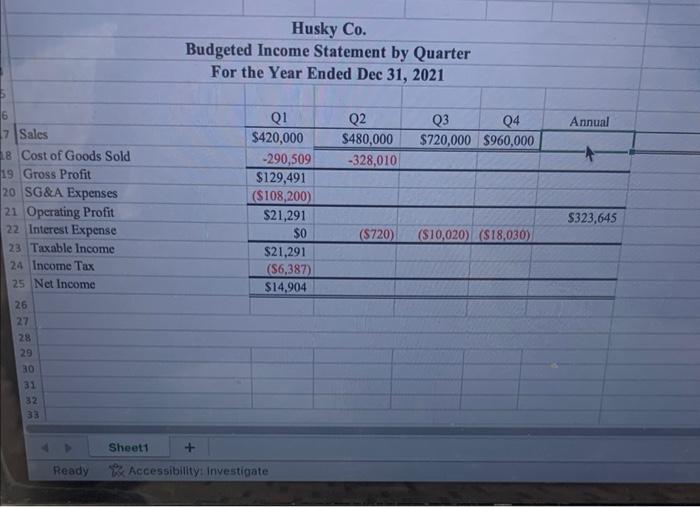

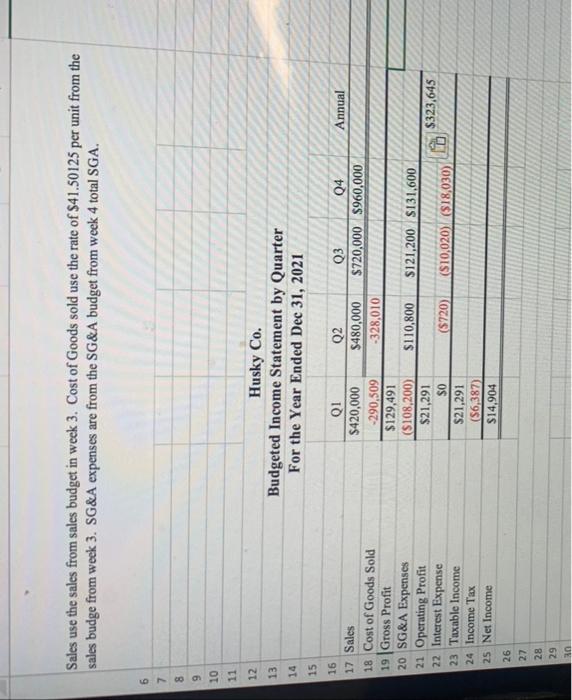

Question: need help completing the chart the rate is $41.50125 per unit Husky Co. Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021

Husky Co. Budgeted Income Statement by Quarter For the Year Ended Dec 31, 2021 Sales Cost of Goods Sold Gross Profit 20 SG\&A Expenses 21 Operating Profit 22 Interest Expense 23 Taxable Income 24 Income Tax 25 Net Income \begin{tabular}{|c|c|c|c|c|} \hline Q1 & Q2 & Q3 & Q4 & Annual \\ \hline$420,000 & $480,000 & $720,000 & $960,000 & \\ \hline290,509 & 328,010 & & & \\ \hline$129,491 & & & & \\ \hline($108,200) & & & & \\ \hline$21,291 & & & & $323,645 \\ \hline$0 & ($720) & ($10,020) & ($18,030) & \\ \hline$21,291 & & & & \\ \hline($6,387) & & & & \\ \hline$14,904 & & & & \\ \hline \end{tabular} 4+4Sheet1+1 Sales use the sales from sales budget in week 3. Cost of Goods sold use the rate of $41.50125 per unit from the sales budge from week 3. SG\&A expenses are from the SG&A budget from week 4 total SGA. \begin{tabular}{|c|l|l|} \hline 6 & & \\ \hline 7 & & \\ \hline 8 & & \\ \hline 9 & 10 & \\ \hline 11 & & \\ \hline 12 & & \\ 13 & & \\ \hline 13usky Co. \end{tabular} \begin{tabular}{|l|r|} \hline 13 & Budgeted Income Statement by Quarter \\ \hline 14 & For the Year Ended Dec 31, 2021 \\ \hline 15 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts