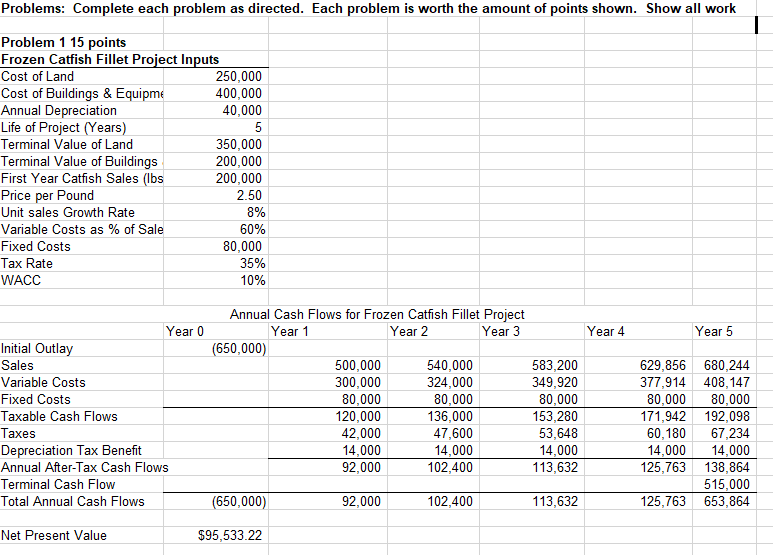

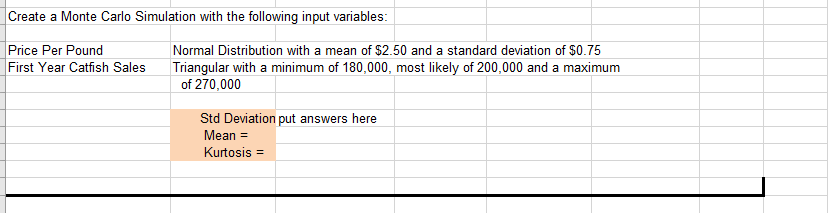

Problems: Complete each problem as directed. Each problem is worth the amount of points shown. Show all work Problem 1 15 points Frozen Catfish Fillet Project Inputs Cost of Land 250,000 Cost of Buildings & Equipme 400,000 Annual Depreciation 40,000 Life of Project (Years) 5 Terminal Value of Land 350,000 Terminal Value of Buildings 200,000 First Year Catfish Sales (lbs 200,000 Price per Pound 2.50 Unit sales Growth Rate 8% Variable Costs as % of Sale 60% Fixed Costs 80,000 Tax Rate 35% WACC 10% Year 4 Year 5 Year 0 Initial Outlay Sales Variable Costs Fixed Costs Taxable Cash Flows Taxes Depreciation Tax Benefit Annual After-Tax Cash Flows Terminal Cash Flow Total Annual Cash Flows Annual Cash Flows for Frozen Catfish Fillet Project Year 1 Year 2 Year 3 (650,000) 500,000 540,000 300,000 324,000 80,000 80,000 120,000 136,000 42,000 47,600 14,000 14,000 92,000 102,400 583,200 349,920 80,000 153,280 53,648 14,000 113,632 629,856 680,244 377,914 408,147 80,000 80,000 171,942 192,098 60,180 67,234 14,000 14,000 125,763 138,864 515,000 125,763 653,864 (650,000) 92,000 102,400 113,632 Net Present Value $95,533.22 Create a Monte Carlo Simulation with the following input variables: Price Per Pound First Year Catfish Sales Normal Distribution with a mean of $2.50 and a standard deviation of $0.75 Triangular with a minimum of 180,000, most likely of 200,000 and a maximum of 270,000 Std Deviation put answers here Mean = Kurtosis = Problems: Complete each problem as directed. Each problem is worth the amount of points shown. Show all work Problem 1 15 points Frozen Catfish Fillet Project Inputs Cost of Land 250,000 Cost of Buildings & Equipme 400,000 Annual Depreciation 40,000 Life of Project (Years) 5 Terminal Value of Land 350,000 Terminal Value of Buildings 200,000 First Year Catfish Sales (lbs 200,000 Price per Pound 2.50 Unit sales Growth Rate 8% Variable Costs as % of Sale 60% Fixed Costs 80,000 Tax Rate 35% WACC 10% Year 4 Year 5 Year 0 Initial Outlay Sales Variable Costs Fixed Costs Taxable Cash Flows Taxes Depreciation Tax Benefit Annual After-Tax Cash Flows Terminal Cash Flow Total Annual Cash Flows Annual Cash Flows for Frozen Catfish Fillet Project Year 1 Year 2 Year 3 (650,000) 500,000 540,000 300,000 324,000 80,000 80,000 120,000 136,000 42,000 47,600 14,000 14,000 92,000 102,400 583,200 349,920 80,000 153,280 53,648 14,000 113,632 629,856 680,244 377,914 408,147 80,000 80,000 171,942 192,098 60,180 67,234 14,000 14,000 125,763 138,864 515,000 125,763 653,864 (650,000) 92,000 102,400 113,632 Net Present Value $95,533.22 Create a Monte Carlo Simulation with the following input variables: Price Per Pound First Year Catfish Sales Normal Distribution with a mean of $2.50 and a standard deviation of $0.75 Triangular with a minimum of 180,000, most likely of 200,000 and a maximum of 270,000 Std Deviation put answers here Mean = Kurtosis =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts