Question: need help asap. please help on requirements 1-17 show formulas best if in excel layout PLEASE & thank you Boyd Corporation is a manufacturer that

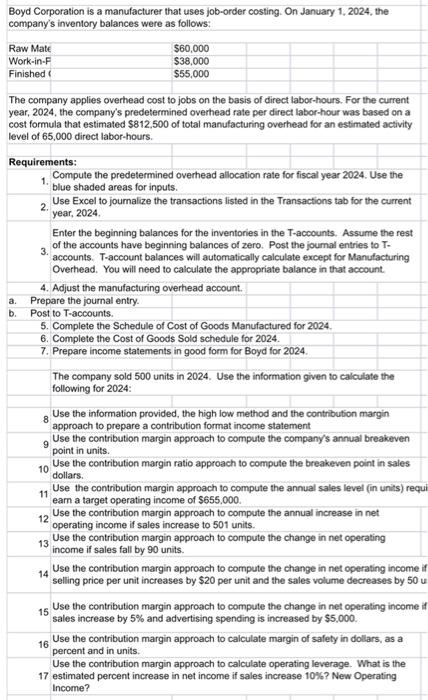

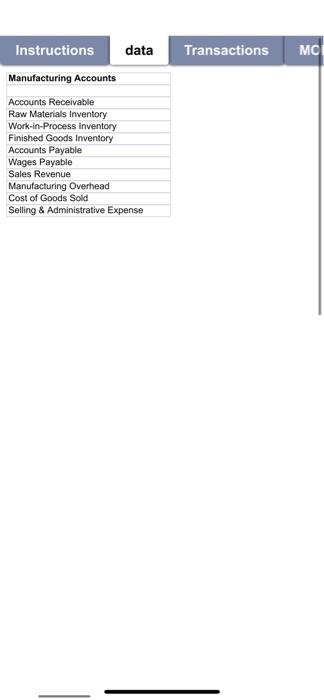

Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the company's inventory balances were as follows: Raw Mate $60,000 Work-in-F $38,000 Finished $55,000 2. a. The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $812,500 of total manufacturing overhead for an estimated activity level of 65,000 direct labor-hours. Requirements: 1. Compute the predetermined overhead allocation rate for fiscal year 2024. Use the blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for the current year, 2024 Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to T- 3. accounts. T-account balances will automatically calculate except for Manufacturing Overhead. You will need to calculate the appropriate balance in that account. 4. Adjust the manufacturing overhead account. Prepare the journal entry. b. Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the cost of Goods Sold schedule for 2024. 7. Prepare income statements in good form for Boyd for 2024 The company sold 500 units in 2024. Use the information given to calculate the following for 2024: Use the information provided the high low method and the contribution margin approach to prepare a contribution format income statement 9 Use the contribution margin approach to compute the company's annual breakeven point in units. 10 Use the contribution margin ratio approach to compute the breakeven point in sales dollars. 11 Use the contribution margin approach to compute the annual sales level (in units) requi earn a target operating income of $655,000 Use the contribution margin approach to compute the annual increase in net 12 operating income il sales increase to 501 units. 13 Use the contribution margin approach to compute the change in net operating income if sales fall by 90 units. Use the contribution margin approach to compute the change in net operating income if selling price per unit increases by $20 per unit and the sales volume decreases by 50 u Use the contribution margin approach to compute the change in net operating income if sales increase by 5% and advertising spending is increased by $5,000. 16 Use the contribution margin approach to calculate margin of safety in dollars, as a percent and in units. Use the contribution margin approach to calculate operating leverage. What is the 17 estimated percent increase in net income if sales increase 10%? New Operating Income? 8 14 15 data Transactions MC Instructions Manufacturing Accounts Accounts Receivable Raw Materials Inventory Work-in-Process Inventory Finished Goods Inventory Accounts Payable Wages Payable Sales Revenue Manufacturing Overhead Cost of Goods Sold Seling & Administrative Expense Instructions data Transactions MOH Rate Solution Journal The following transactions were recorded for the year Raw materials were purchased on account. 60.000 Raw materials used in production $530,000. As of the materials were we are The following costs for employer bor850.000, director $0.00 maling and administratives 280,000 incurred versing wives vel costs, and frihed goods warehousing 417.000 incurred various ming over en de 300.000 Matulering ved cows applied to production. The company 8.000 hours on all during the year Jobcouting $1.720,000 o manucure coording to the other county son account to customers the year for at 2.250.000 Thebe $1.740.000 mature according to the cost sheets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts