Question: Need help on D, E, F please and thank you! QUESTION 13 Currency Strangles. The following information is currently available for Canadian dollar (CS) options

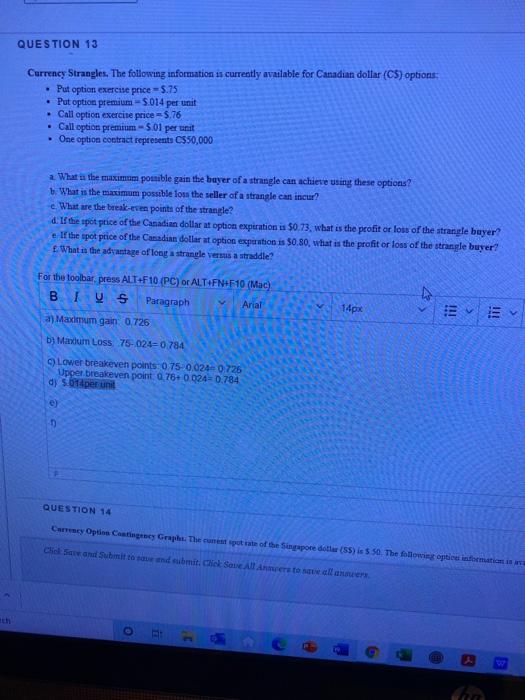

QUESTION 13 Currency Strangles. The following information is currently available for Canadian dollar (CS) options Put option exercise price = 5.75 Put option premium - $.014 per unit Call option exercise price = 5,76 Call option premium - 5.01 per unit One option contract represents CS50,000 2. What is the maximum posible gain the buyer of a strangle can achieve using these options? t. What is the maximum possible loss the seller of a strangle can incur? c. What are the break-even points of the strangle? d. If the spot price of the Canadian dollar at option expiration is 50.73, what is the profit or loss of the strangle buyer? e. If the spot price of the Canadian dollar at optice expiration is $0.80, what is the profit or loss of the strangle buyer? . What is the advantage of long a strangle versus a straddle? For the toolbar press ALT+F10 (PC) or ALT+FN+F 10 (Mac) BIOS Paragraph Arial a) Maximum gain 0.726 14px Es b) Madu Loss 75 024 0.784 Lower breakeven points 0.75 0.0240725 Upper breakeven point 0.76+0.024-0.784 dy 5.011 per unit D QUESTION 14 Carry Opties Centre Graphs. The content spot rate of the Singapore dollar (55) 5 50. The following optionsformatii Chal Sand Submit tonsibmit Chick Sa Allarmente alla w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts