Question: NEED HELP!!! ASAAPP QUESTION 1 Chapter 4 Question (38 minutes, 25 marks) BigHeat (big) is a locally owned business that sells and installs garage heating

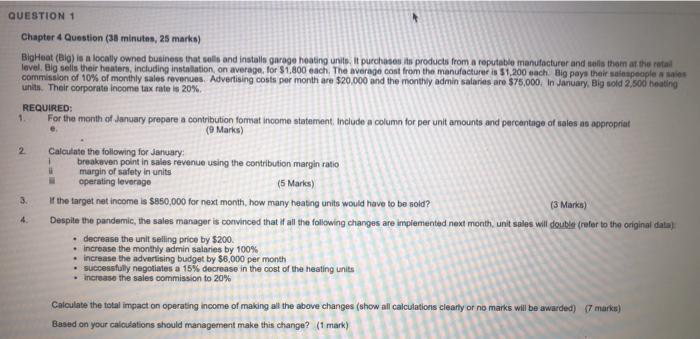

QUESTION 1 Chapter 4 Question (38 minutes, 25 marks) BigHeat (big) is a locally owned business that sells and installs garage heating units. It purchase its products from a reputable manufacturer and sell them at the road level. Big sells their heaters, including installation, on average for $1,800 each. The average cost from the manufacturer is 31,200 each Big pays their salespeople commission of 10% of monthly sales revenues. Advertising costs per month are $20,000 and the monthly admin salaries are $75,000. In January, Big sold 2.0d heating units. Their corporate income tax rate is 20% REQUIRED: For the month of January prepare a contribution tomat income statement include a column for per unit amounts and percentage of tales en sopropriat (9 Marks) 2 Calculate the following for January 1 breakeven point in sales revenue using the contribution margin ratio margin of safety in units operating leverage (5 Marks) 3. of the target net income is $850,000 for next month, how many heating units would have to be sold? (3 Marks) 4. Despite the pandemic, the sales manager is convinced that if all the following changes are implemented next month, unt sales will doubled (refer to the original dala) decrease the unit selling price by $200. Increase the monthly admin salaries by 100% increase the advertising budget by $6.000 per month successfully negotiates a 15% decrease in the cost of the heating units increase the sales commission to 20% Calculate the total impact on operating income of making all the above changes (show all calculations clearly or no marks will be awarded) (7 marka) Based on your calculations should management make this change? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts