Question: ABC Corp. has issued zero - coupon corporate bonds with a three - year maturity. Each bond has a face value of $ 1 0

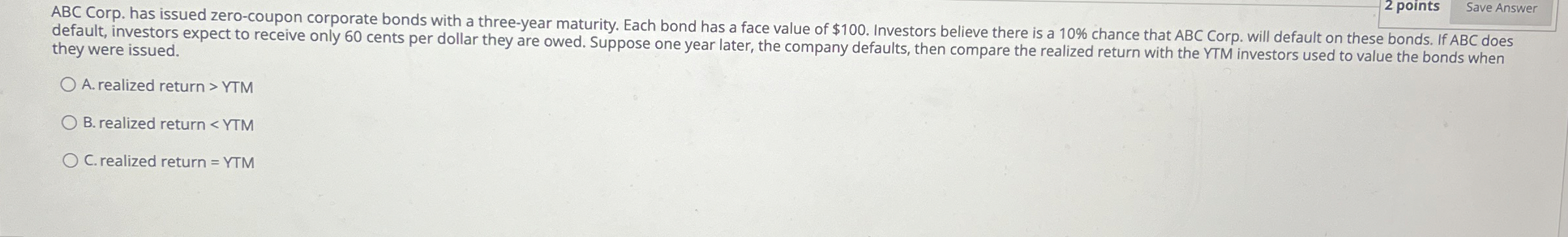

ABC Corp. has issued zerocoupon corporate bonds with a threeyear maturity. Each bond has a face value of $ Investors believe there is a chance that ABC Corp. will default on these bonds. If ABC does

default, investors expect to receive only cents per dollar they are owed. Suppose one year later, the company defaults, then compare the realized return with the YTM investors used to value the bonds when

they were issued.

A realized return YTM

B realized return YTM

C realized return YTM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock