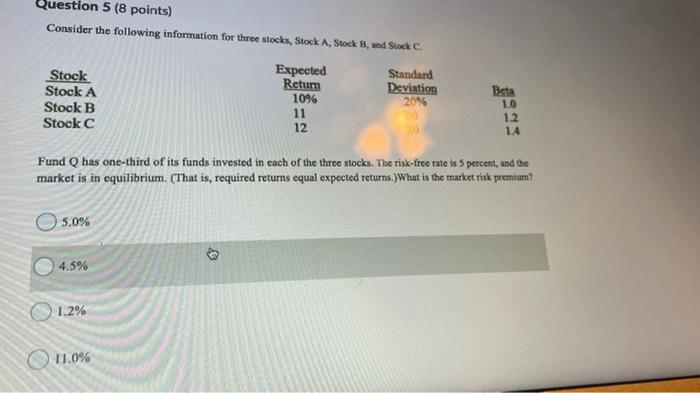

Question: need help on both Question 5 (8 points) Consider the following information for three stocks, Stock A, Stock Band Stock C. Stock Stock A Stock

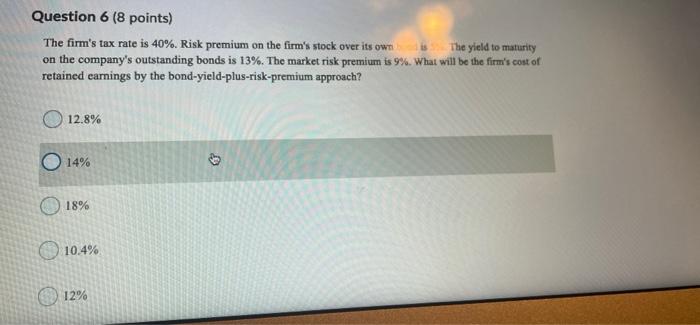

Question 5 (8 points) Consider the following information for three stocks, Stock A, Stock Band Stock C. Stock Stock A Stock B Stock C Expected Retur 10% 11 12 Standard Deviation 20% Beta 1.0 1.2 1.4 Fund Q has one-third of its funds invested in each of the three stocks. The risk-free rate is 5 percent, and the market is in equilibrium. (That is required returns equal expected returns.)What is the market risk premium? 5.0% 4.5% 1.2% 11.0% Question 6 (8 points) The firm's tax rate is 40%. Risk premium on the firm's stock over its own The yield to maturity on the company's outstanding bonds is 13%. The market risk premium is 9%. What will be the firm's cost of retained earnings by the bond-yield-plus-risk-premium approach? 12.8% O 14% 18% 10.4% 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts