Question: NEED HELP ASAP PLS. THANKS HERE IT IS. help asap sorry about that. here is thr full details. pls help asap! thank u 4 B

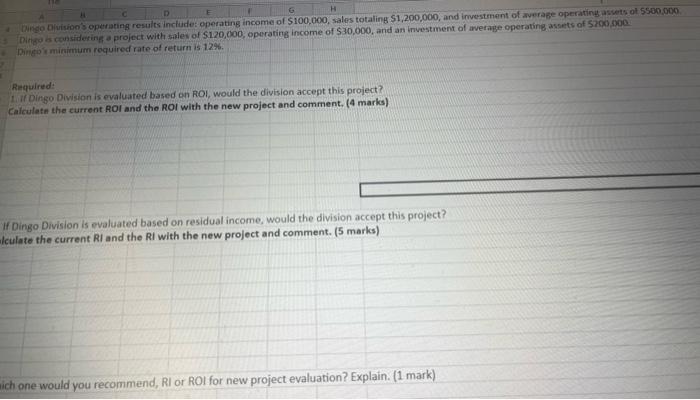

4 B D Dingo Division's operating results include: operating income of $100,000, sales totaling $1,20 5 Dingo is considering a project with sales of $120,000, operating income of $30,000, and an in 6 Dingo's minimum required rate of return is 12%. 7 3 Required: 1. If Dingo Division is evaluated based on ROI, would the division accept this project? 1 Calculate the current ROI and the ROI with the new project and comment. (4 marks) 2. If Dingo Division is evaluated based on residual income, would the division accept this proj Calculate the current Rl and the Rl with the new project and comment. (5 marks) 3. Which one would you recommend, Ri or ROI for new project evaluation? Explain. (1 mark) Question 3 - Performance Evaluation - Version B (10 marks) Dingo Division's operating results include: operating income of $100,000, sales totaling S Dingo is considering a project with sales of $120,000, operating income of $30,000, and Dingo's minimum required rate of return is 12%. Required: 1. If Dingo Division is evaluated based on ROI, would the division accept this project? Calculate the current ROI and the ROI with the new project and comment. (4 marks) 2. If Dingo Division is evaluated based on residual income, would the division accept thi Calculate the current RI and the Rl with the new project and comment. (5 marks) D G H Dingo Dision operating results include: operating income of $100,000, sales totaling $1,200,000, and investment of average operating assets of $500.000 Dingo is considering project with sales of $120,000, operating income of $30,000, and an investment of average operating assets of 5200.000 Dingo minimum required rate of return is 12% Required: 1 Dingo Division is evaluated based on ROI, would the division accept this project? Calculate the current ROI and the ROI with the new project and comment. (4 marks) If Dingo Division is evaluated based on residual income, would the division accept this project? lculate the current Rl and the Rl with the new project and comment. (5 marks) nich one would you recommend, Rl or ROI for new project evaluation? Explain. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts