Question: Need help completing form 1120- schedule k 10-3 Assessment Problems i 2 Part 2 of 3 10 points Skipped eBook Print References ! Sales revenue

- Need help completing form 1120- schedule k

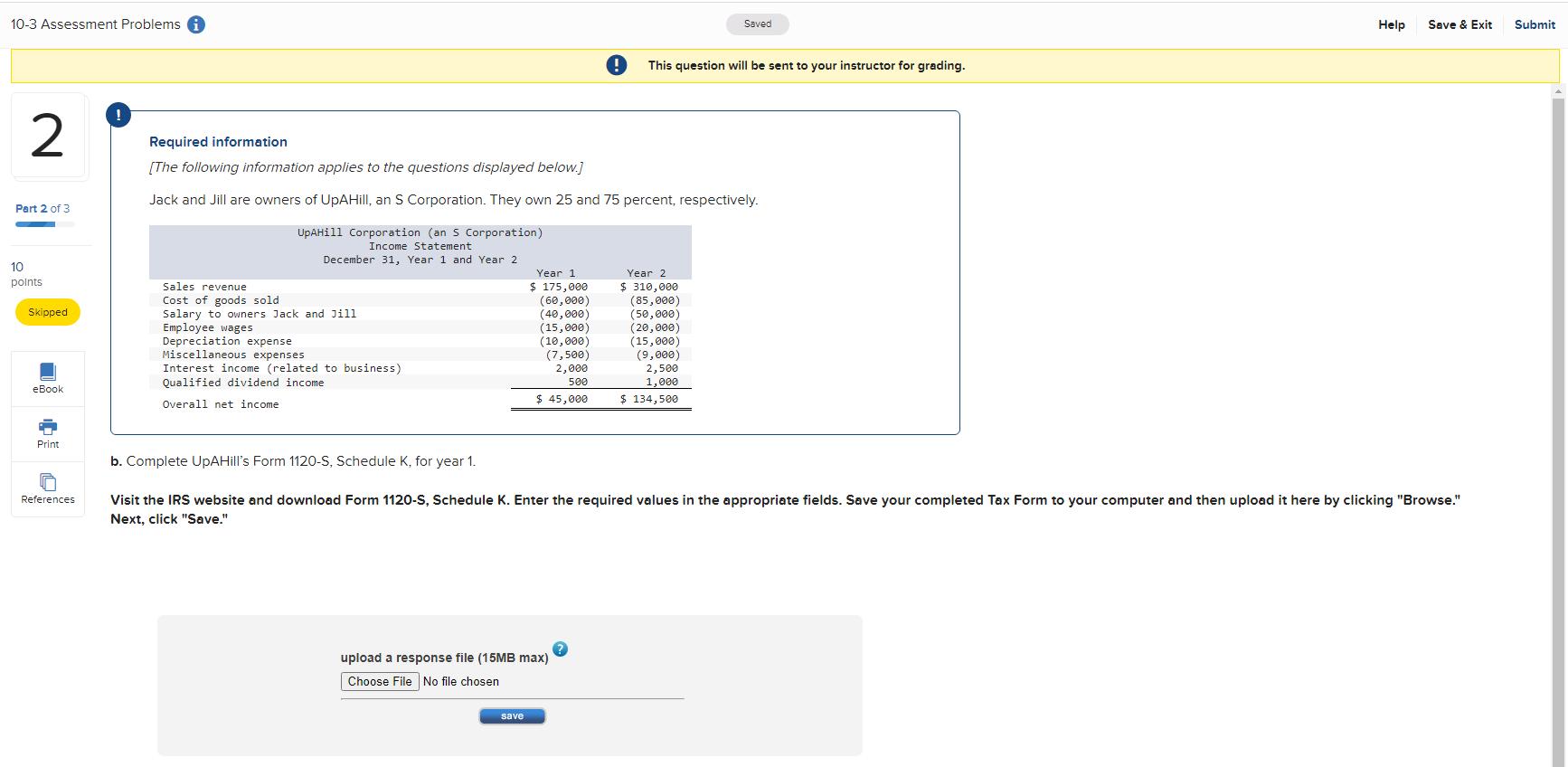

10-3 Assessment Problems i 2 Part 2 of 3 10 points Skipped eBook Print References ! Sales revenue Cost of goods sold Salary to owners Jack and Jill Employee wages Required information [The following information applies to the questions displayed below.] Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively. UpAHill Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 2 Depreciation expense Miscellaneous expenses Interest income (related to business) Qualified dividend income Overall net income b. Complete UpAHill's Form 1120-S, Schedule K, for year 1. Year 1 $ 175,000 (60,000) (40,000) (15,000) (10,000) (7,500) 2,000 500 $ 45,000 save ! upload a response file (15MB max) Choose File No file chosen Saved This question will be sent to your instructor for grading. Year 2 $ 310,000 (85,000) (50,000) (20,000) (15,000) (9,000) 2,500 1,000 $ 134,500 Help Visit the IRS website and download Form 1120-S, Schedule K. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." Save & Exit Submit

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

UPAHills from the 1120S schedule K fo... View full answer

Get step-by-step solutions from verified subject matter experts