Question: need help forming the amortization schedule, thanks! Techprod sells computer systems. Techprod leases computers to Kansas Prairie Company on January 1, 2016. The manufacturing cost

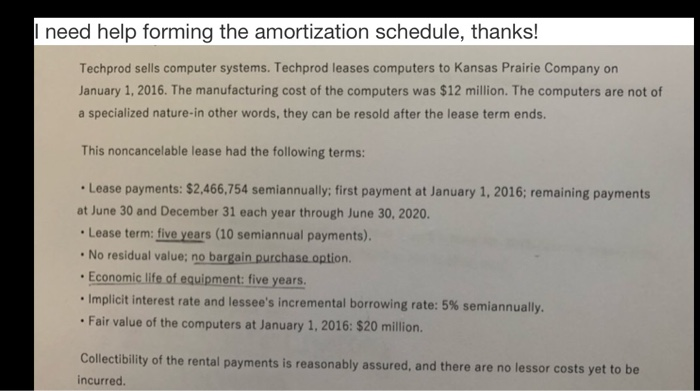

need help forming the amortization schedule, thanks! Techprod sells computer systems. Techprod leases computers to Kansas Prairie Company on January 1, 2016. The manufacturing cost of the computers was $12 million. The computers are not of a specialized nature-in other words, they can be resold after the lease term ends. This noncancelable lease had the following terms: Lease payments: $2,466,754 semiannually; first payment at January 1, 2016; remaining payments at June 30 and December 31 each year through June 30, 2020. Lease term: five years (10 semiannual payments). No residual value; no bargain purchase option. Economic life of equipment: five years. Implicit interest rate and lessee's incremental borrowing rate: 5% semiannually. Fair value of the computers at January 1, 2016: $20 million. Collectibility of the rental payments is reasonably assured, and there are no lessor costs yet to be incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts