Question: Need help in solving Vfix please. Thank you. A plain vanilla interest rate swap is arranged. The notional principal is N = 10 million dollars

Need help in solving Vfix please. Thank you.

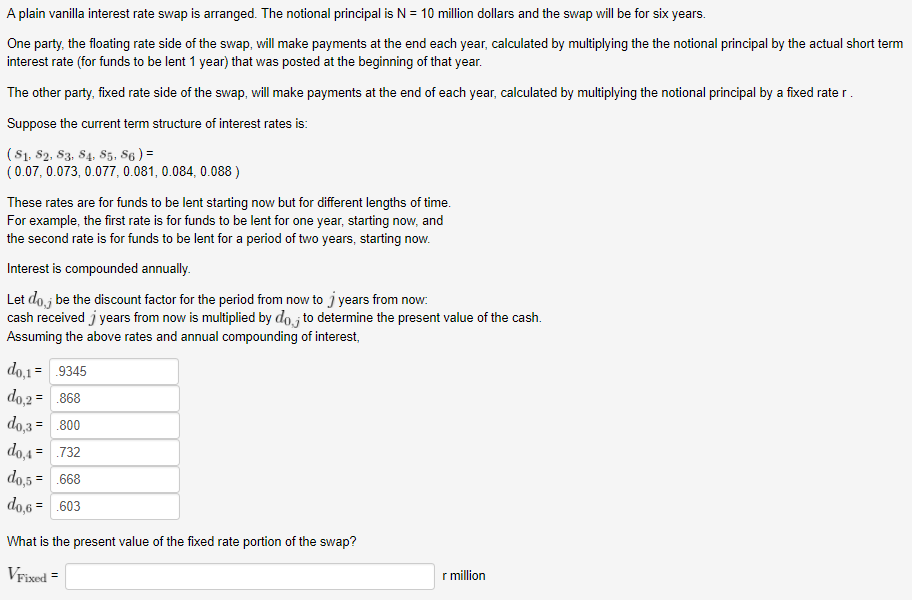

A plain vanilla interest rate swap is arranged. The notional principal is N = 10 million dollars and the swap will be for six years. One party, the floating rate side of the swap, will make payments at the end each year, calculated by multiplying the the notional principal by the actual short term interest rate (for funds to be lent 1 year) that was posted at the beginning of that year The other party, fixed rate side of the swap, will make payments at the end of each year, calculated by multiplying the notional principal by a fixed rater Suppose the current term structure of interest rates is ( 81, s2, s3, s4, s5, s6 ) = (0.07, 0.073, 0.077, 0.081, 0.084, 0.088) These rates are for funds to be lent starting now but for different lengths of time For example, the first rate is for funds to be lent for one year, starting now, and the second rate is for funds to be lent for a period of two years, starting novw Interest is co annually Let doj be the discount factor for the period from now to J years from now cash received j years from now is multiplied by do.j to determine the present value of the cash. Assuming the above rates and annual compounding of interest, ,1 9345 2 = .868 3 = .800 4 732 5.668 6603 What is the present value of the fixed rate portion of the swap? VFixed r million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts