Question: need help Moser purchased a used van for use in its business on January 1, 2020. If paid $16,000 for the van, Moser erpects the

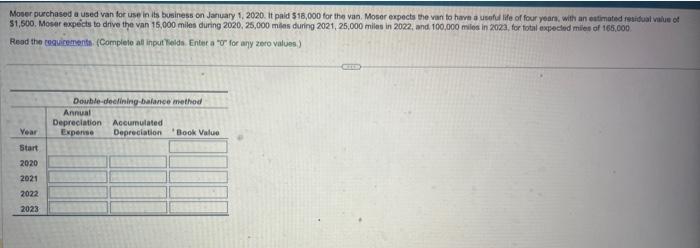

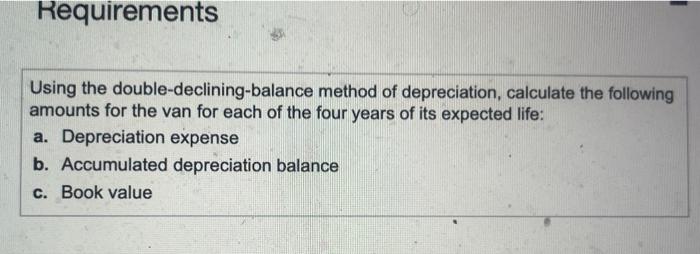

Moser purchased a used van for use in its business on January 1, 2020. If paid $16,000 for the van, Moser erpects the van to have a usoful life of four years, with an entimated fetitual vilue of 51, 500 . Mosar expects to drive the van 15,000 miles during 2020, 25,000 milas during 2021, 25,000 miles in 2022 , and, 100,000 milos in 2022 , for fotal expecled miles of 165,000 Reod the ceguicements. (Complele at input Kelds Enter a "or for any zero values.) Requirements Using the double-declining-balance method of depreciation, calculate the following amounts for the van for each of the four years of its expected life: a. Depreciation expense b. Accumulated depreciation balance c. Book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts