Question: need help not sure if im doing it right! need help with this!!! HDFS 330: Credit Purchase Activity Credit Purchase Activity Handout Step 1: Comparison

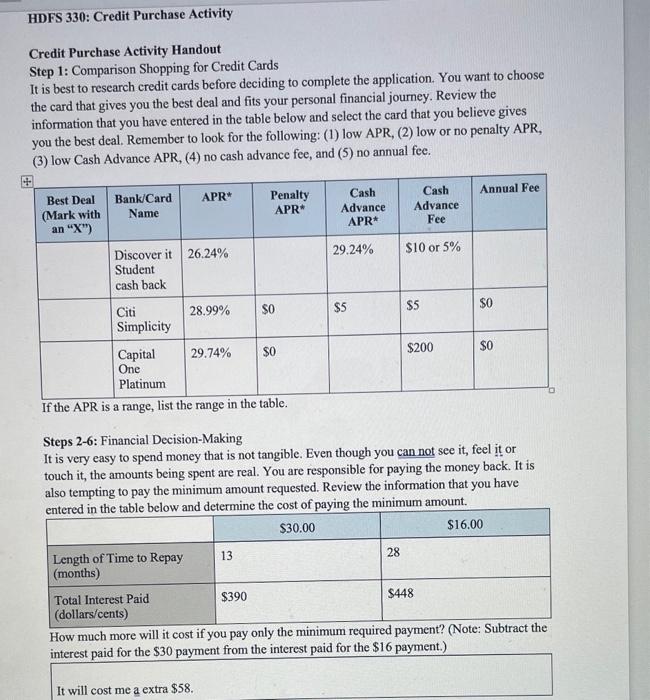

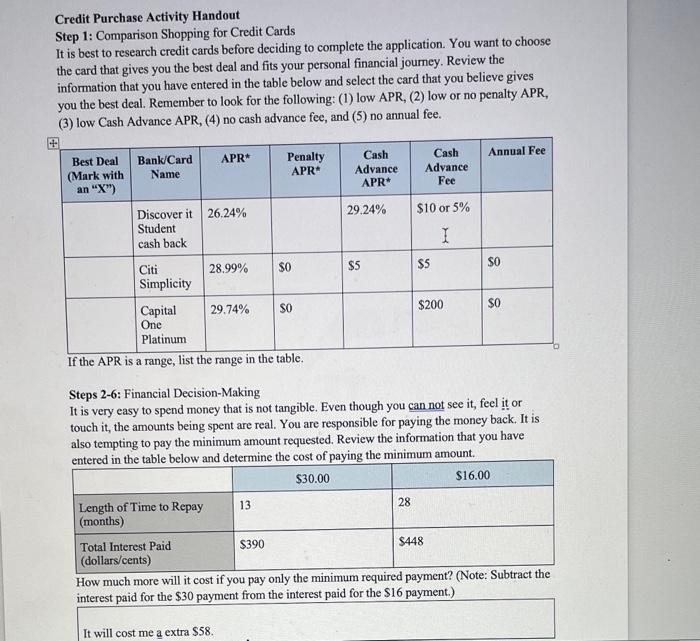

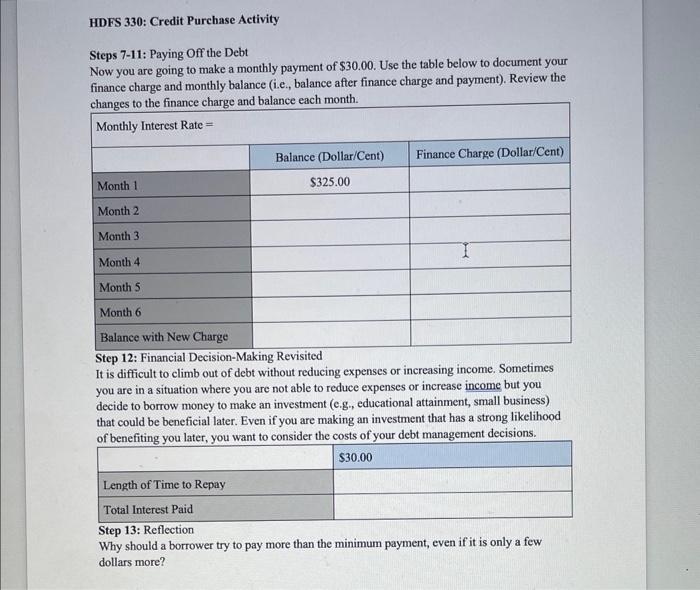

HDFS 330: Credit Purchase Activity Credit Purchase Activity Handout Step 1: Comparison Shopping for Credit Cards It is best to research credit cards before deciding to complete the application. You want to choose the card that gives you the best deal and fits your personal financial journey. Review the information that you have entered in the table below and select the card that you believe gives you the best deal. Remember to look for the following: (1) low APR, (2) low or no penalty APR, (3) low Cash Advance APR, (4) no cash advance fee, and (5) no annual fee. If the APR is a range, list the range in the table. Steps 2-6: Financial Decision-Making It is very easy to spend money that is not tangible. Even though you can not see it, feel it or touch it, the amounts being spent are real. You are responsible for paying the money back. It is also tempting to pay the minimum amount requested. Review the information that you have entered in the table below and determine the cost of paying the minimum amount. Credit Purchase Activity Handout Step 1: Comparison Shopping for Credit Cards It is best to research credit cards before deciding to complete the application. You want to choose the card that gives you the best deal and fits your personal financial journey. Review the information that you have entered in the table below and select the card that you believe gives you the best deal. Remember to look for the following: (1) low APR, (2) low or no penalty APR, (3) low Cash Advance APR, (4) no cash advance fee, and (5) no annual fee. If the APR is a range, list the range in the table. Steps 2-6: Financial Decision-Making It is very easy to spend money that is not tangible. Even though you can not see it, feel it or touch it, the amounts being spent are real. You are responsible for paying the money back. It is also tempting to pay the minimum amount requested. Review the information that you have entered in the table below and determine the cost of paying the minimum amount. How much more will it cost if you pay only the minimum required payment? (Note: Subtract the interest paid for the $30 payment from the interest paid for the $16 payment.) It will cost me a extra $58. HDFS 330: Credit Purchase Activity Steps 7-11: Paying Off the Debt Now you are going to make a monthly payment of $30.00. Use the table below to document your finance charge and monthly balance (i.e., balance after finance charge and payment). Review the ahannee tn tha finance charpe and balance each month. Step 12: Financial Decision-Making Revisited It is difficult to climb out of debt without reducing expenses or increasing income. Sometimes you are in a situation where you are not able to reduce expenses or increase income but you decide to borrow money to make an investment (e.g., educational attainment, small business) that could be beneficial later. Even if you are making an investment that has a strong likelihood of benefiting vou later. vou want to consider the costs of your debt management decisions. Step 13: Reflection Why should a borrower try to pay more than the minimum payment, even if it is only a few dollars more? HDFS 330: Credit Purchase Activity Credit Purchase Activity Handout Step 1: Comparison Shopping for Credit Cards It is best to research credit cards before deciding to complete the application. You want to choose the card that gives you the best deal and fits your personal financial journey. Review the information that you have entered in the table below and select the card that you believe gives you the best deal. Remember to look for the following: (1) low APR, (2) low or no penalty APR, (3) low Cash Advance APR, (4) no cash advance fee, and (5) no annual fee. If the APR is a range, list the range in the table. Steps 2-6: Financial Decision-Making It is very easy to spend money that is not tangible. Even though you can not see it, feel it or touch it, the amounts being spent are real. You are responsible for paying the money back. It is also tempting to pay the minimum amount requested. Review the information that you have entered in the table below and determine the cost of paying the minimum amount. Credit Purchase Activity Handout Step 1: Comparison Shopping for Credit Cards It is best to research credit cards before deciding to complete the application. You want to choose the card that gives you the best deal and fits your personal financial journey. Review the information that you have entered in the table below and select the card that you believe gives you the best deal. Remember to look for the following: (1) low APR, (2) low or no penalty APR, (3) low Cash Advance APR, (4) no cash advance fee, and (5) no annual fee. If the APR is a range, list the range in the table. Steps 2-6: Financial Decision-Making It is very easy to spend money that is not tangible. Even though you can not see it, feel it or touch it, the amounts being spent are real. You are responsible for paying the money back. It is also tempting to pay the minimum amount requested. Review the information that you have entered in the table below and determine the cost of paying the minimum amount. How much more will it cost if you pay only the minimum required payment? (Note: Subtract the interest paid for the $30 payment from the interest paid for the $16 payment.) It will cost me a extra $58. HDFS 330: Credit Purchase Activity Steps 7-11: Paying Off the Debt Now you are going to make a monthly payment of $30.00. Use the table below to document your finance charge and monthly balance (i.e., balance after finance charge and payment). Review the ahannee tn tha finance charpe and balance each month. Step 12: Financial Decision-Making Revisited It is difficult to climb out of debt without reducing expenses or increasing income. Sometimes you are in a situation where you are not able to reduce expenses or increase income but you decide to borrow money to make an investment (e.g., educational attainment, small business) that could be beneficial later. Even if you are making an investment that has a strong likelihood of benefiting vou later. vou want to consider the costs of your debt management decisions. Step 13: Reflection Why should a borrower try to pay more than the minimum payment, even if it is only a few dollars more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts