Question: Need help ASAP thanks https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fle. G Chapter 16 Homework i Saved Help Save & Ch River Cruises is all-equity-financed. Current Data 3.5 Number of shares

Need help ASAP thanks

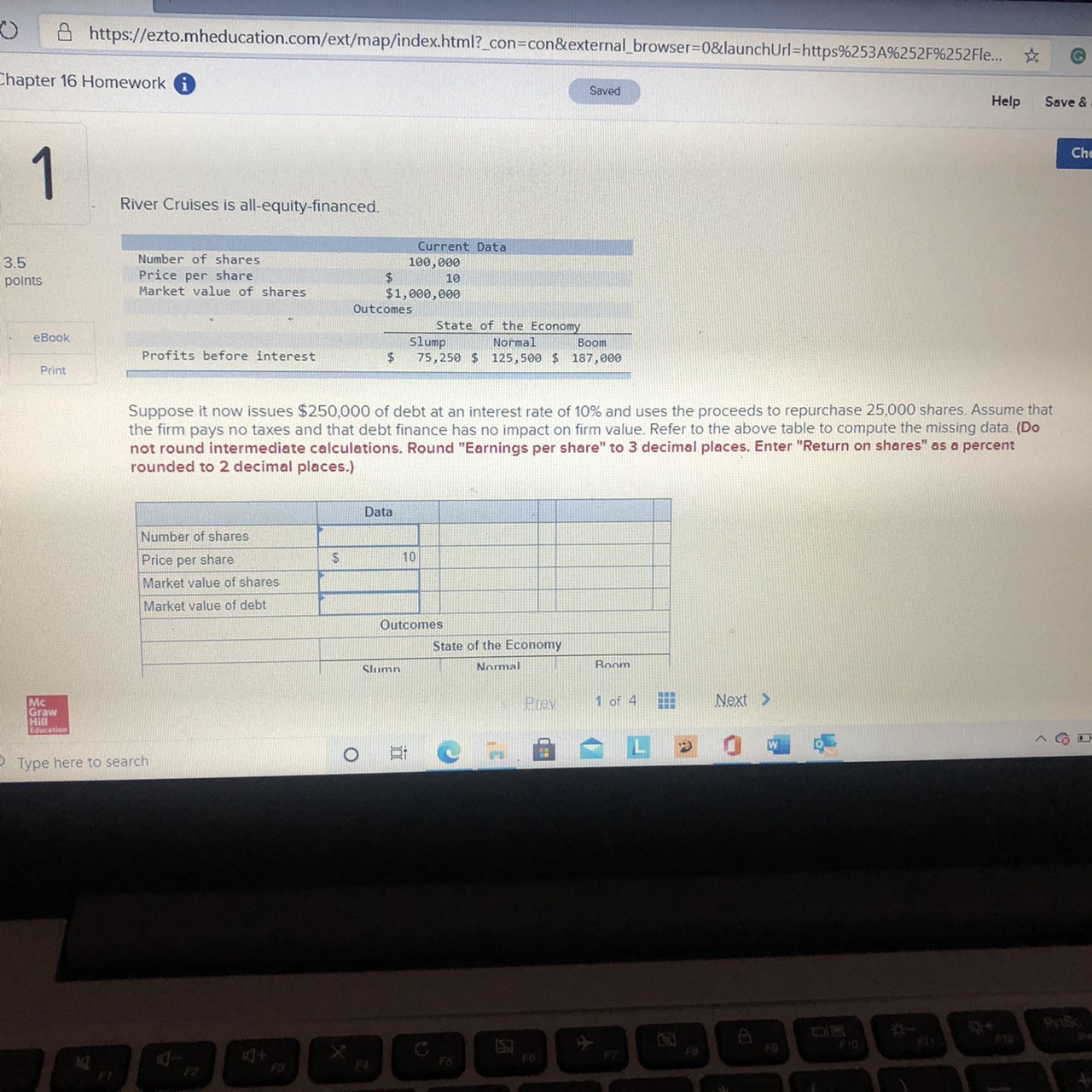

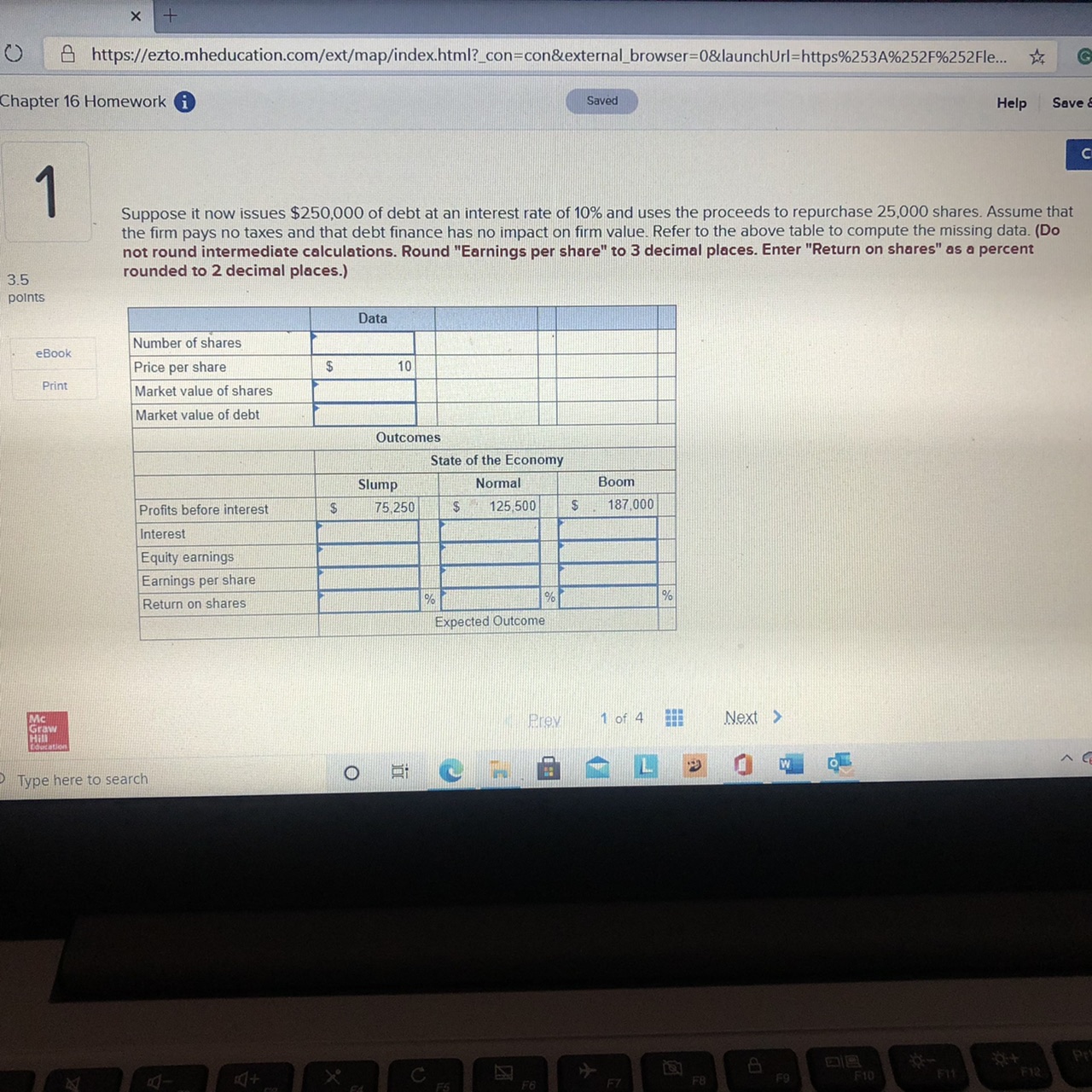

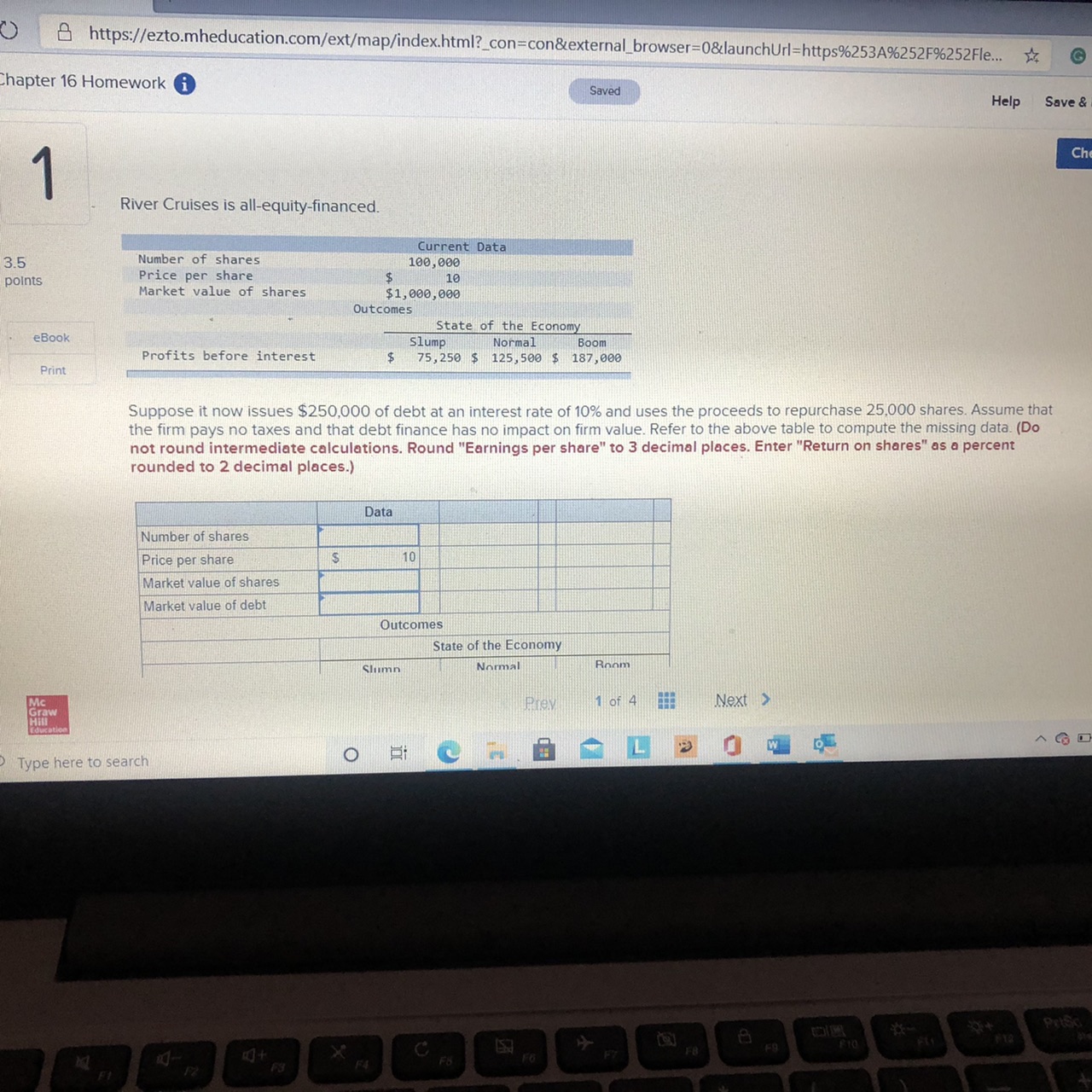

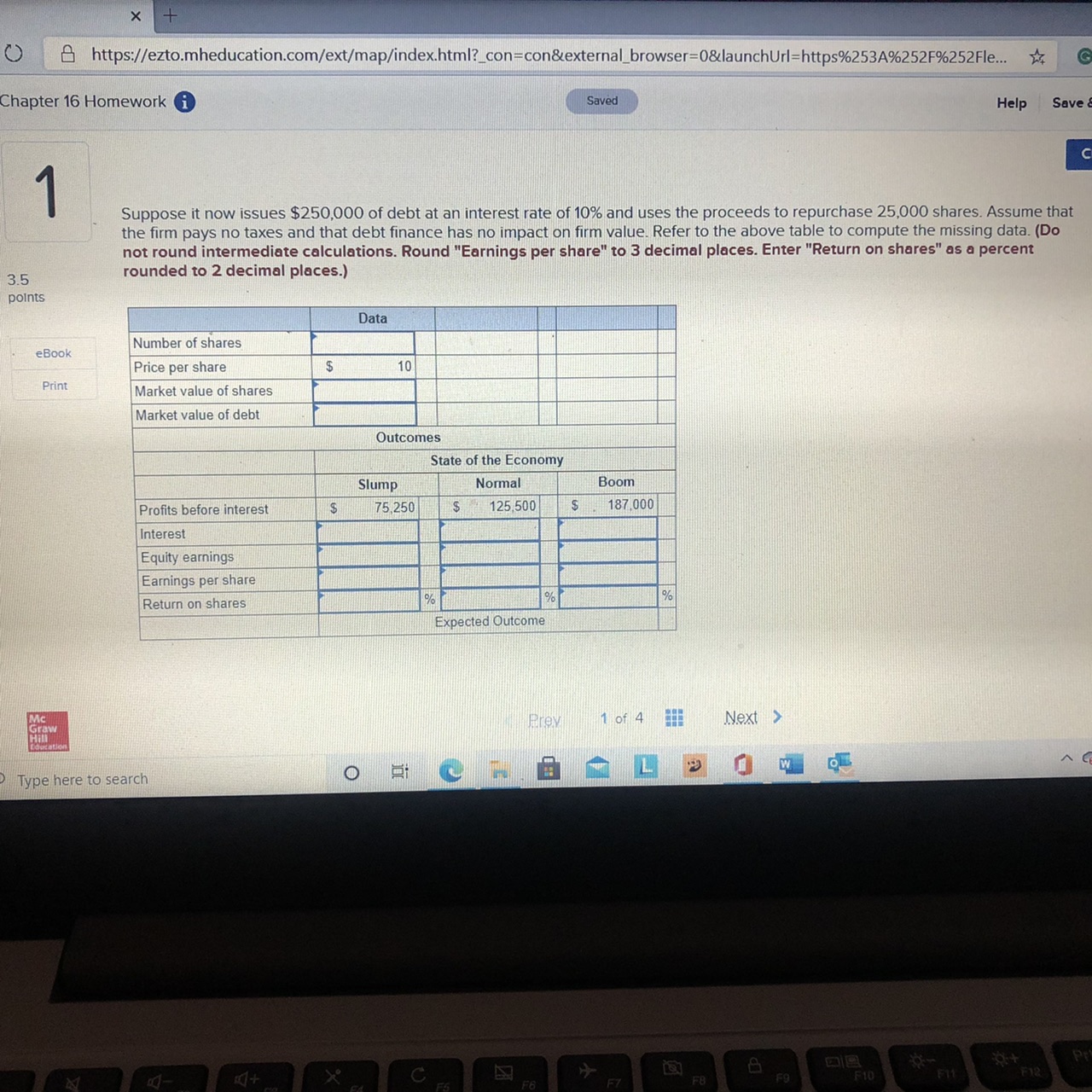

https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fle. G Chapter 16 Homework i Saved Help Save & Ch River Cruises is all-equity-financed. Current Data 3.5 Number of shares 100,000 points Price per share $ 10 Market value of shares $1, 000,000 Outcomes State of the Economy eBook Slump Normal Boom Profits before interest $ 75, 250 $ 125, 500 $ 187,000 Print Suppose it now issues $250,000 of debt at an interest rate of 10% and uses the proceeds to repurchase 25,000 shares. Assume that the firm pays no taxes and that debt finance has no impact on firm value. Refer to the above table to compute the missing data. (Do not round intermediate calculations. Round "Earnings per share" to 3 decimal places. Enter "Return on shares" as a percent rounded to 2 decimal places.) Data Number of shares Price per share s 10 Market value of shares Market value of debt Outcomes State of the Economy Slumn Normal Room Prey 1 of 4 Next > Fraw Type here to search O L Petsic X C F9 P2 F3 F4 F8https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fle... Chapter 16 Homework i Saved Help Save Suppose it now issues $250,000 of debt at an interest rate of 10% and uses the proceeds to repurchase 25,000 shares. Assume that the firm pays no taxes and that debt finance has no impact on firm value. Refer to the above table to compute the missing data. (Do not round intermediate calculations. Round "Earnings per share" to 3 decimal places. Enter "Return on shares" as a percent 3.5 rounded to 2 decimal places.) points Data eBook Number of shares Price per share 10 Print Market value of shares Market value of debt Outcomes State of the Economy Slump Normal Boom Profits before interest $ 75,250 $ 125,500 $ 187.000 Interest Equity earnings Earnings per share Return on shares % % % Expected Outcome Mc Graw Prey 1 of 4 Next > Hill Type here to search O + XO C FB F9 F11 F12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts