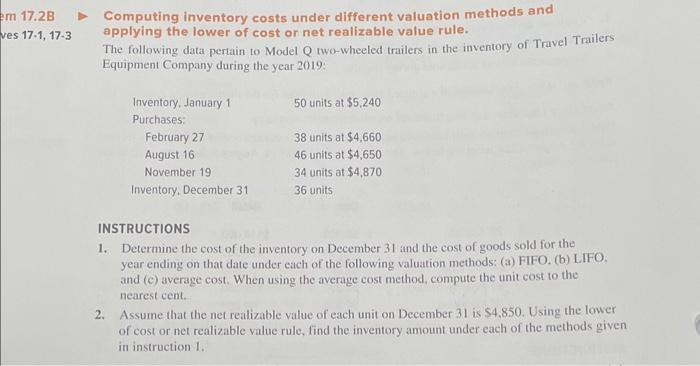

Question: Need help! Computing inventory costs under different valuation methods and applying the lower of cost or net realizable value rule. The following data pertain to

Computing inventory costs under different valuation methods and applying the lower of cost or net realizable value rule. The following data pertain to Model Q two-wheeled trailers in the inventory of Travel Trailers Equipment Company during the year 2019: INSTRUCTIONS 1. Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under each of the following valuation methods: (a) FIFO. (b) LIFO. and (c) average cost. When using the average cost method, compute the unit cost to the nearest cent. 2. Assume that the net realizable value of each unit on December 31 is $4,850. Using the lower of cost or net realizable value rule, find the inventory amount under each of the methods given in instruction 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts