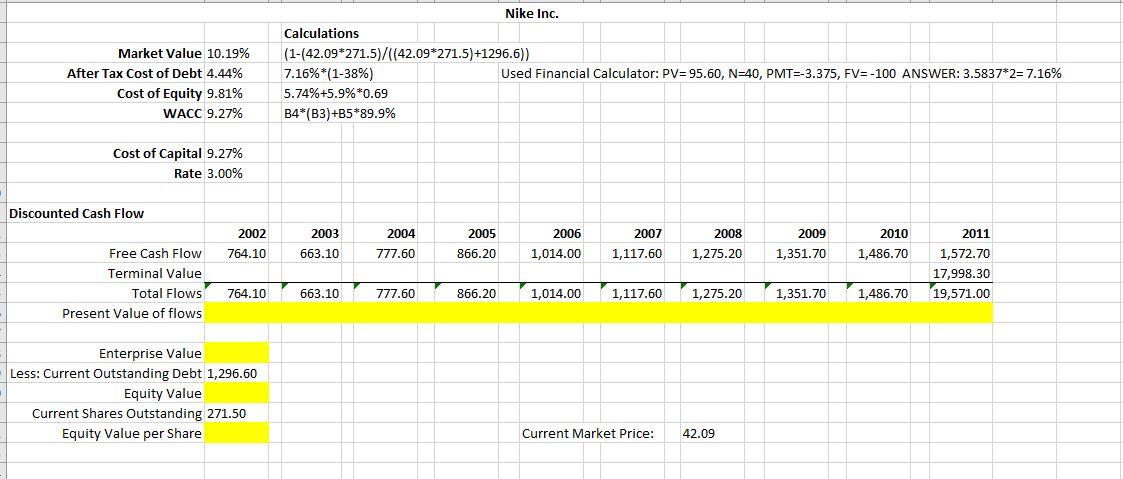

Question: Need help finding the yellow values. Please show calculations to help my understanding. Market Value 10.19% After Tax Cost of Debt 4.44% Cost of Equity

Need help finding the yellow values. Please show calculations to help my understanding.

Market Value 10.19% After Tax Cost of Debt 4.44% Cost of Equity 9.81% WACC 9.27% Nike Inc. Calculations (1-(42.09*271.5)/((42.09*271.5)+1296.6)) 7.16%*(1-38%) Used Financial Calculator: PV= 95.60, N=40, PMT=-3.375, FV=-100 ANSWER: 3.5837*2= 7.16% 5.74%+5.9%*0.69 B4*(B3)+B5*89.9% Cost of Capital 9.27% Rate 3.00% Discounted Cash Flow 2002 764.10 2003 663.10 2004 777.60 2005 866.20 2006 1,014.00 2007 1,117.60 2008 1,275.20 2009 1,351.70 2010 1,486.70 Free Cash Flow Terminal Value Total Flows Present Value of flows 2011 1,572.70 17,998.30 19,571.00 764.10 663.10 777.60 866.20 1,014.00 1,117.60 1,275.20 1,351.70 1,486.70 Enterprise Value Less: Current Outstanding Debt 1,296.60 Equity Value Current Shares Outstanding 271.50 Equity Value per Share Current Market Price: 42.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts