Question: Need help completing statement of cash flows. Stock In structions Income Statement Balance Sheet Stmt of Cash Flows Analysis ACCT 2023PROJECT azing Company began operations

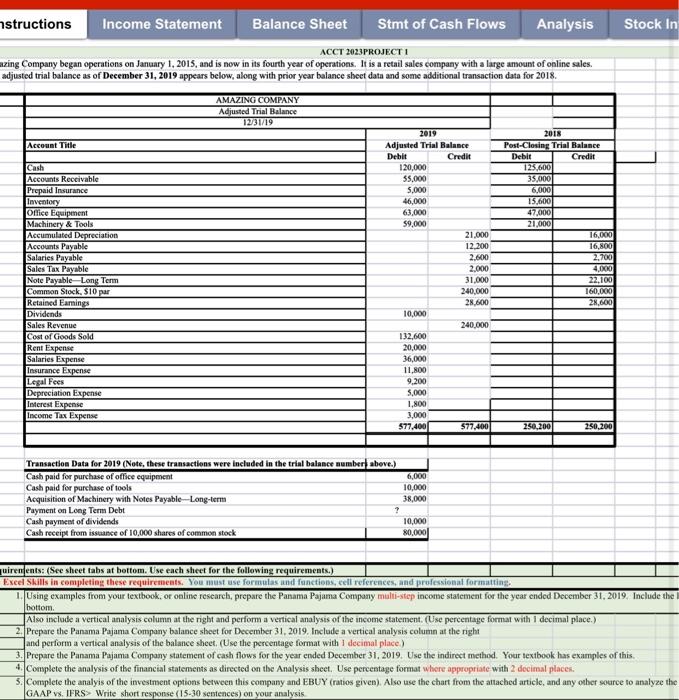

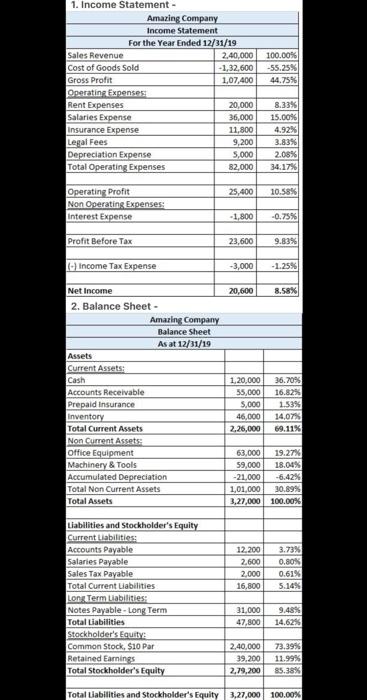

Stock In structions Income Statement Balance Sheet Stmt of Cash Flows Analysis ACCT 2023PROJECT azing Company began operations on January 1, 2015, and is now in its fourth year of operations. It is a retail sales company with a large amount of online sales adjusted trial balance as of December 31, 2019 appears below, along with prior year balance sheet data and some additional transaction data for 2018. AMAZING COMPANY Adjusted Trial Balance 1231719 Account Title Cash Accounts Receivable Prepaid Insurance Inventory Office Equipment Machinery & Tools Accumulated Depreciation Accounts Payable Salaries Payable Sales Tax Payable Note Payable Long Term Common Stock, S10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Rent Expense Salaries Expense Insurance Expense Legal Fees Depreciation Expense Interest Expense Income Tax Expense 2019 Adjusted Trial Balance Debit Credit 120,000 55.000 5,000 46,000 63,000 59,000 21.000 12.200 2.600 2.000 31.000 240,000 28.600 10,000 240.000 132,600 20,000 36,000 11,800 9.200 5,000 1,800 3.000 $77,400 $77,400 2018 Post-Closing Trial Balance Debit Credit 123,600 35,000 6,000 15,600 47.000 21,000 16.000 16,800 2.700 4.000 22.100 160,000 21.600 250.200 250.200 Transaction Data for 2019 (Note, these transactions were included in the trial balance number above.) Cash paid for purchase of office equipment 6,000 Cash paid for purchase of tools 10,000 Acquisition of Machinery with Notes Payable-Long-term 38,000 Payment on Long Term Debt ? Cash paynet of dividends 10,000 Cash receipt from issuance of 10,000 shares of common stock 80,000 uiren ents: (See sheet tabs at bottom. Use each sheet for the following requirements.) Excel Skills in completing these requirements. You must use formulas and functions, cell references, and professional formatting 1. Using examples from your textbook or online research, prepare the Panama Pajama Company multi-step income statement for the year ended December 31, 2019. Include the hottom Also include a vertical analysis column at the right and perform a vertical analysis of the income statement. (Use percentage format with 1 decimal place.) 2. Prepare the Panama Pajama Company balance sheet for December 31, 2019. Include a vertical analysis column at the right and perform a vertical analysis of the balance sheet. (Use the percentage format with 1 decimal place) 3. Prepare the Panama Pajama Company statement of cash flows for the year ended December 31, 2019. Use the indirect method. Your textbook has examples of this. 4. Complete the analysis of the financial statements as directed on the Analysis sheet. Use percentage format where appropriate with 2 decimal places. 5. Complete the analyis of the investment options between this company and EBUY (ratios given). Also use the chart from the attached article, and any other source to analyze the GAAP vs IFRS> Write short response (15-30 sentences) on your analysis 100.00% -55.25% 44.75% 1. Income Statement- Amazing Company Income Statement For the Year Ended 12/31/19 Sales Revenue 2.40.000 Cost of Goods Sold -1,32,600 Gross Profit 1,07,400 Operating Expenses Rent Expenses 20,000 Salaries Expense 36,000 Insurance Expense 11,800 Legal Fees 9,200 Depreciation Expense 3,000 Total Operating Expenses 82,000 8.33% 15.00% 4.92% 3.8355 2.08% 34.17% 25,400 10.58% Operating Profit Non Operating Expenses: Interest Expense -1,800 -0.75% Profit Before Tax 23,600 9.83% Income Tax Expense -3,000 -1.25% 20,600 8.58% Net Income 2. Balance Sheet Amazing Company Balance Sheet As at 12/31/19 Assets Current Assets: Cash Accounts Receivable Prepaid Insurance Inventory Total Current Assets Non Current Assets Office Equipment Machinery & Tools Accumulated Depreciation Total Non Current Assets Total Assets 1,20,000 55,000 5.000 46,000 2,26,000 36.70% 16.82% 1.539 14,07% 69.11% 63.000 19.27% 59,000 18.04% -21.000 -6.42% 1,01,000 30.89% 3,27,000 100.00% 12.200 2.600 2.000 16.800 3.73% 0.80% 0.61% 5.14% Liabilities and Stockholder's Equity Current Liabilities: Accounts Payable Salaries Payable Sales Tax Payable Total Current Liabilities Long Term Liabilities: Notes Payable - Long Term Total Liabilities Stockholder's faulty Common Stock, $10 Par Retained Earnings Total Stockholder's Equity 31,000 47,800 9.48% 14.62% 2.40,000 39,200 2,79,200 73.39% 11.99% 85.38% Total Liabilities and Stockholder's Equity 3,27,000 100.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts