Question: Need help for B Question 2 On July 1, 2017, Crane Corp. issued $3,990,000 of 10-year, 5% bonds at $4,316,211. This price resulted in a

Need help for B

Need help for B

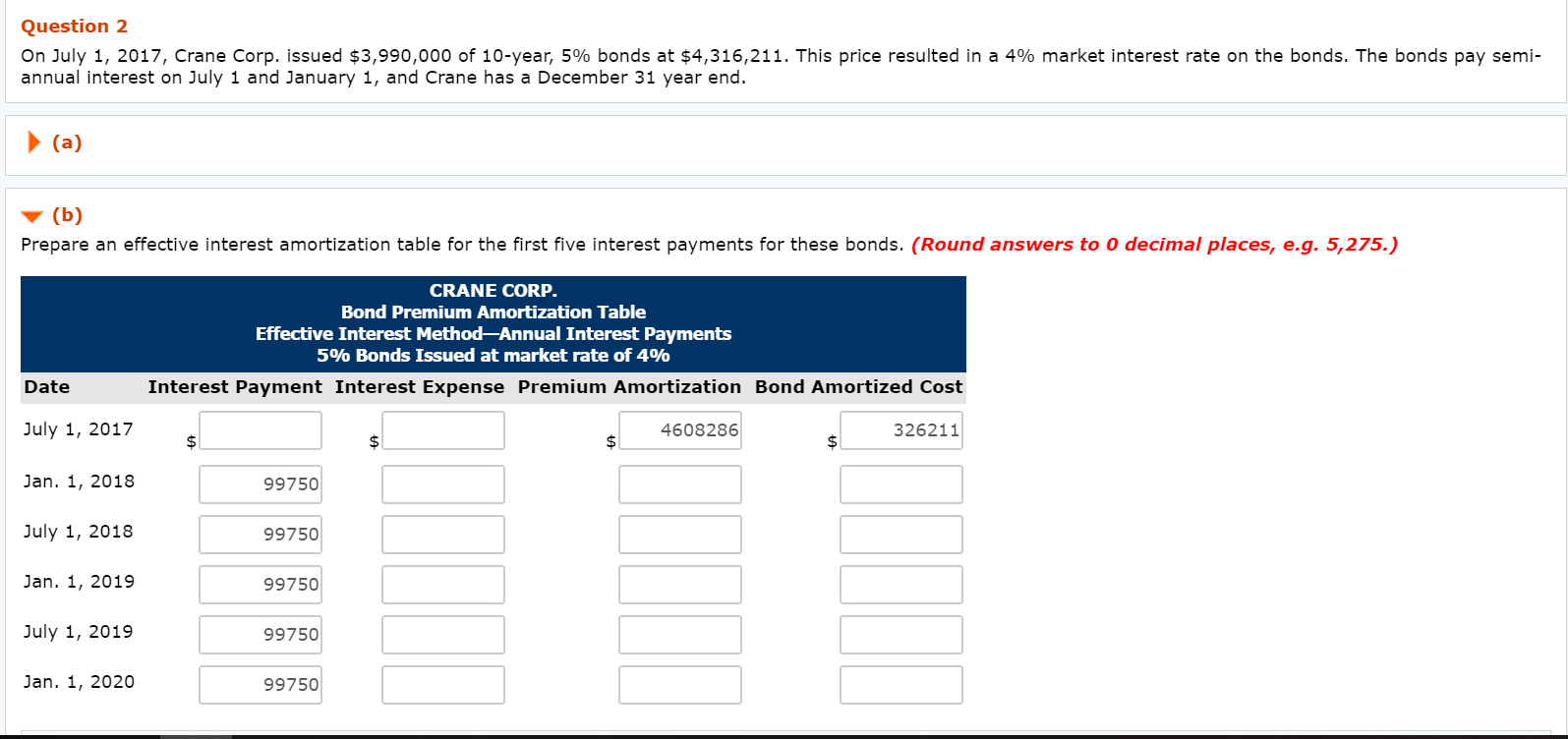

Question 2 On July 1, 2017, Crane Corp. issued $3,990,000 of 10-year, 5% bonds at $4,316,211. This price resulted in a 4% market interest rate on the bonds. The bonds pay semi- annual interest on July 1 and January 1, and Crane has a December 31 year end. (a) (b) Prepare an effective interest amortization table for the first five interest payments for these bonds. (Round answers to 0 decimal places, e.g. 5,275.) CRANE CORP. Bond Premium Amortization Table Effective Interest Method Annual Interest Payments 5% Bonds Issued at market rate of 4% Interest Payment Interest Expense Premium Amortization Bond Amortized Cost Date July 1, 2017 4608286 326211 $ $ $ $ Jan. 1, 2018 99750 July 1, 2018 99750 Jan. 1, 2019 99750 July 1, 2019 99750 Jan. 1, 2020 99750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts