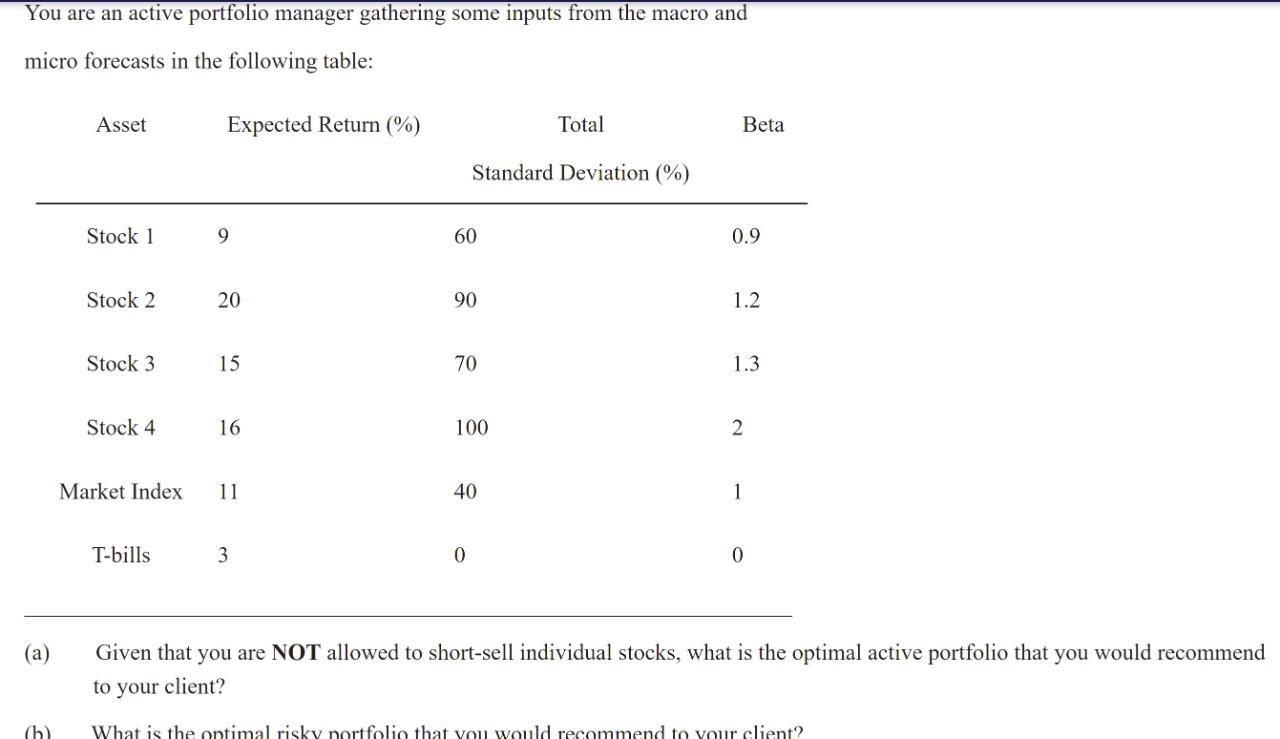

Question: You are an active portfolio manager gathering some inputs from the macro and micro forecasts in the following table: Asset Expected Return (%) Total Beta

You are an active portfolio manager gathering some inputs from the macro and micro forecasts in the following table: Asset Expected Return (%) Total Beta Standard Deviation (%) Stock 1 9 60 0.9 Stock 2 20 90 1.2 Stock 3 15 70 1.3 Stock 4 16 100 2 Market Index 11 40 1 T-bills 3 0 0 (a) Given that you are NOT allowed to short-sell individual stocks, what is the optimal active portfolio that you would recommend to your client? (h What is the optimal risky portfolio that you would recommend to your client? You are an active portfolio manager gathering some inputs from the macro and micro forecasts in the following table: Asset Expected Return (%) Total Beta Standard Deviation (%) Stock 1 9 60 0.9 Stock 2 20 90 1.2 Stock 3 15 70 1.3 Stock 4 16 100 2 Market Index 11 40 1 T-bills 3 0 0 (a) Given that you are NOT allowed to short-sell individual stocks, what is the optimal active portfolio that you would recommend to your client? (h What is the optimal risky portfolio that you would recommend to your client

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts