Question: need help b. Based on the findings from part a, where you calculated the required retirement savings to generate monthly living expenses through interest earnings,

need help

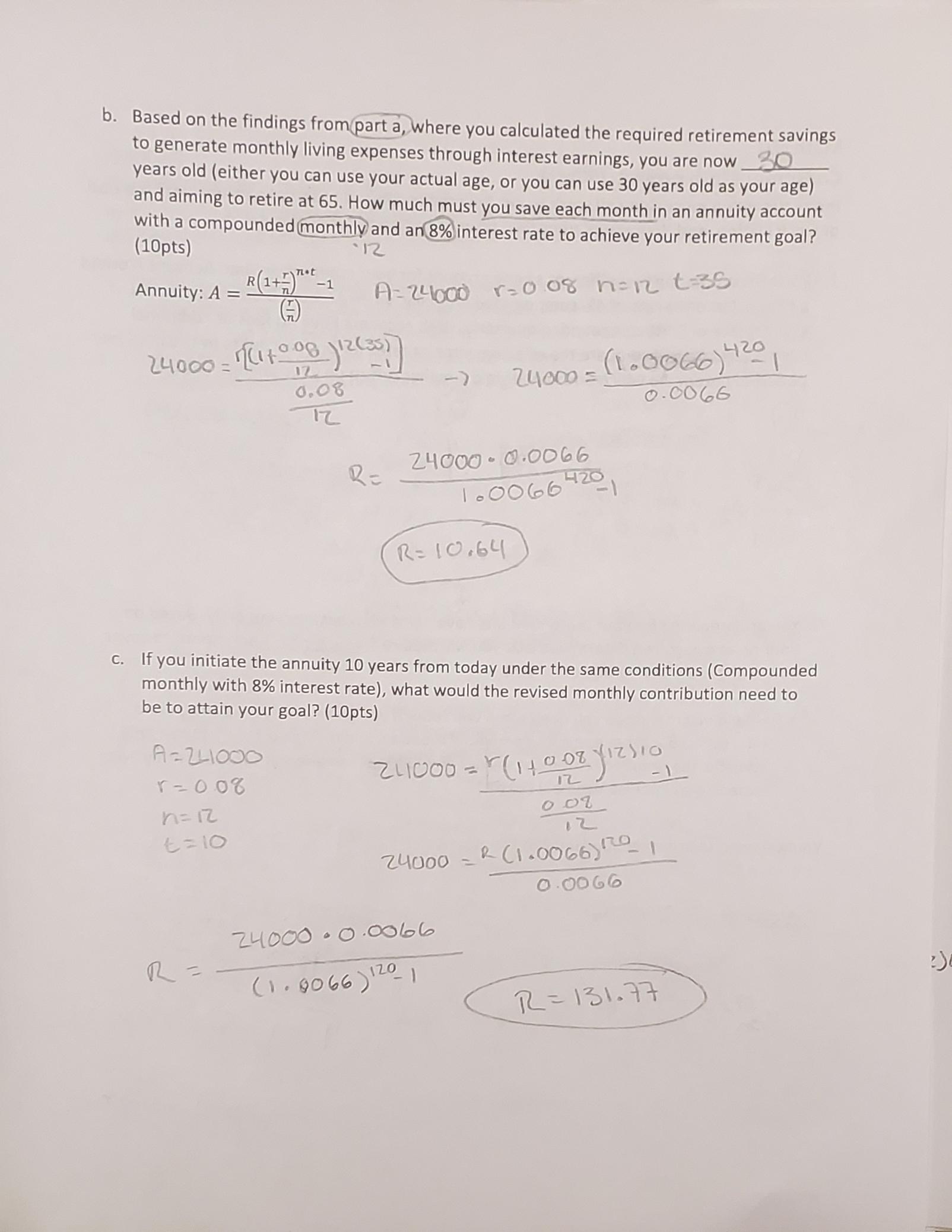

b. Based on the findings from part a, where you calculated the required retirement savings to generate monthly living expenses through interest earnings, you are now 30 years old (either you can use your actual age, or you can use 30 years old as your age) and aiming to retire at 65. How much must you save each month in an annuity account with a compounded monthly and an 8% interest rate to achieve your retirement goal? (10pts) Annuity: A = R(1+7)** 1 12 A=24000 r=0.08 n=12 t-35 24000 = [(1+0.00)12(35) 12 -> 0.08 24000 = (1.0066) 420, 0.0066 72 24000 0.0066 R= 102499001 R=10.64 c. If you initiate the annuity 10 years from today under the same conditions (Compounded monthly with 8% interest rate), what would the revised monthly contribution need to be to attain your goal? (10pts) A=241000 1-008 n=12 t=10 211000 = (1+008/12sio 12 009 12 24000 = R(1.0066) 201 0.0066 24000 0.0066 R = (1.8066) 120-1 R=131.77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts