Question: Need help on finding the last remaining values for the red boxes. Thank you time t0, an asset has value So-3 (1 pt) At t

Need help on finding the last remaining values for the red boxes. Thank you

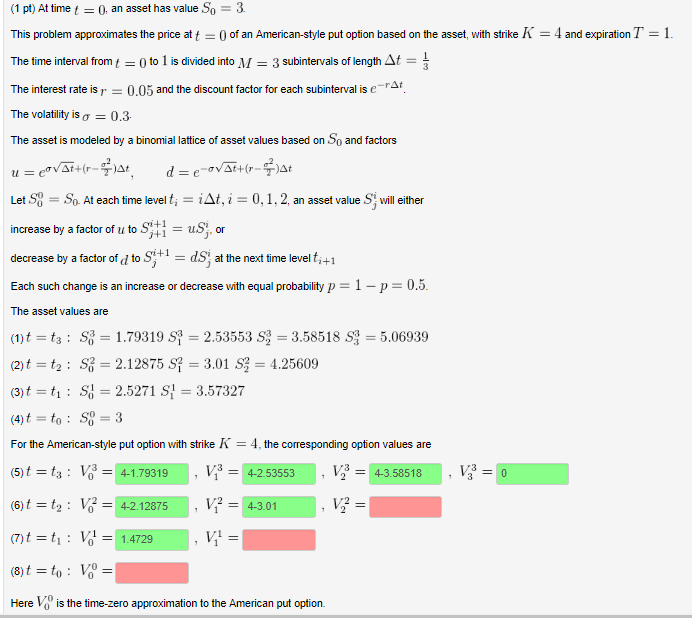

time t0, an asset has value So-3 (1 pt) At t This problem approximates the price at tof an American-style put option based on the asset, with strike K4 and expiration T-1 The time interval from t = 0 to 1 is divided into M 3 subintervals of length ?t = ? The interest rate is r 0,05 and the discount factor for each subinterval is e The volatility is ? 0.3. The asset is modeled by a binomial lattice of asset values based on So and factors Let.sg-Sp At each time level ti-? t, 2-0, 1 . 2, an asset value S1 will either increase by a factor of u to Sjti-uS, or of d to ST+1 dS at the next time level ti+1 Each such change is an increase or decrease with equal probability p 1- p 0.5 The asset values ane (1t t3: S 1.79319 S 2.53553 S 3.58518 S 5.06939 (2)t t2: S 2.12875 S 3.01 S 4.25609 (3) t-ti : S -2.5271 S-3.57327 (4)t- to So-3 For the American-style put option with strike K-4, the corresponding option values are (5)t-ta: V-1.79319 V3-4253553,V2 4-3. 58518 3 t = t2 : V,2= 4-301 = 42.12875 , vi t-t: Vo14729 Here Vo is the time-zero approximation to the American put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts