Question: Need help for part B Current Attempt in Progress On January 1, 2024, the capital balances in Crane Partnership are as follows: Neither partner had

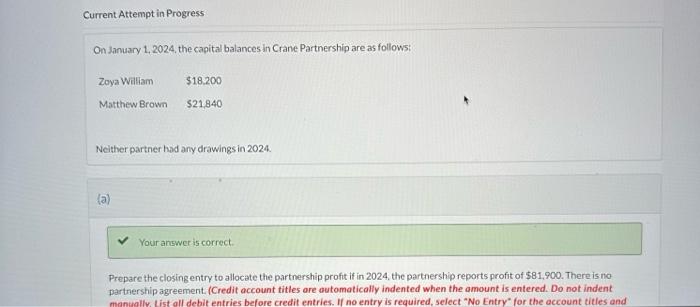

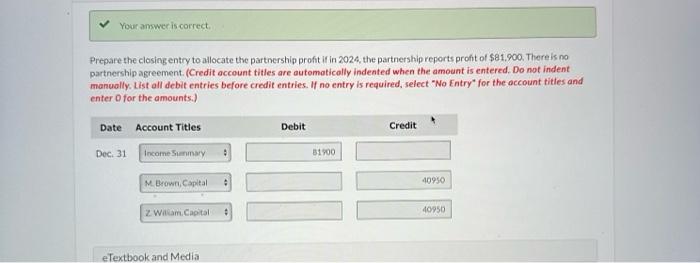

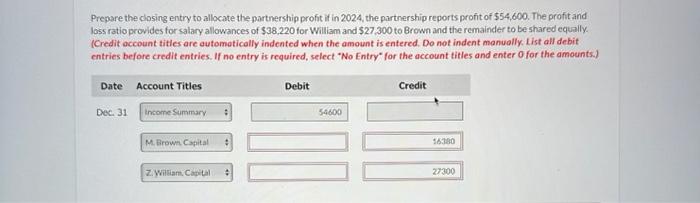

Current Attempt in Progress On January 1, 2024, the capital balances in Crane Partnership are as follows: Neither partner had any drawings in 2024. (a) Prepare the closing entry to allocate the partnership profit if in 2024, the partnership reports profit of $81,900. There is no partnership agreement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually, List all debit entries before credit entries. II no entry is required, select "No Entry" for the account titles and Prepare the closing entry to allocate the partnership profit if in 2024, the partnership reports profit of $81.900. There is no partnership agreement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts.) Prepare the closing entry to allocate the partnership profit if in 2024, the partnership reports profit of $54,600. The profit and lass ratio provides for salary allowances of $38,220 for William and $27,300 to Brown and the remainder to be shared equally. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts