Question: Need help answering part b.) and c.) Provide work if possible Problem 2: Steven Steel Corporation obtains a liability policy with a $100,000 self- insured

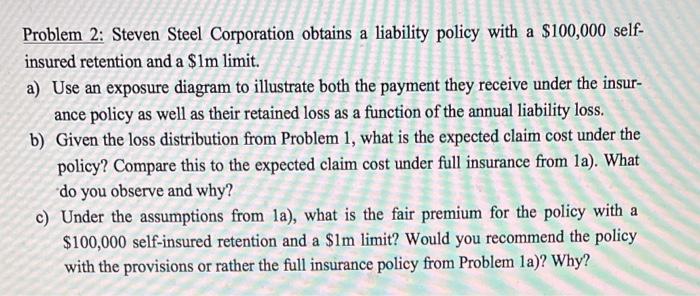

Problem 2: Steven Steel Corporation obtains a liability policy with a $100,000 self- insured retention and a $1m limit. a) Use an exposure diagram to illustrate both the payment they receive under the insur- ance policy as well as their retained loss as a function of the annual liability loss. b) Given the loss distribution from Problem 1, what is the expected claim cost under the policy? Compare this to the expected claim cost under full insurance from la). What do you observe and why? c) Under the assumptions from la), what is the fair premium for the policy with a $100,000 self-insured retention and a $1m limit? Would you recommend the policy with the provisions or rather the full insurance policy from Problem 1a)? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts