Question: Need help on e, f, g, h. You are given the following information concerning two stocks: a Firm-Specific Beta Standard Deviation Stock A 0.9 20%

Need help on e, f, g, h.

Need help on e, f, g, h.

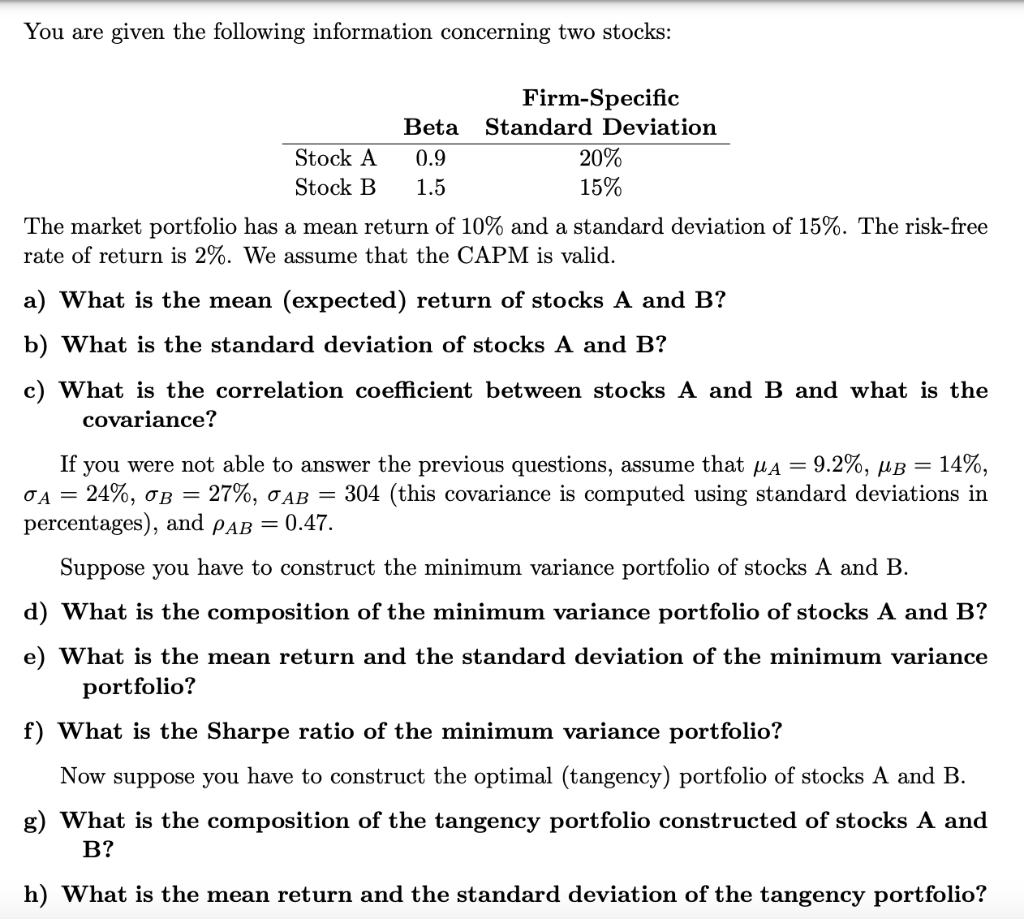

You are given the following information concerning two stocks: a Firm-Specific Beta Standard Deviation Stock A 0.9 20% Stock B 1.5 15% The market portfolio has a mean return of 10% and a standard deviation of 15%. The risk-free rate of return is 2%. We assume that the CAPM is valid. a) What is the mean (expected) return of stocks A and B? b) What is the standard deviation of stocks A and B? c) What is the correlation coefficient between stocks A and B and what is the covariance? = = If you were not able to answer the previous questions, assume that ja = 9.2%, MB = 14%, 24%, ob = 27%, o AB = 304 (this covariance is computed using standard deviations in percentages), and PAB = 0.47. Suppose you have to construct the minimum variance portfolio of stocks A and B. d) What is the composition of the minimum variance portfolio of stocks A and B? e) What is the mean return and the standard deviation of the minimum variance portfolio? f) What is the Sharpe ratio of the minimum variance portfolio? Now suppose you have to construct the optimal (tangency) portfolio of stocks A and B. g) What is the composition of the tangency portfolio constructed of stocks A and B? h) What is the mean return and the standard deviation of the tangency portfolio? You are given the following information concerning two stocks: a Firm-Specific Beta Standard Deviation Stock A 0.9 20% Stock B 1.5 15% The market portfolio has a mean return of 10% and a standard deviation of 15%. The risk-free rate of return is 2%. We assume that the CAPM is valid. a) What is the mean (expected) return of stocks A and B? b) What is the standard deviation of stocks A and B? c) What is the correlation coefficient between stocks A and B and what is the covariance? = = If you were not able to answer the previous questions, assume that ja = 9.2%, MB = 14%, 24%, ob = 27%, o AB = 304 (this covariance is computed using standard deviations in percentages), and PAB = 0.47. Suppose you have to construct the minimum variance portfolio of stocks A and B. d) What is the composition of the minimum variance portfolio of stocks A and B? e) What is the mean return and the standard deviation of the minimum variance portfolio? f) What is the Sharpe ratio of the minimum variance portfolio? Now suppose you have to construct the optimal (tangency) portfolio of stocks A and B. g) What is the composition of the tangency portfolio constructed of stocks A and B? h) What is the mean return and the standard deviation of the tangency portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts