Question: Need help answering the question in this image, thanks. Question 9 (1 point) Q At the end of 2014, its first year of operations, Connecticut

Need help answering the question in this image, thanks.

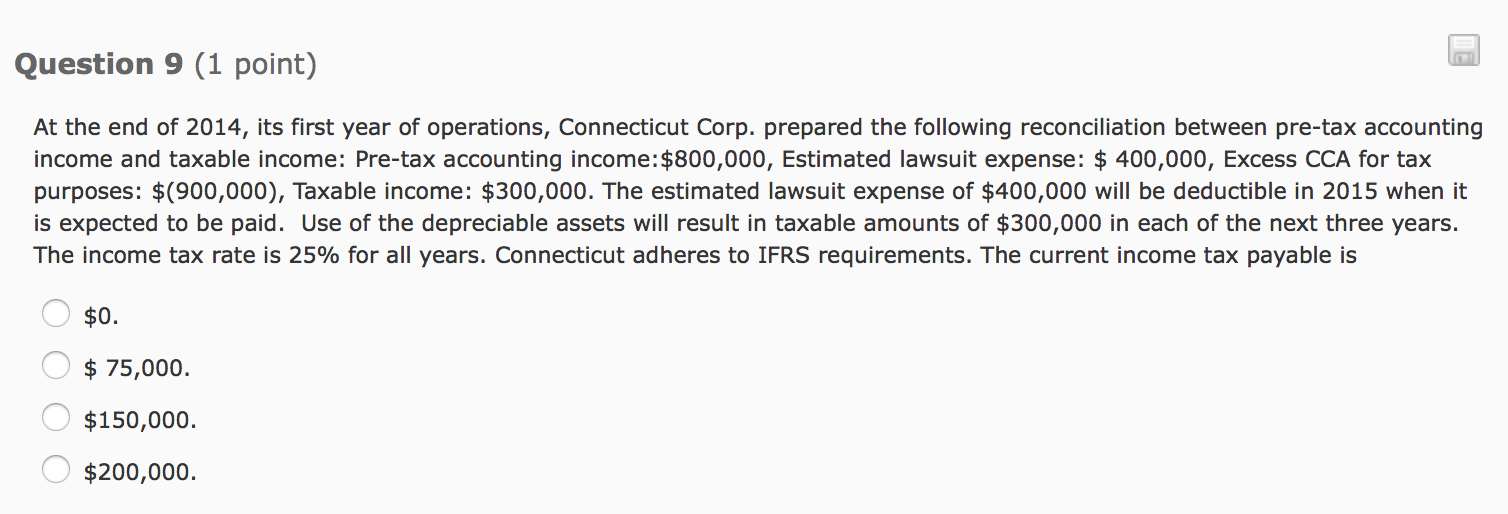

Question 9 (1 point) Q At the end of 2014, its first year of operations, Connecticut Corp. prepared the following reconciliation between pre-tax accounting income and taxable income: Pre-tax accounting income:$800,000, Estimated lawsuit expense: 3; 400,000, Excess CCA for tax purposes: $(900,000), Taxable income: $300,000. The estimated lawsuit expense of $400,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Connecticut adheres to IFRS requirements. The current income tax payable is A $0. IA $ 75,000. A $150,000. A $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts