Question: NEED HELP ASAP Aboud AatibCcDd * A S SIE O DOS 002 Normal ACCT 3210 2020ed. Chapter 1 Assignment 1. A taxpayer has $95,000 of

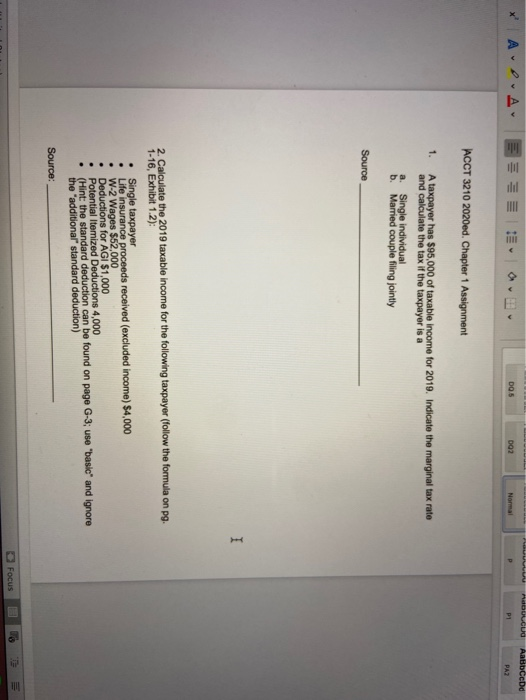

Aboud AatibCcDd * A S SIE O DOS 002 Normal ACCT 3210 2020ed. Chapter 1 Assignment 1. A taxpayer has $95,000 of taxable income for 2019. Indicate the marginal tax rate and calculate the tax if the taxpayer is a a. Single individual b. Married couple filing jointly Source 2. Calculate the 2019 taxable income for the following taxpayer (follow the formula on pg. 1-16, Exhibit 1.2): Single taxpayer Life insurance proceeds received (excluded income) $4,000 W-2 Wages $52,000 Deductions for AGI $1,000 Potential itemized Deductions 4,000 (Hint: the standard deduction can be found on page G-3; use "basic and ignore the "additional standard deduction) Source: Focus DE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts