Question: Need help on part b & c In 2000, Ms. Ennis, a head of household, contributed $50,000 in exchange for 500 shares of Seta stock.

Need help on part b & c

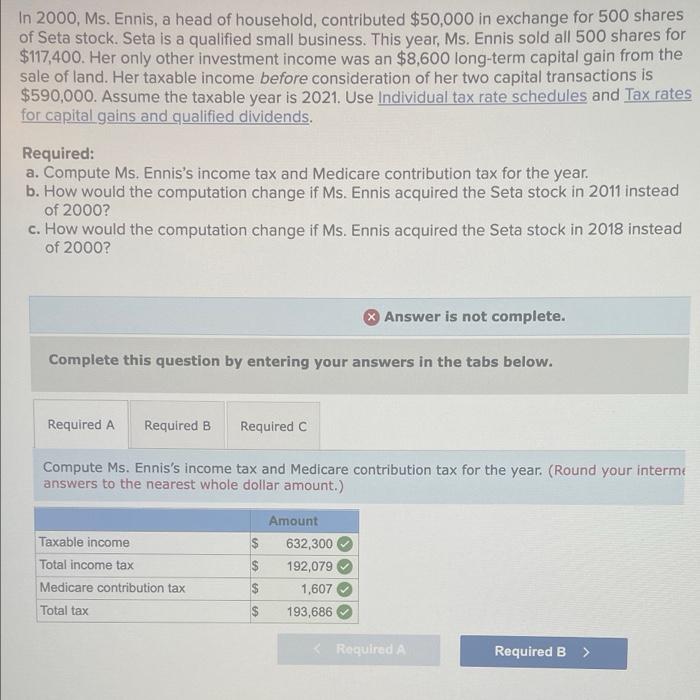

Need help on part b & cIn 2000, Ms. Ennis, a head of household, contributed $50,000 in exchange for 500 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 500 shares for $117,400. Her only other investment income was an $8,600 long-term capital gain from the sale of land. Her taxable income before consideration of her two capital transactions is $590,000. Assume the taxable year is 2021. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2018 instead of 2000? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute Ms. Ennis's income tax and Medicare contribution tax for the year. (Round your interm answers to the nearest whole dollar amount.) $ $ Taxable income Total income tax Medicare contribution tax Total tax Amount 632,300 192,079 1,607 193,686 $ $ Required Required B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts