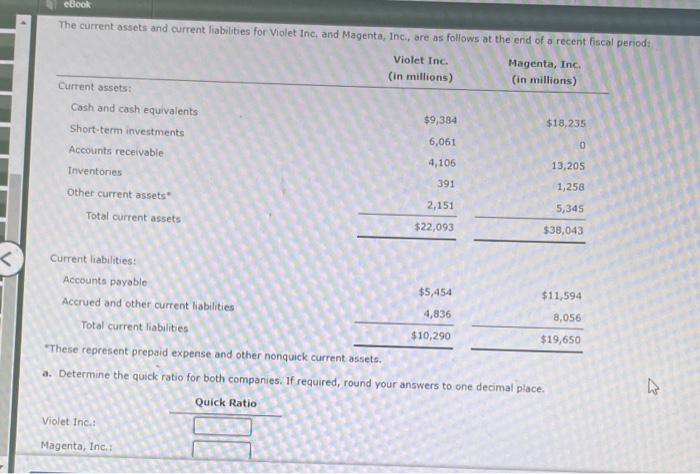

Question: need help asap! eBook The current assets and current liabilities for Violet Inc. and Magenta, Inc., are as follows at the end of a recent

eBook The current assets and current liabilities for Violet Inc. and Magenta, Inc., are as follows at the end of a recent fiscal period: Violet Inc. (in millions) Magenta, Inc. (in millions) Current assets: Cash and cash equivalents Short-term investments Accounts receivable Inventories Other current assets Total current assets Current liabilities: Accounts payable Accrued and other current liabilities Total current liabilities $9,384 6,061 4,106 391 2,151 $22,093 Violet Inc.: Magenta, Inc.: $5,454 4,836 $10,290 $18,235 0 13,205 1,258 5,345 $38,043 "These represent prepaid expense and other nonquick current assets. a. Determine the quick ratio for both companies. If required, round your answers to one decimal place. Quick Ratio $11,594 8,056 $19,650 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts