Question: need help asap. Updated with the full info The question should be the ones that are marked incorrect, the first few photos are the answers

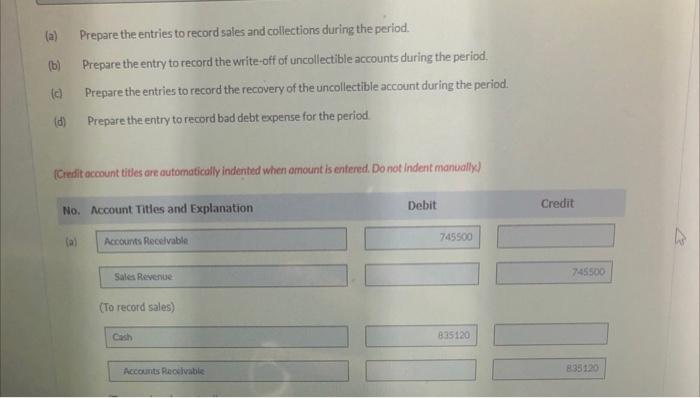

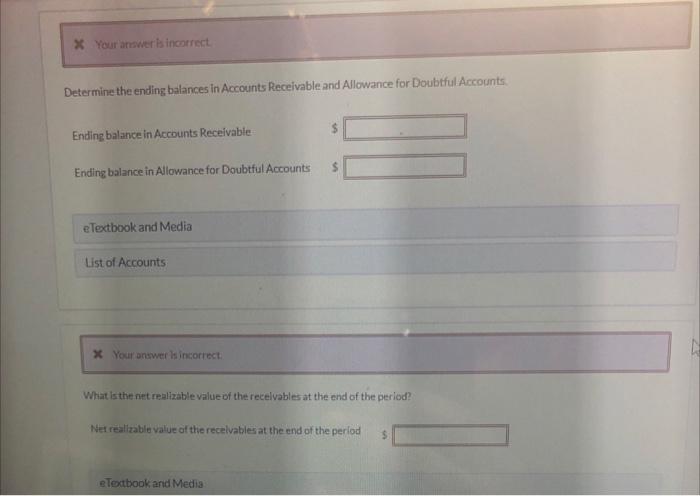

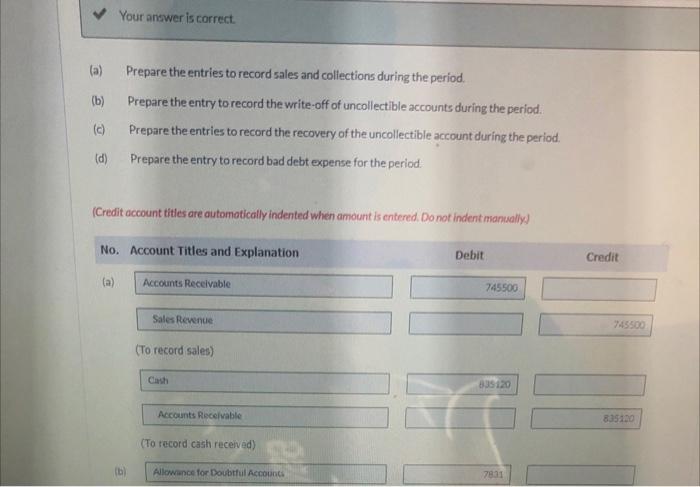

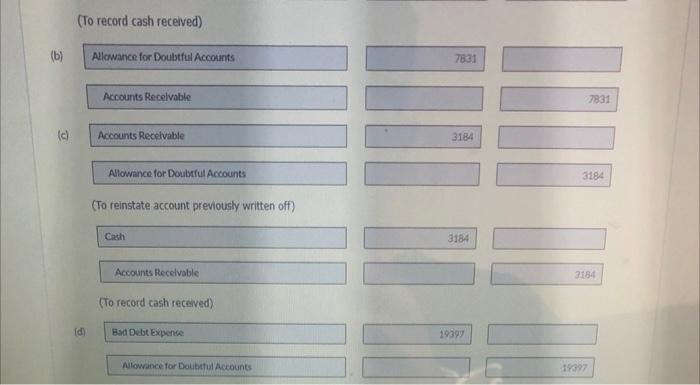

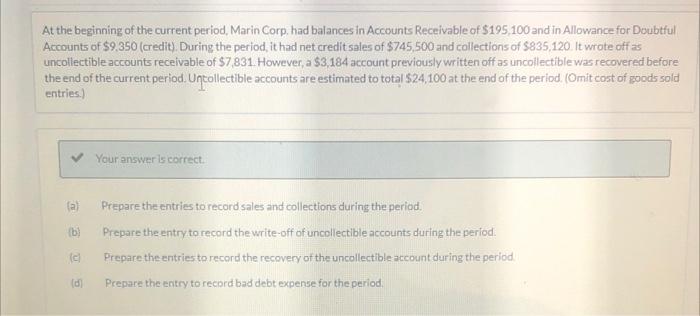

(a) (b) Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. Prepare the entry to record bad debt expense for the period lo (d) (Credit account titles are automatically indented when amount is entered. Do not Indent manually) No. Account Titles and Explanation Debit Credit (a) Accounts Receivable 745500 Sales Revenue 745500 (To record sales) Cash 835120 Accounts Receivable 835120 x Your answer is incorrect Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts Ending balance in Accounts Receivable Ending balance in Allowance for Doubtful Accounts e Textbook and Media List of Accounts X Your answer is incorrect What is the net realizable value of the recelvables at the end of the period? Net realizable value of the receivables at the end of the period $ Textbook and Media Your answer is correct. (a) (b) Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. Prepare the entry to record bad debt expense for the period (d) (Credit account titles are automatically indented when amount is entered. Do not indent marsally) No. Account Titles and Explanation Debit Credit (a) Accounts Receivable 745500 Sales Revenue (To record sales) Cash 33120 Accounts Receivable 815100 (To record cash received) ( Allowance for Doubtful Account 7831 (To record cash received) (b) Allowance for Doubtful Accounts 7831 Accounts Recevable 7831 (c) Accounts Recevable 3184 Allowance for Doubtful Accounts 3184 (To reinstate account previously written off) Cach 3184 Accounts Recevable 3184 (To record cash received) (d) Bad Debt Expense 19399 Allowance for Doubtful Accounts 19397 X Your answer is incorrect. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. Ending balance in Accounts Receivable Ending balance in Allowance for Doubtful Accounts e Textbook and Media List of Accounts x Your answer is incorrect What is the net realizable value of the receivables at the end of the period? . Net realizable value of the receivables at the end of the period $ At the beginning of the current period, Marin Corp, had balances in Accounts Receivable of $195,100 and in Allowance for Doubtful Accounts of $9,350 (credit). During the period, it had net credit sales of $745,500 and collections of $835,120. It wrote affas uncollectible accounts receivable of $7,831. However, a $3,184 account previously written off as uncollectible was recovered before the end of the current period. Untollectible accounts are estimated to total $24,100 at the end of the period. (Omit cost of goods sold entries.) Your answer is correct (a b) Prepare the entries to record sales and collections during the period Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period Prepare the entry to record bad debt expense for the period, d X Your answer is incorrect Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts Ending balance in Accounts Receivable $ Ending balance in Allowance for Doubtful Accounts e Textbook and Media List of Accounts x Your answer is incorrect What is the net realizable value of the receivables at the end of the period? Netraitzable value of the receivables at the end of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts