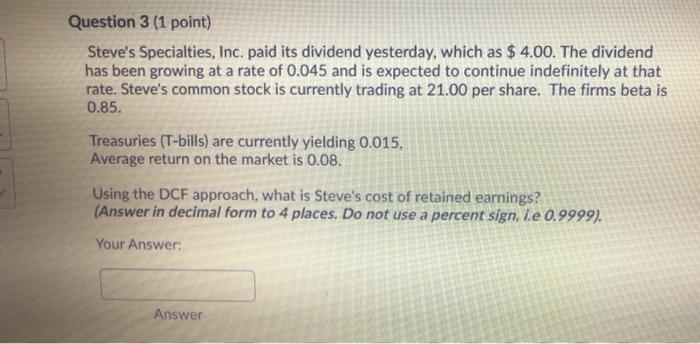

Question: need help on 3 and 4 Question 3 (1 point) Steve's Specialties, Inc. paid its dividend yesterday, which as $4.00. The dividend has been growing

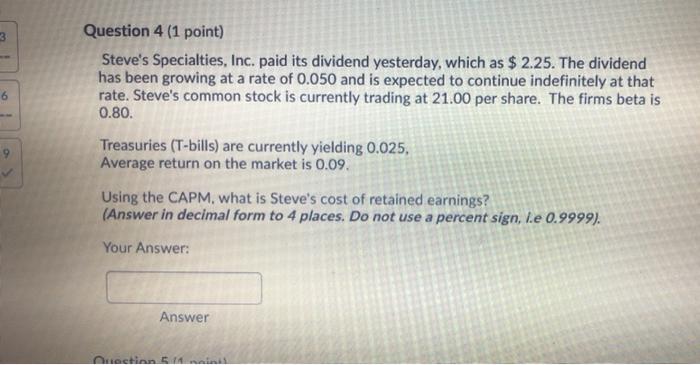

Question 3 (1 point) Steve's Specialties, Inc. paid its dividend yesterday, which as $4.00. The dividend has been growing at a rate of 0.045 and is expected to continue indefinitely at that rate. Steve's common stock is currently trading at 21.00 per share. The firms beta is 0.85. Treasuries (T-bills) are currently yielding 0.015, Average return on the market is 0.08. Using the DCF approach, what is Steve's cost of retained earnings? (Answer in decimal form to 4 places. Do not use a percent sign, i.e 0.9999). Your Answer: Answer 6 Question 4 (1 point) Steve's Specialties, Inc. paid its dividend yesterday, which as $ 2.25. The dividend has been growing at a rate of 0.050 and is expected to continue indefinitely at that rate. Steve's common stock is currently trading at 21.00 per share. The firms beta is 0.80. Treasuries (T-bills) are currently yielding 0.025, Average return on the market is 0.09. Using the CAPM. what is Steve's cost of retained earnings? (Answer in decimal form to 4 places. Do not use a percent sign, le 0.9999). 9 Your Answer: Answer rectinn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts