Question: *** Need help in finding the value for Vfloat. Thank you *** A plain vanilla interest rate swap is arranged. The notional principal is N

*** Need help in finding the value for Vfloat. Thank you ***

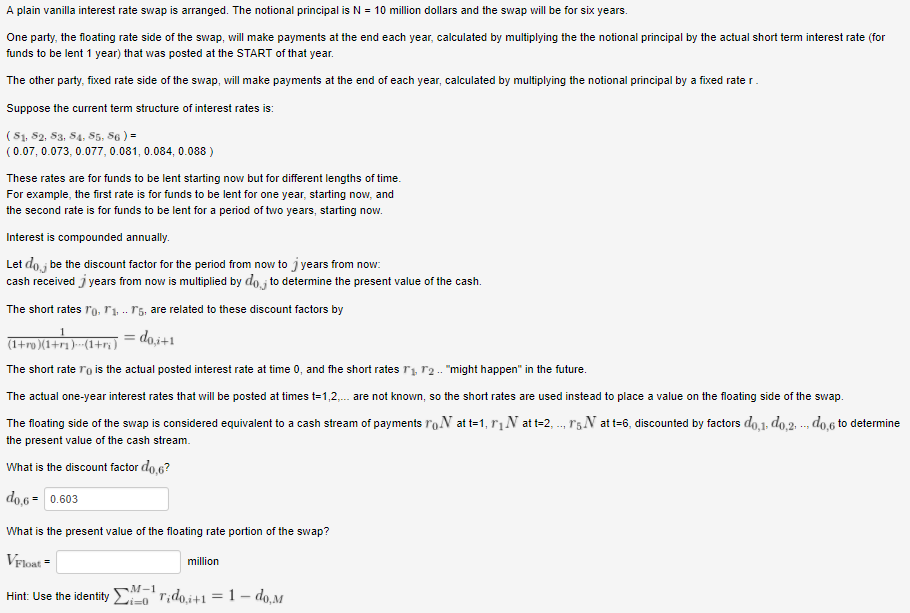

A plain vanilla interest rate swap is arranged. The notional principal is N = 10 million dollars and the swap will be for six years. One party, the floating rate side of the swap, will make payments at the end each year, calculated by multiplying the the notional principal by the actual short term interest rate (for funds to be lent 1 year) that was posted at the START of that year. The other party, fixed rate side of the swap, will make payments at the end of each year, calculated by multiplying the notional principal by a fixed rate r Suppose the current term structure of interest rates is (s1, s2, s3, s4, s5, s6 ) = 0.07, 0.073, 0.077, 0.081, 0.084, 0.088) These rates are for funds to be lent starting now but for different lengths of time For example, the first rate is for funds to be lent for one year, starting now, and the second rate is for funds to be lent for a period of two years, starting now. Interest is compounded annually Let do,j be the discount factor for the period from now to j years from now cash received years from now is multiplied by doj to determine the present value of the cash. The short rates ro, ri, ..rs, are related to these discount factors by i+1 The short rate ro is the actual posted interest rate at time 0, and fhe short rates ri r2.. "might happen" in the future The actual one-year interest rates that will be posted at times t=12 are not known, so the short rates are used instead to place a value on the floating side of the swap. The floating side of the swap is considered equivalent to a cash stream of payments r0N at t=1, ri at t-2 5 at t-6 discounted by factors 0,1 d 0,2 d 0,6 to determine the present value of the cash stream What is the discount factor do.6? 6= | 0.603 What is the present value of the floating rate portion of the swap? Float million M-1 Hint Use the identity .0'ndo. +1 = 1-do,M A plain vanilla interest rate swap is arranged. The notional principal is N = 10 million dollars and the swap will be for six years. One party, the floating rate side of the swap, will make payments at the end each year, calculated by multiplying the the notional principal by the actual short term interest rate (for funds to be lent 1 year) that was posted at the START of that year. The other party, fixed rate side of the swap, will make payments at the end of each year, calculated by multiplying the notional principal by a fixed rate r Suppose the current term structure of interest rates is (s1, s2, s3, s4, s5, s6 ) = 0.07, 0.073, 0.077, 0.081, 0.084, 0.088) These rates are for funds to be lent starting now but for different lengths of time For example, the first rate is for funds to be lent for one year, starting now, and the second rate is for funds to be lent for a period of two years, starting now. Interest is compounded annually Let do,j be the discount factor for the period from now to j years from now cash received years from now is multiplied by doj to determine the present value of the cash. The short rates ro, ri, ..rs, are related to these discount factors by i+1 The short rate ro is the actual posted interest rate at time 0, and fhe short rates ri r2.. "might happen" in the future The actual one-year interest rates that will be posted at times t=12 are not known, so the short rates are used instead to place a value on the floating side of the swap. The floating side of the swap is considered equivalent to a cash stream of payments r0N at t=1, ri at t-2 5 at t-6 discounted by factors 0,1 d 0,2 d 0,6 to determine the present value of the cash stream What is the discount factor do.6? 6= | 0.603 What is the present value of the floating rate portion of the swap? Float million M-1 Hint Use the identity .0'ndo. +1 = 1-do,M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts