Question: Need help answering questions 1 & 2 put in table format and provide write up. Answer these questions: 1) Calculate the revised product costs(i.e. $60,000

Need help answering questions 1 & 2 put in table format and provide write up.

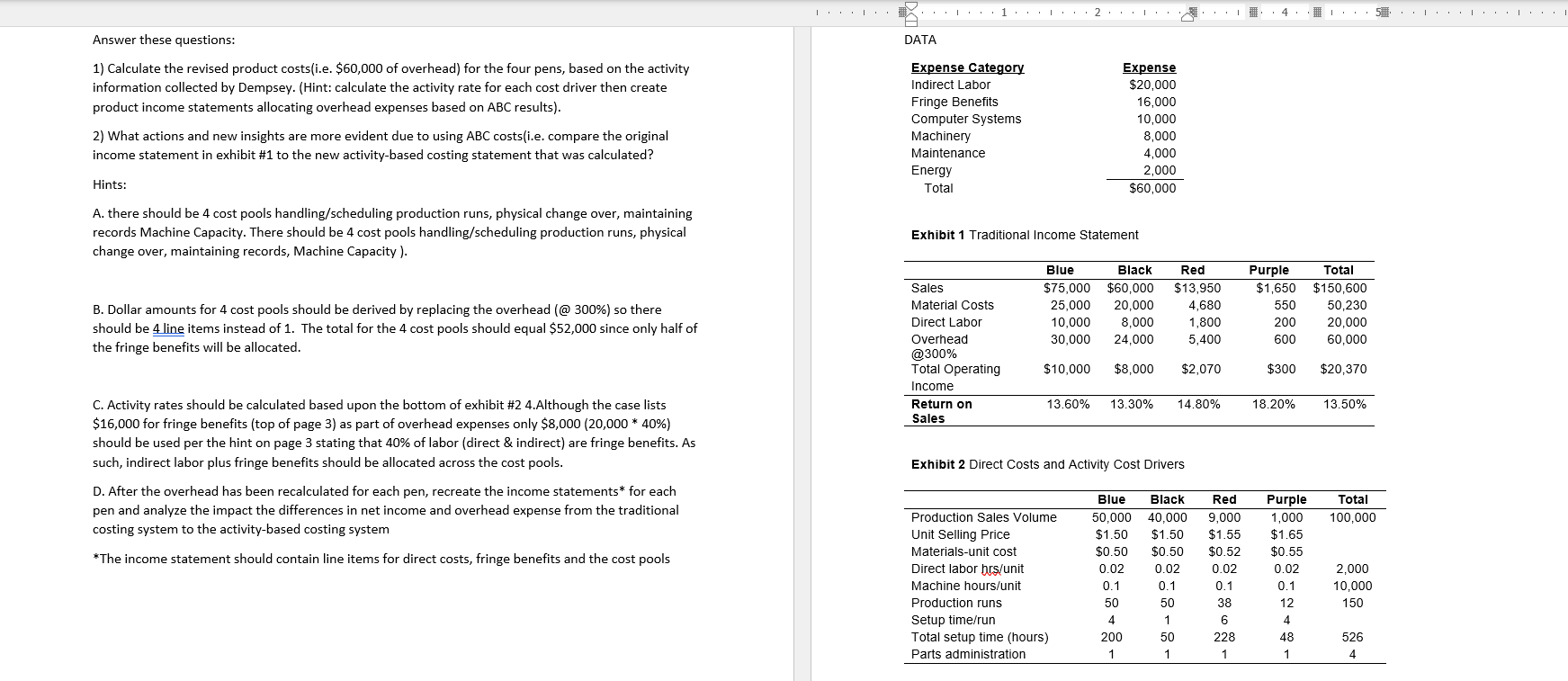

Answer these questions: 1) Calculate the revised product costs(i.e. $60,000 of overhead) for the four pens, based on the activity information collected by Dempsey. (Hint: calculate the activity rate for each cost driver then create product income statements allocating overhead expenses based on ABC results). 2) What actions and new insights are more evident due to using ABC costs(i.e. compare the original income statement in exhibit #1 to the new activity-based costing statement that was calculated? Hints: A. there should be 4 cost pools handling/scheduling production runs, physical change over, maintaining records Machine Capacity. There should be 4 cost pools handling/scheduling production runs, physical change over, maintaining records, Machine Capacity ). B. Dollar amounts for 4 cost pools should be derived by replacing the overhead (@ 300%) so there should be 4 line items instead of 1. The total for the 4 cost pools should equal $52,000 since only half of the fringe benefits will be allocated. C. Activity rates should be calculated based upon the bottom of exhibit #2 4.Although the case lists $16,000 for fringe benefits (top of page 3) as part of overhead expenses only $8,000 (20,000 * 40%) should be used per the hint on page 3 stating that 40% of labor (direct & indirect) are fringe benefits. As such, indirect labor plus fringe benefits should be allocated across the cost paols. D. After the overhead has been recalculated for each pen, recreate the income statements* for each pen and analyze the impact the differences in net income and overhead expense from the traditional costing system to the activity-based costing system *The income statement should contain line items for direct costs, fringe benefits and the cost pools DATA Expense Category Indirect Labor Fringe Benefits Computer Systems Machinery Maintenance Energy Total Expense $20,000 16,000 10,000 5,000 4,000 2,000 $60,000 Exhibit 1 Traditional Income Statement Blue Black Red Purple Total Sales $75.000 $60,000 $13,950 $1,650 $150,600 Material Costs 25,000 20,000 4,680 550 90,230 Direct Labor 10,000 8,000 1,800 200 20,000 Overhead 30,000 24,000 5,400 600 60,000 @300% Total Operating $10,000 $8,000 $2,070 $300 $20,370 Income Return on 13.60% 13.30% 14.80% 18.20% 13.50% Sales Exhibit 2 Direct Costs and Activity Cost Drivers Blue Black Red Purple Total Production Sales Volume 50,000 40,000 9,000 1,000 100,000 Unit Selling Price $1.50 $1.50 $1.55 $1.65 Materials-unit cost $0.50 5050 $0.52 $0.55 Direct labor prs/unit 0.02 0.02 0.02 0.02 2,000 Machine hours/unit 01 01 a1 0.1 10,000 Preduction runs 50 50 38 12 150 Setup time/run 4 1 6 4 Total setup time (hours) 200 50 228 48 526 Parts administration 1 1 1 1 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts