Question: need help Mobley purchased a used van for use in its business on Jaruary 1, 2020. It paid 318,000 for the van. Mobley expects the

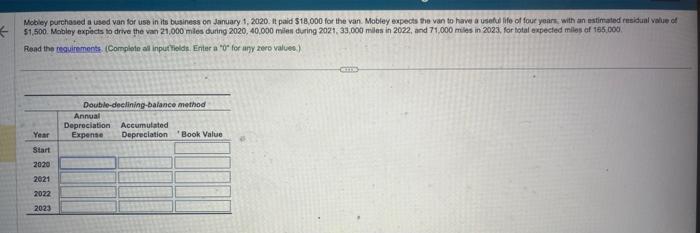

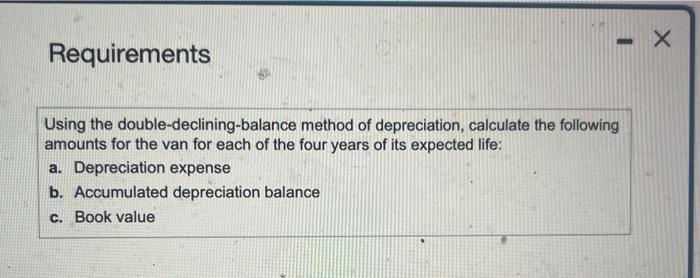

Mobley purchased a used van for use in its business on Jaruary 1, 2020. It paid 318,000 for the van. Mobley expects the van to have a usefud hifo of four years with an estimated residual value of 51,500. Mobley expects to drive the van 21,000 miles during 2020, 40,000 miles thring, 2021,33,000 miles in 2022, and 71,000 miles in 2023 , for hotal expected milos of 155 , 000. Read the reguire ments. (Complote all inputtiolds. Enter a "0" for any zero values) Requirements Using the double-declining-balance method of depreciation, calculate the following amounts for the van for each of the four years of its expected life: a. Depreciation expense b. Accumulated depreciation balance c. Book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts